Rocket Lawyer Review: Features to the Moon and Back?

Anyone looking to build a startup for the first time need look no further than…

Our content is reader-supported. Things you buy through links on our site may earn us a commission

Never miss out on well-researched articles in your field of interest with our weekly newsletter.

Author

Noah is an American copywriter on a mission to help clarify the nuances of the business world through unique insights stemming from backgrounds in both engineering and the medical field. When not working, you’ll likely find him running or traveling.

Anyone looking to build a startup for the first time need look no further than…

Business registration in the US may seem like a challenge, but the process is actually…

Payroll mistakes can leave a black mark on an otherwise exemplary company profile. Failure to…

Managing projects in a business of any size is no simple task. For startups, having…

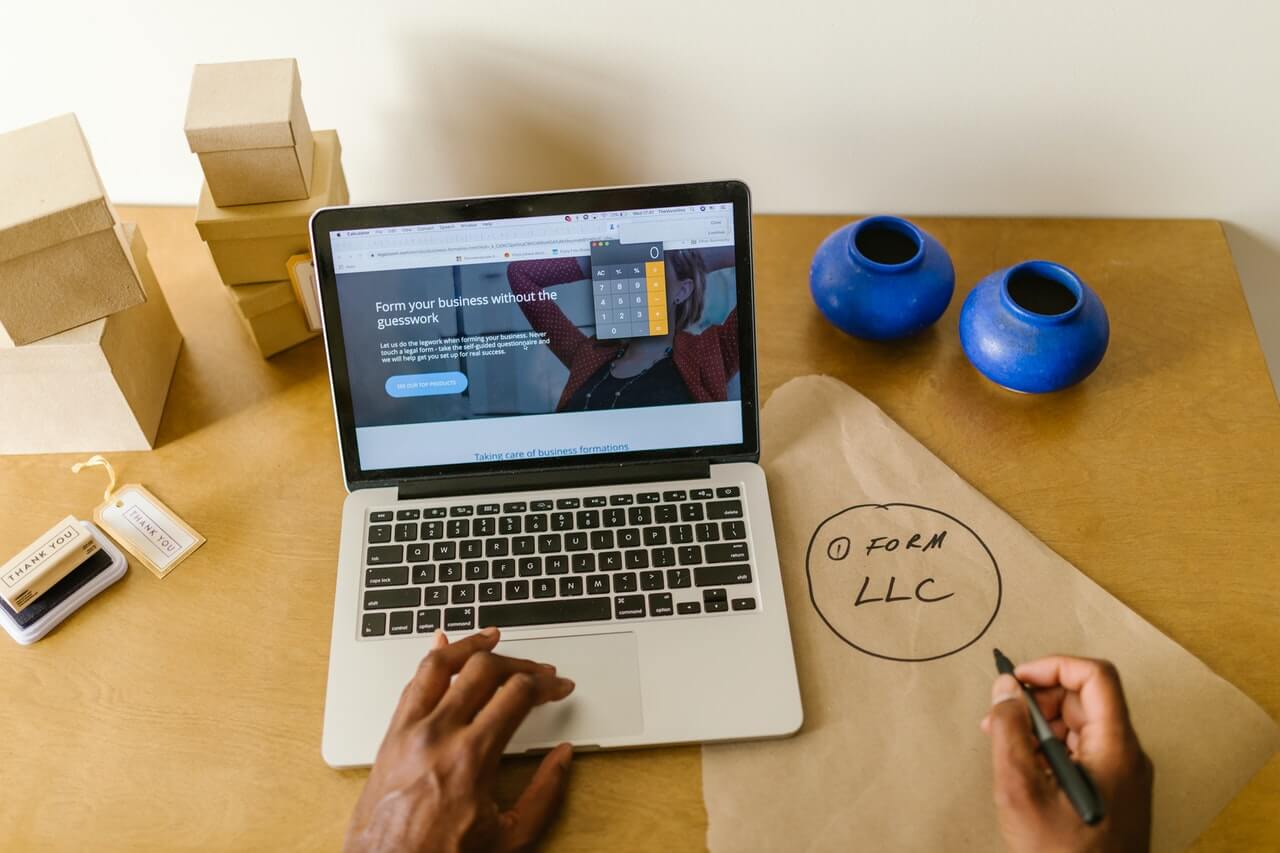

Whether you’re starting a new business or converting an existing company to a limited liability…

We understand that customers are the lifeblood of any ecommerce company. Fortunately, customer relationship management…

There are many types of project management software out there, but they are not all…

Gusto is a payroll processing software, offering tools to expedite payment processing and tax filing.…

As new technology emerges, professional communication tools are no longer limited to large corporations. Voice…

Thanks to modern technology, starting an online store has never been easier. Shipping companies make…

SurePayroll is a payment processing app designed to take the stress and guesswork out of…

Managing all the facets of a restaurant can be a tireless endeavor. Fortunately, point of…

Hiring can be a time-consuming process that costs a lot of money and distracts your…

Every business that needs to hire employees will need to process payroll. With all of…

Conference calling helps connect with clients and brings team members into the fold through audio…

Video conferencing software helps make our world that much smaller by connecting people from wherever…