Zander has joined the board of a privately owned company that is growing rapidly and has plans to list within the next year or two. He is excited by the prospect of the IPO and determined to do a good job as a director, even though he has no prior board experience.

He is finding the role unexpectedly difficult as the CEO, who is also the founding entrepreneur and chairman, is very independent and views the board as a nice think tank – but not as an authority over him. On a few occasions the board has met without seeing up to date financial reports because the CEO was, by his own admission, “too busy building the business to worry about administration”. Whilst the business does appear to be going well Zander is worried that he is not discharging his duty.

Zander had a coffee with the CEO to discuss his concerns. At that meeting, the CEO let slip that he had set up a board because the company had reached a growth threshold where a board was required rather than because he felt any need for guidance or control.

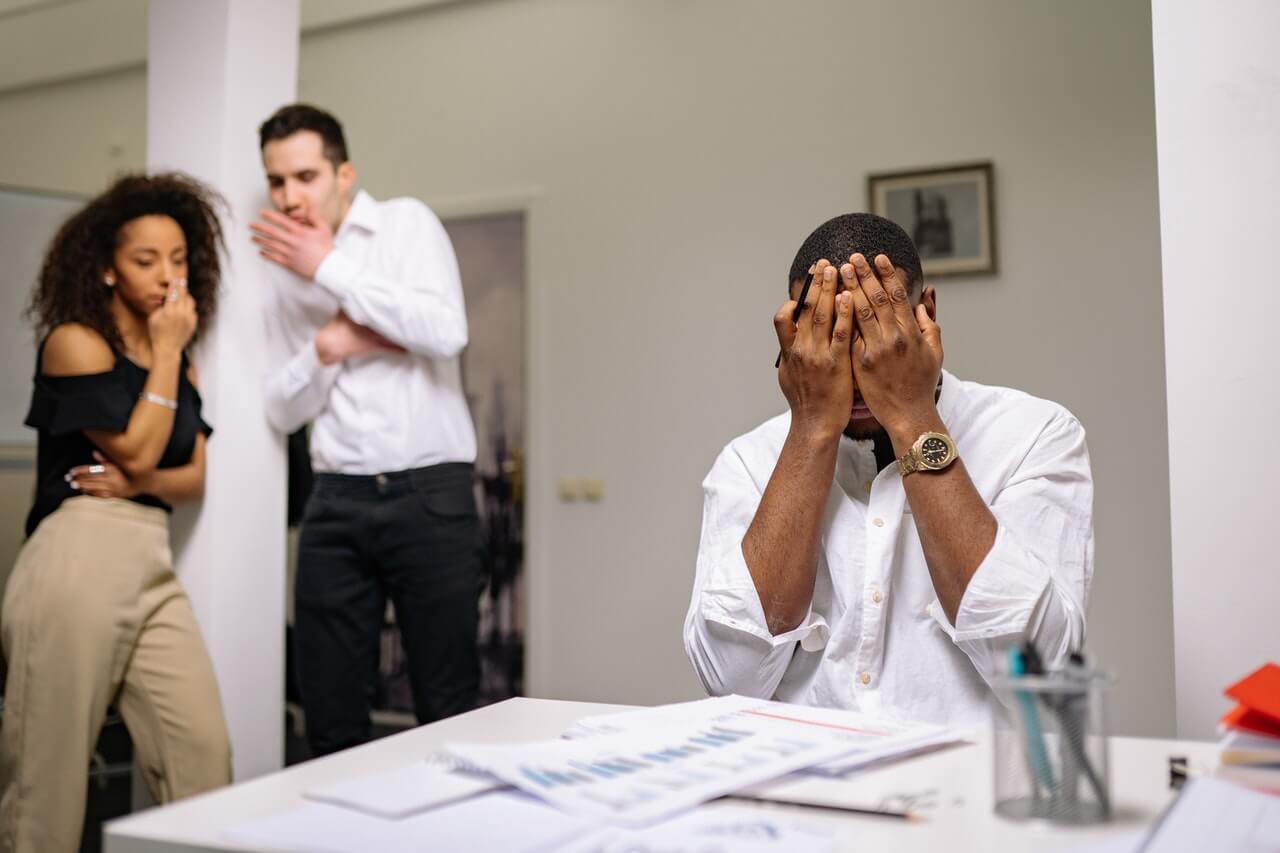

At the latest meeting it became apparent that the capital structure of the company was changing and that new investors were being invited to take up shares. The board had not approved a prospectus or information memorandum or any valuation of the company. The meeting became quite disorderly as the two professional non executives expressed their concerns and the CEO refused to divulge information because it was ‘his company’ and he didn’t think they should know how much he got from the sale.

Directors’ fees were due for payment a week after the meeting but have not been paid. The CEO is not returning calls or replying to emails and Zander is wondering what he should do.

How would you advise him to proceed?

Many readers of this blog will be familiar with my newsletter The Director’s Dilemma. This newsletter features a real life case study with expert responses containing advice for the protagonist. Many readers of this blog are practicing experts and have valuable advice to offer so, again, we are posting an unpublished case study and inviting YOU to respond.

If you would like to publish your advice on this topic in a global company directors’ newsletter please respond to the dilemma above with approximately 250 words of advice for Zander. Back issues of the newsletter are available at http://www.mclellan.com.au/newsletter.html where you can check out the format and quality.

The newsletters will be compiled into a book. If your advice relates to a legal jurisdiction, the readers will be sophisticated enough to extract the underlying principles and seek detailed legal advice in their own jurisdiction. The first volume of newsletters is published and available at http://www.amazon.com/Dilemmas-Practical-Studies-Company-Directors/dp/1449921965/ref=sr_1_1?ie=UTF8&qid=1321912637&sr=8-1

What would you advise?

Julie Garland-McLellan has been internationally acclaimed as a leading expert on board governance. See her website atwww.mclellan.com.auor visit her author page athttp://www.amazon.com/Julie-Garland-McLellan/e/B003A3KPUO