If you decide you don’t want to form an LLC or corporation, you’ll likely want a “doing business as” registered name for your sole proprietorship or partnership. A DBA checking account can be a game-changer for a small company looking to build a brand. It can facilitate business processes, saving time and reducing headaches.

What is a DBA?

In both sole proprietorships and partnerships, the legal name of your business becomes your own name. Because of this, many small business owners wish to file a DBA to showcase themselves under a different name.

DBA stands for “doing business as.” Submitting a DBA allows you to operate your company under a different name even though its legal name does not change. Doing so helps create an image for your venture that you can build a brand around.

For instance, Sam Cutter starts up a sole proprietorship running store. Since he doesn’t want to refer to his business as “Sam Cutter,” he files a DBA for the name Sam’s Running Store. Now he has a clear brand to build his company around.

Some states may have naming restrictions you’ll need to follow. For the most part, you can name your business something serious, funny, or anything in between. In any case, DBAs help separate business and personal at least on paper. A DBA does not protect you from any legal ramifications you may face as a sole proprietor.

Filing a DBA

The DBA process is usually as simple as filling out specific paperwork and submitting it at the appropriate level. Some states require paperwork at the state level, while others only ask you to provide documents to the country. Others mandate submitting paperwork at both levels. After paying the necessary fees, your DBA is ready to go.

Creating a DBA Checking Account

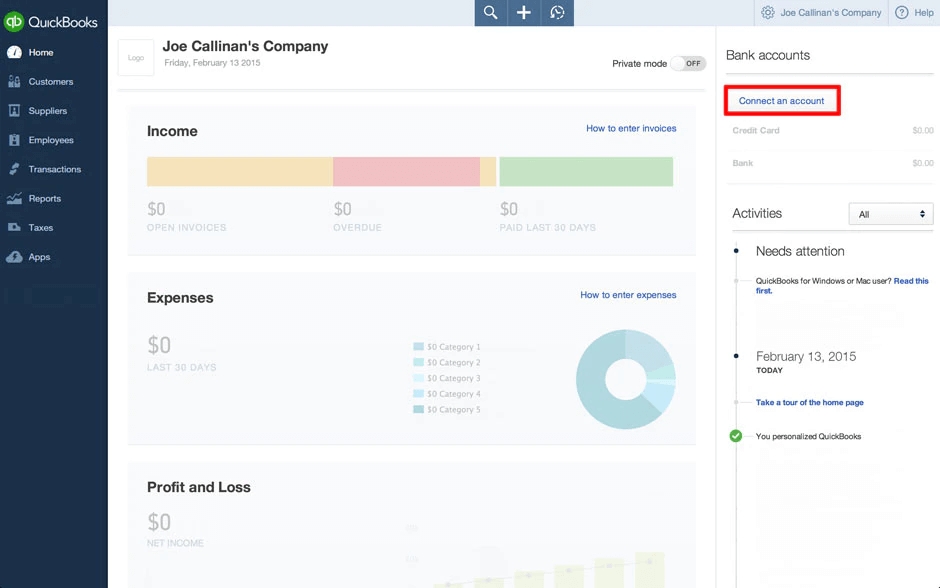

Once you start operating your sole proprietorship or partnership under a DBA, you may need a DBA checking account as well. Fortunately, setting up a DBA checking account is even easier than filing for a DBA in the first place. Some banks may even let you sign up online.

Requirements for opening your DBA checking account may vary from bank to bank. However, financial institutions typically look for the following:

DBA Certificate

You’ll receive a DBA certificate from the state or county once you file your doing-business-as name. The bank will want to see this document if you want to create an account under your DBA name.

Social Security or Employer Identification Number

Sole proprietorship owners often use their social security number for business identification. Partnerships are better off using an employer identification number (EIN), as there are two owners. In either case, the bank will need to know the number you used when starting your business. Here’s how you can open a business account with EIN.

Photo Identification

Any legal photo ID works for proving you are who you say you are. Common options include a driver’s license, state identification card, or passport.

Business License

Bring along any business licenses your city, county, or state required you to obtain when you started up your business. This includes specialized licenses or permits your particular company needs to function legally. Make sure each document lists your name and your company’s name.

Who is a DBA Checking Account Best For?

It is possible for any business type to open a DBA checking account, but it isn’t always practical. LLCs and corporations can create a company name on creation and should have no need to file for a DBA.

DBA checking accounts are best for sole proprietors and partnerships. Upon formation, a sole proprietorship’s legal name becomes your personal name. Partnerships typically take on the last names of the owners. It makes sense to file for a DBA and set up a checking account reflecting this new business name.

Benefits of a DBA Checking Account

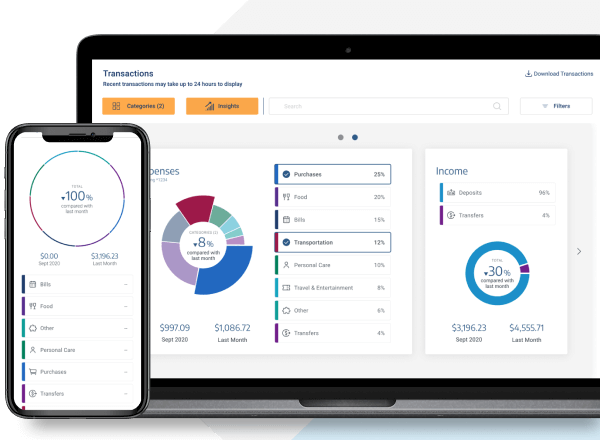

Using a DBA as a sole proprietor or partnership allows you to open a business checking account through a service like Bluevine instead of a personal one for your company. This enables your small business to reap the benefits a business checking account has to offer.

Separating Business and Personal

Opening a business bank account makes it easy to keep your personal finances apart from what you’re bringing in on the business side. Avoiding the mess of mingling funds helps with tracking income, expenses, and paying out taxes. It also helps to remove your real name from public advertisements that may compromise privacy.

Fast Transactions

As a business owner, you’re going to be buying supplies and selling products or services frequently. Personal bank accounts don’t always allow quick money transfers and may charge fees. Free business banking accounts are geared around the flow of funds, both expediting the process and making it cost-effective at the same time.

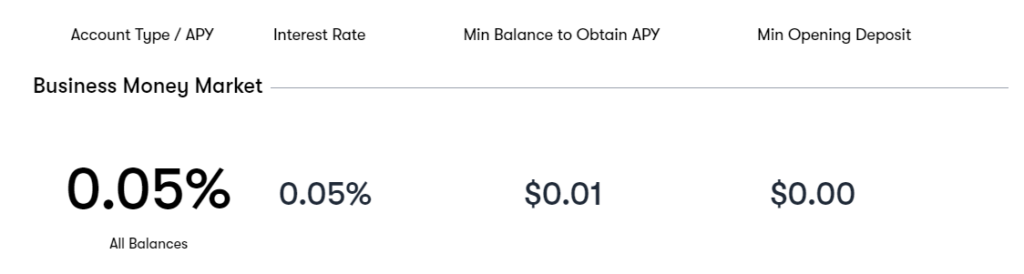

Interest Checking

The best business checking accounts tend to offer interest on funds stored within. The rate can be a significant boost to money you’re waiting to use for payments or holding for tax purposes.

Professionalism

No matter how small your company may be, having a DBA checking account adds a level of professionalism to your interactions with customers. Instead of seeing your name on transactions, your business has an appropriate name and reveals your purpose.

Future Financing

Many banks require you to have a business bank account for a certain number of years before you can request a line of credit or a small business loan. Starting a DBA checking account while you’re running a business solo helps set the stage for future growth.

Multiple DBAs Within a Single Bank Account

In most cases, it is possible to have multiple DBAs within a single bank account. Business owners may choose this route to further differentiate brands, products, or services within one business entity. It can be hard to juggle multiple DBAs unless you stay on top of your books.

If you take this approach, keep a very detailed list of funds moving into and out of your bank account, including the DBA they are moving through. Be sure payments clearly spell out where funds need to go with account numbers for tracking purposes.

Finances can get quite murky, and you don’t want to end up getting sued or audited along the way. It’s paramount to have a well-documented money trail lest you end up suffering through penalties or legal fees.

Alternatives to Using a DBA Checking Account

Using a DBA to open up a bank account isn’t for everyone. Here are a couple of other options you can consider instead.

Personal Checking Account

Sole proprietors don’t have to create a business account when forming their company. There isn’t a legal requirement to have a separate bank account for business purposes, so it’s possible to use your personal account instead. Depending on the type of business you own, it may be very challenging to distinguish funds. If you wish to create a business account, then check out the best business bank accounts for your sole proprietors.

Establish an LLC

Whether a sole proprietor or in a partnership, you can take your business to the next level by establishing an LLC. LLCs separate your personal and business funds, protecting your personal assets in the event of an audit or lawsuit. Your LLC will need a business bank account but doesn’t require a DBA to open.

Joint Bank Account

Partnerships can go the route of a joint bank account to keep business funds in a single account. Both partners receive full ownership of the account to make use of as they please. You will need information from both individuals, but you won’t need a DBA.

Frequently Asked Questions (FAQs) for DBA Checking Account

DBA checking accounts can be a confusing business. This FAQ will help alleviate your most pressing questions.

Bottom Line on DBA Checking Accounts

Filing a DBA for your sole proprietorship or partnership is a great way to help your business stand out in a sea of others. DBA checking accounts offer a sense of privacy and professionalism while making it easy to send and receive payments. In the same vein, many banks give added incentives to business owners that you won’t find in personal accounts.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.