The most secure VPNs protect you from privacy issues and cybercrime when you connect to the internet. It’s no wonder that virtual private network (VPN) usage in the U.S. shot up from 26% in 2019 to 69% in 2021.

Let’s compare the seven safest VPNs in the industry based on pricing, security, and features in this guide. Discover which VPN provider is ideal for you as a small business owner or freelancer.

Most Secure VPNs

- Surfshark: Best Overall Secure VPN

- NordVPN: Best for Safe Cloud Storage

- CyberGhost: Best for Most Servers

- ProtonVPN: Best for Speed

- ExpressVPN: Best for Unlimited Bandwidth

- Windscribe: Best for Flexibility

- TunnelBear: Best for Affordability

Secure VPNs

Pricing

Security

Servers

Speed

Audits

Starts at $2.49/month

AES-256-GCM encryption + Change IP + Private DNS + Leak protection + CleanWeb + MultiHop + Security protocols + Bypasser + No logs

3,200+

1 Gbps – 10 Gbps

Yes

Starts at $3.29/month

Encrypted cloud storage + AES 256-bit encryption + Threat Protection + IP masking + Multi-factor authentication + No logs

5,569

No speed or bandwidth limits

Yes

Starts at $3.25/month

AES 256-bit encryption + IP masking + Private browser + No logs

8,000+

6 Mbps – 1 Gbps

Yes

Starts at free

AES-256 encryption + Secure Core servers + NetShield + VPN Accelerator + No logs

1,772

Up to 10 Gbps

Yes

Starts at $8.32/month

AES-256 encryption + Threat Manager + VPN split tunneling + IP masking + TrustedServer + No logs

Undisclosed

Undisclosed

Yes

Starts at $1/location/month

AES-256 encryption + R.O.B.E.R.T. + Leak protection + No logs

Undisclosed

1 Gbps for uplinks

No

Starts at free/500 MB

AES 256-bit encryption + GhostBear + IP tracking prevention + Global content access + Bypass censorship + No logs

Undisclosed

Undisclosed

Yes

Surfshark ranks first among the most secure VPNs in our list because it merges together advanced security, snappy speed, many servers, and budget-friendly pricing. Founded in 2018, this Netherland-based VPN provider makes high-quality digital security accessible to everyone.

Pricing

Surfshark only charges you as low as $2.49 per month if you select the 2-year plan. Take note that the rate will rise to $12.95 per month if you choose to be billed monthly instead. Although it doesn’t have a free plan like TunnelBear or Windscribe, it has the cheapest rates among the VPN providers with paid plans.

Security

As discussed in our Surfshark review, it has the widest range of security features in the bunch. First, it safeguards your privacy through industry-standard AES-256-GCM encryption. Next, it doesn’t monitor your surfing through activity logs. Also, it changes your IP address to hide your real identity.

Plus, the private DNS and leak protection reduce the risk of compromising your data, while CleanWeb helps you avoid ads, phishing, trackers, and malware. MultiHop adds an extra layer of security by directing your web traffic through two different servers.

Aside from this, you can take your pick from security protocols like IKEv2/IPsec and OpenVPN. Finally, the Bypasser function lets you designate which apps and websites are allowed to bypass the VPN.

Servers

After CyberGhost and NordVPN, Surfshark has the third largest network with over 3,200 servers across 95 countries. To make things better, each server has its own private DNS. Through its innovative Nexus technology, your traffic is routed along the entire network instead of a lone VPN tunnel for better safety and performance.

Speed

Tied with ProtonVPN, Surfshark showcases the fastest estimated connection speeds in the group. Each of its servers has at least one port with 1 Gbps speeds. On top of this, the latest 10 Gbps ports are being added on a daily basis.

Audits

Surfshark first completed an independent audit back in November 2018 by Cure53, a German cybersecurity firm. This initial audit confirmed that the browser extensions have robust security with only two small issues.

The latest audit in May 2021 extended to the server infrastructure of this VPN provider. This time around, Cure53 commended the good defaults of the server network and skilled configuration of the constructs. Only a few minor issues were spotted during the audit, which were promptly fixed by Surfshark.

While the aspects of VPN services that were checked are limited, it’s still reassuring that Surfshark gained generally positive results from third-party audits.

Why we chose it: We award Surfshark as the best overall secure VPN because it gives you exceptional value for your money in terms of security, speed, servers, and rates. That’s why it also deserves to be counted as one of the best VPNs for PCs.

- Strong security suite

- Above-average connection speeds

- 3,200+ servers in 95 countries

- Economical rates of paid plans

- No free plan

Limited coverage of audits

Pricing:

- 2 Years: $2.49/month

- 1 Year: $3.99/month

- 1 Month: $12.95/month

NordVPN is the close runner-up in our roundup of the safest VPNs. Aside from its attractive offerings, it grants you a generous 1 TB of encrypted cloud storage where you can keep your sensitive data. Established in 2012, this VPN provider currently operates from its headquarters in Panama.

Pricing

NordVPN has the second steepest rates among its competitors, right after ExpressVPN. Nevertheless, the price range of the 2-year plans are still reasonable at $3.29 to $5.29 per month. Admittedly, you do need to reach deeper into your pocket if you prefer to pay monthly, with rates from $11.99 to $13.99 per month.

Security

Although NordVPN encountered a third-party breach in 2018, it bounced back by taking several steps to boost its security. At present, it has a rich set of security features, almost comparable to Surfshark.

In addition to cloud storage with encryption, it comes with AES 256-bit encryption which is designed for shielding classified information. Plus, the built-in Threat Protection blocks malware, trackers, ads, and malicious websites. It masks your IP address to maintain the privacy of your internet browsing.

Also, multi-factor authentication ensures that only you can access your account. Last but not least, NordVPN is one of the most secure non-logging VPNs in the market. After all, it’s not required to store logs because Panama doesn’t have a mandatory data retention law

Speed

NordVPN doesn’t place any caps on your connection speed or bandwidth, unlike most of its peers except ExpressVPN. However, your actual speed will be determined by various factors, such as your internet speed, VPN protocol, and server proximity. NordVPN explains that it’s normal to expect a slightly slower connection when your traffic is routed through an encrypted VPN tunnel.

Servers

NordVPN has the second biggest server network in the bunch, only next to CyberGhost. It currently has 5,566 servers in 60 countries all around the globe. These servers are compatible with NordLynx, OpenVPN, and IKEv2/IPSec protocols.

Audits

NordVPN ordered its first independent assurance engagement to check its no-log policy in late 2018. After evaluating the VPN service, auditing firm PricewaterhouseCoopers AG Switzerland verified the authenticity of its no-log claim.

In May 2020, NordVPN requested an expanded third-party audit involving its central server infrastructure. The Double VPN, obfuscated, and P2P servers were inspected by the auditors. Once again, PricewaterhouseCoopers confirmed that the VPN provider uses the right configurations and keeps its no-log promise.

Finally, NordVPN underwent an advanced application security audit by VerSprite, a global cybersecurity consulting firm, in June 2021. Thankfully, VerSprite didn’t find any critical vulnerabilities during its evaluation.

Why we chose it: We picked NordVPN as the best for safe cloud storage among the most secure VPNs because it gives you a reliable digital space where you can keep your private information. It’s not surprising that it’s also considered one of the best VPNs for mobile phones in terms of security.

- 1 TB encrypted cloud storage

- Solid security features

- 5,566 servers in 60 countries

- No speed or bandwidth limits

- Slightly pricey rates

- Third-party breach in 2018

Pricing:

- 2 Years: $3.29-$5.29/month

- 1 Year: $4.99-$6.99/month

- 1 Month: $11.99-$13.99/month

CyberGhost has an edge over its competitors because it has the highest number of servers among the safest VPNs in this review. It currently shows off more than 8,000 servers in 91 countries. This means that you have more servers to choose from, as well as more computing resources to share with other VPN users.

Founded in 2011 in Germany, the headquarters of this VPN provider is now located in Bucharest, Romania. At present, it shields the privacy of more than 38 million users across the globe. It’s a pioneer in the VPN industry when it comes to publishing transparent reports and developing crypto-technology.

Pricing

While it doesn’t present free plans like ProtonVPN, Windscribe, and TunnelBear, CyberGhost has the second lowest rates for paid plans next to Surfshark. You only need to pay $3.25 per month if you sign up for a 2-year plan. While the difference isn’t that big for the 1-year plan at $3.99 per month, the monthly rate will jump to $12.95 if you opt to pay every month instead.

Security

CyberGhost has good security features, although admittedly not as comprehensive as Surfshark and NordVPN. It keeps your data private through military-grade AES 256-bit encryption. Also, it gives you the chance to surf anonymously by hiding your IP address and providing a private browser. It sticks to a no-logs policy while operating under Romanian law, which doesn’t require the retention of data.

If you’re willing to pay extra, you can also access the NoSpy servers which are operated independently by CyberGhost for greater security and performance. The add-on price is $4.99 per month for annual billing.

Speed

The estimated connection speed of CyberGhost is the slowest among the VPN providers that disclose this information. You can expect around 6 Mbps if you have a regular internet connection, although you may potentially reach up to 1 Gbps under ideal circumstances.

Servers

CyberGhost leads the pack when it comes to the expansiveness of its server network. As we explained in our CyberGhost review, it currently counts over 8,000 VPN servers all over the world. That’s almost 2,500 more servers than second-ranked NordVPN. These bountiful servers support OpenVPN, L2TP/IPSec, and iKEv2 network protocols.

Audits

The last time CyberGhost went through a third-party inspection was in March 2012. Back then, it passed the audit and verification by QSCert on the Information Safety Management System (ISMS). However, at the time of writing, CyberGhost hasn’t undergone any recent audits to prove its claims in the privacy policy and transparency reports.

Why we chose it: We selected CyberGhost as the best for most servers since it grants you access to an incredibly broad server network.

- Leading number of servers

- Respectable security features

- Transparency reports

- Slowest estimated speed

- Extra charge for NoSpy server access

- No recent third-party audit

Pricing:

- 2 Years: $3.25/month

- 1 Year: $4.29/month

- 1 Month: $12.99/month

ProtonVPN is way ahead of the other most secure VPNs in terms of estimated speed for paid plans. Its server network is capable of generating up to a whopping 10 Gbps connection. Thanks to its cutting-edge VPN Accelerator technology, it exponentially boosts the speed and stability of the VPN service.

Established in 2014, it’s presently based in Geneva, Switzerland. It originally started with the creation of Proton Mail, which eventually led to the development of ProtonVPN. Today, this open-source VPN service focuses on online security for millions of global users.

Pricing

ProtonVPN is one of the three VPN providers that offer a free plan, along with TunnelBear and Windscribe. That’s why it’s counted as one of the best free VPNs in the market. If you prioritize server speed, you may consider subscribing to paid plans that range from $4.99 to $9.99 per month, which we expounded on in our ProtonVPN review.

Security

ProtonVPN has an adequate amount of security features, although not on the same level as Surfshark or NordVPN. It guards your network traffic through AES-256 encryption, while it blocks ads, malware, and trackers through the DNS filter NetShield.

This VPN provider operates its own Secure Core servers which have the ability to defend itself against network attacks. Lastly, it enforces its no logs policy under Swiss law, which doesn’t require it to save user connection logs.

Speed

ProtonVPN has the swiftest estimated connection speeds in the group, which can go up to a maximum of 10 Gbps. Nevertheless, you should be aware that you can only experience this phenomenal speed if you subscribe to a paid plan. If you opt for the free plan, you can only expect medium speed, which is enough for basic users but probably not for power users.

Servers

At the time of this writing, ProtonVPN operates a total of 1,772 servers in 63 different countries. While it doesn’t have as many servers as CyberGhost, NordVPN, or Surfshark, at least it has over 1,000 servers unlike TunnelBear and ExpressVPN.

The company operates 96 Secure Core servers that it fully owns and operates. Nevertheless, only ProtonVPN Plus users can connect to these superior VPN servers. The network supports P2P file sharing protocols like BitTorrent..

Audits

Just last April 2022, ProtonVPN announced that it completed a third-party audit on its no-logs policy. After evaluating the infrastructure and server-side operations, Securitum verified that the VPN provider doesn’t keep any activity or metadata logs. Plus, the European security auditing firm didn’t pinpoint any major security issues during the audit. In addition to this, ProtonVPN also went through regular audits by independent security experts in the past.

Why we chose it: We acknowledge ProtonVPN as the best for speed because you can benefit from first-rate, high-speed connections if you get a paid package.

- 10 Gbps maximum speed

- Free plan available

- Very recent third-party audit

- Medium speed for free plan

- 2-year plan rates are relatively high

- Secure Core servers for paying users only

Pricing:

- ProtonVPN Free: $0/month

- ProtonVPN Plus:

- 2 Years: $4.99/month

- 1 Year: $5.99/month

- 1 Month: $9.99/month

ExpressVPN is the most generous among the safest VPNs when it comes to bandwidth allotment. It doesn’t cap your online traffic at all so you can download as much content as you like without worrying about excess usage fees. Founded in 2009, it’s presently based in the British Virgin Islands. It now caters to around 3 million active subscribers in 180 countries and counting.

Pricing

ExpressVPN definitely has the overall most expensive pricing of the lot. The annual package will set you back $8.32 per month, the half-year package $9.99 each month, and the monthly billing $12.95 every month.

Security

While it doesn’t match Surfshark or NordVPN, ExpressVPN has a decent suite of security features. It satisfies basic security standards with AES-256-bit encryption, while the Threat Manager tool blocks trackers and malicious users. Aside from masking your IP address, the VPN split tunneling routes your traffic efficiently.

Thanks to the TrustedServer technology, none of your data will be written on hard drives. There’s a private DNS on every server as well to bump up the security. Finally, this VPN provider doesn’t keep any connection or activity logs.

Speed

ExpressVPN doesn’t give an estimate of the Mbps or Gbps like most of its peers, but it assures users that the next-generation Lightway protocol is designed for quick connection speeds. Plus, the unlimited bandwidth ensures that you can enjoy as much data transfers as you like.

Servers

According to its official website, ExpressVPN has thousands of servers, but it doesn’t disclose the exact number. At least, it shares that the servers are placed in 160 locations in 94 countries. Also, it explains that the TrustedServer network provides extra security via private DNS.

Audits

ExpressVPN went through a recent independent audit by F-Secure last November to December 2021. The third-party cybersecurity firm validated the security of the Windows app by confirming it didn’t find significant issues. Back in 2019, ExpressVPN also benefited from positive results from security audits by PricewaterhouseCoopers and Cure53.

Why we chose it: We recognize ExpressVPN as the best for unlimited bandwidth because it allows you to make as many data transfers as you need.

- No bandwidth caps

- Satisfactory security features

- Speedy Lightway protocol

- Most expensive pricing

- Server number info unavailable

- No numeric speed estimate

Pricing:

- 1 Year: $8.32/month

- 6 Months: $9.99/month

- 1 Month: $12.95/month

Windscribe stands out for being the only VPN provider in this roundup to offer a Build A Plan option. This pay-as-you-go service helps you save money by charging you only for the server locations you actually use. Established in 2016, it’s based at present in Toronto, Canada. It enables users to access geographically restricted content while protecting them from surveillance, marketers, and cybercriminals.

Pricing

Windscribe has the most versatile pricing in the group, thanks to the one-of-a-kind Build A Plan arrangement. At $1 per location each month, it has the second most budget-friendly rate, next to ProtonVPN and TunnelBear. If you prefer a flat rate, you can pick the yearly plan which goes for $4.08 per month or the monthly plan which charges $9.00 every month.

Security

Windscribe may have simple security features compared to most of its competitors, but it’s got the basics covered. Like most VPNs, it uses an AES-256 cipher to encrypt your data for private browsing. Plus, R.O.B.E.R.T. gives you the choice to block certain IPs and domains. This configurable DNS-based tool keeps you safe from ads, malware, trackers, and specific content as well.

Also, it doesn’t record logs to identify you via IP address and timestamp. On top of this, you can activate more security functions through the desktop app and browser extensions, including firewalls and WebRTC Slayer for leak protection.

Speed

Windscribe has an average speed of 1 Gbps for uplinks for both free and paid servers. However, the actual speed will depend on how many people are connected to each server. In addition to this, you can get from 10 GB up to unlimited bandwidth for Build A Plan, while data bandwidth is unlimited for paid plans.

Servers

Windscribe doesn’t disclose the exact number of its servers. Nevertheless, it does share that the network spans 110 cities located in 63 countries. If you install the browser extension, you can take advantage of the Auto Pilot feature which automatically selects the optimal location for you.

Audits

During the time of this writing, Windscribe hasn’t completed any external audits of its VPN services. This means its privacy claims haven’t ever been confirmed by independent firms at all. Disappointingly, it’s the only VPN provider in the list that never went through a recent or past third-party audit.

Why we chose it: We pick Windscribe as the best for flexibility because you can customize its Build A Plan based on your budget and location.

- Build A Plan adjustable rates

- Simple yet sufficient security

- 10 GB to unlimited bandwidth

- Not the fastest connection speed

- Server number info unavailable

- Zero third-party audits

Pricing:

- Build A Plan: $1/location/month

- Pro Plans:

- 1 Year: $4.08/month

- 1 Month: $9/month

TunnelBear is one of the most affordable alternatives among the most secure VPNs in this guide. After all, it grants you 500 MB per month if you sign up for the free plan. Your data allocation renews automatically every month, although you can’t carry over leftover data from the previous month. Founded in 2011, its headquarters are situated in Toronto, Canada. It’s a user-friendly VPN for casual users because of its freebies and simple apps.

Pricing

TunnelBear is one of the three VPN providers here that present a free plan, along with ProtonVPN and Windscribe. If you need more advanced VPN services, you can pay for the unlimited plan which begins at $3.33 per month or the Teams plan which is priced at $5.75 per user each month. As you can see, even the paid plans have pretty cost-effective rates.

Security

TunnelBear probably has the most basic security features among its peers. Still, the GhostBear feature helps you avoid VPN blocking. Plus, it gives you essential protection through AES 256-bit encryption for essential privacy, while preventing intrusive IP tracking. Also, it doesn’t log your online activity. Lastly, it allows you to access global content and bypass local censorship.

Speed

TunnelBear claims it has lightning-fast speeds on its server network. However, it doesn’t share what the actual speed is in terms of Mbps or Gbps. It’s up to you if you want to take the company’s word for it.

Servers

TunnelBear doesn’t disclose information about the exact number of its servers. The official website only mentions that there are more than 40 server locations in 48 countries. At least, it placed servers in some underrepresented geographical areas, not just in the usual popular server spots.

Audits

TunnelBear finished a fairly recent annual independent security audit last October 2020. It’s the VPN provider’s fourth audit since it first went through the inspection in 2016. The results showed that Cure53 spotted two low, two medium, and a single high-risk vulnerability. Nevertheless, the auditor commended TunnelBear for its ongoing efforts to reduce security issues.

Why we chose it: We give a nod to TunnelBear as the best for affordability because it’s a practical option if you want to try a VPN service for the first time or if you can’t afford a paid plan.

- Free 500MB per month

- Easy-to-use apps

- Annual security audits

- Simple security only

- Estimated speed unavailable

- Server number info unavailable

- One high-risk vulnerability found in recent audit

Pricing:

- Free: $0/500 MB

- Unlimited: Starts at $3.33/month

- Teams: $5.75/user/month

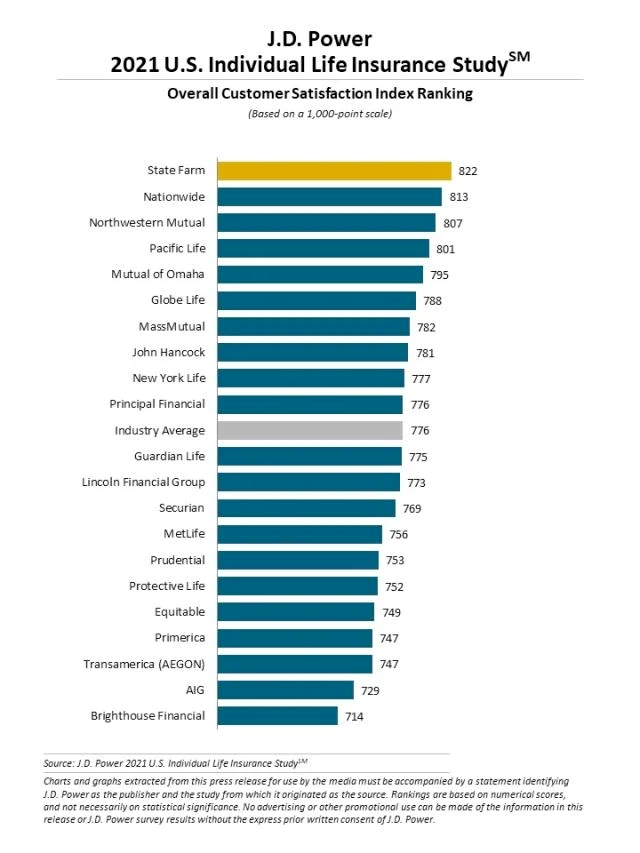

Methodology for the Most Secure VPNs

We considered security and other relevant factors while choosing the most secure VPNs. In short, we ranked the safest VPNs based on which providers clearly stand out in these areas:

- Pricing: We checked if each VPN provider offers both free plans and paid packages. Plus, we listed how much the monthly rates of the paid plans are in terms of 2-year, annual, biannual, or monthly billing.

- Security: We evaluated the basic or advanced security suite that’s included with every VPN service. Some examples of security features we discussed are VPN routing, encryption standards, IP masking, ad blocking, and no-logs policies. Read more on what a VPN protects you from here.

- Servers: We examined how many servers each VPN provider currently has in its network. Also, we explained if it has any special features like network protocols, private DNS, and auto location selection.

- Speed: We took note of the estimated speed of the VPN connection, at least if the numeric information is disclosed by the provider. Keep in mind that the actual speed might not always be the same as real-life speed since it’s based on different factors. In addition to this, we indicated the amount of bandwidth allotment if the data is available.

- Audits: We reported if the VPN provider underwent independent audits by third-party security auditing firms, such as Cure53, PricewaterhouseCoopers, or VerSprite. Aside from pinpointing which aspect of the VPN service was scrutinized, we summarized what the results of these inspections are.

Take note that the information in this comparative review is based on current data as of the time of this writing.

Frequently Asked Questions (FAQs) for Most Secure VPNs

The most secure VPNs keep your data and devices safe while you browse through the internet. That’s why the global VPN market has grown to a staggering $44.6 billion this 2022. Learn the answers to these frequently asked questions if you’re on the lookout for the safest VPNs.

Bottom Line on the Most Secure VPNs

We hope our comparison review helped you pick the best VPN provider which matches your business needs and budget. All seven industry-leading safest VPNs in this guide offer secure and reliable connections for your small business network and devices. Nevertheless, we especially recommend Surfshark as our top pick among the most secure VPNs because it combines superior security, quick speed, abundant servers, and affordable rates.