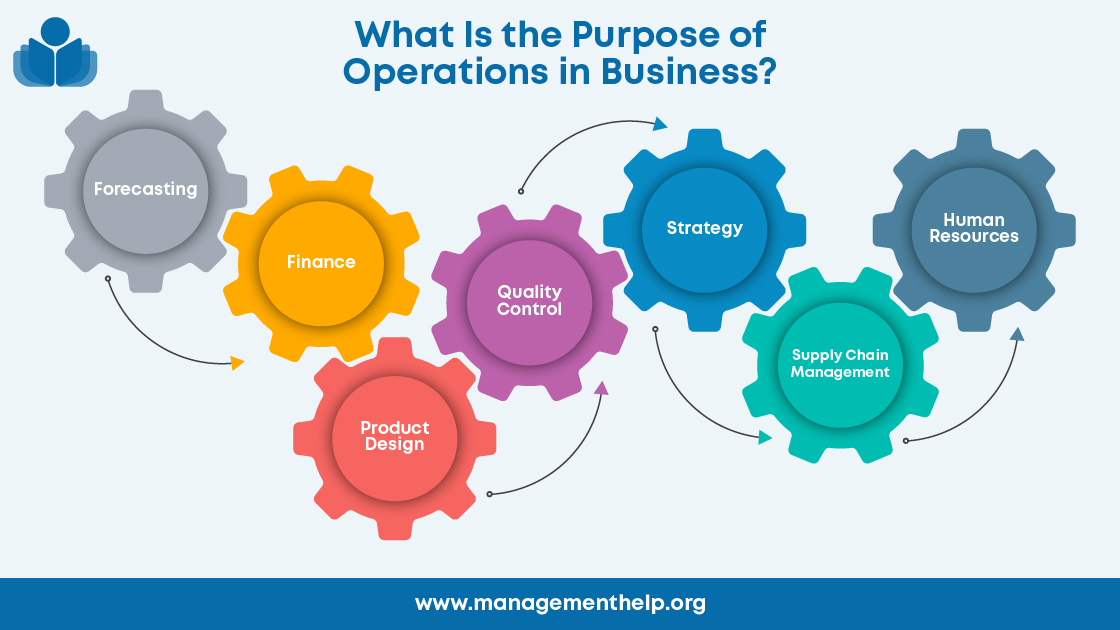

What Is the Purpose of Operations in a Business?

Business operations is an elusive but necessary part of any organization looking to maximize productivity…

Our content is reader-supported. Things you buy through links on our site may earn us a commission

Never miss out on well-researched articles in your field of interest with our weekly newsletter.

Author

Noah is an American copywriter on a mission to help clarify the nuances of the business world through unique insights stemming from backgrounds in both engineering and the medical field. When not working, you’ll likely find him running or traveling.

Business operations is an elusive but necessary part of any organization looking to maximize productivity…

RingCentral is a voice-over-internet protocol (VoIP) communications service, providing streamlined calling to anywhere in the…

Routing voice calls over the internet is becoming more economical and can provide a whole…

This Capital One review will show you how the bank can bring flexibility to the…

Corporations are responsible for a bevy of taxes on the state level across different mediums.…

Using one of the best 100% free VPNs lets you browse the web safely without…

VPNs allow for a safe, encrypted connection to the internet to protect your information from…

GoDaddy is a web hosting platform that goes above and beyond with a slew of…

Crypto wallets can provide security for the multitudes of digital assets currently available for purchase.…

Rental properties are a great way to earn income either full-time or on the side.…

Voice over internet protocol (VoIP) makes it possible for any business to develop an efficient…

Registering your own business doesn’t have to be daunting. Business registration services exist to streamline…

Customer lifetime value (CLV) is a metric you can track to discover who are your…

Hashtag Legal offers a modern approach to forming a business while providing a clear path…

Building the website of your dreams doesn’t have to break the bank. Free web hosting…

Payroll is an essential part of any business, whether you have one employee or 10,000.…