Have you been investing in cryptocurrency? Maybe now it’s time to calculate and pay your crypto taxes. What is already a complicated activity can get a lot trickier if you don’t work with crypto tax software. In this article, we’ve wrapped up the best crypto tax software for 2023.

Best Crypto Tax Software

- CoinLedger – Best Overall

- Coinpanda – Best for Beginners

- Koinly – Best for Frequent Traders

- TaxBit – Best for Free Tax Reports

- ZenLedger – Best for Customer Support

Our Methodology

Most crypto tax software platforms offer similar products and services. To pick the best bang for the buck for our readers, we’ve analyzed if they have four things: free tax report (even if it’s a limited number) if it’s supported in multiple countries and offers multiple transactions, and most importantly, if it’s suitable for all budgets. Read more about our methodology here.

Product

Pricing

Free Trial

Integrations

Transactions

Supported countries

Starts at $49

Yes

Supports exchanges, wallets, and DeFi

Up to 100 with the Hobbyist plan

International tax reporting

Starts at $0

Yes

Supports exchanges, wallets, and blockchains

Up to 25 with the Free plan

65+

Starts at $0

Yes

Supports exchanges, wallets, and blockchains

Up to 10,000 with the Free plan

20+

Starts at $0

Yes

Supports exchanges, wallets, DeFi, NFTs, and more

Unlimited in the Free plan

US only

Starts at $0

Yes

Supports exchanges, blockchains, and DeFi

Up to 25 in the free plan and unlimited in the Platinum plan

US only

CoinLedger supports a broad set of exchanges, wallets, and DeFi. While CoinLedger does not offer a free plan, users can access many of the features available in each plan at no cost. If you commit to a plan, and in case it doesn’t correspond to your expectations, CoinLedger provides a 14-day money-back guarantee. But be aware that users will have to pay to use the platform after this period, as it doesn’t offer free plan tiers.

However, you are likely not to be disappointed: this crypto tax software has been reported by users as an easy-to-use program with excellent customer service. The platform’s automated data importing lets users import, track and reconcile all information in a few clicks. It also easily integrates with TurboTax and TaxDirect and 100 crypto exchanges and the most popular crypto wallets. It supports Ethereum blockchain and NFT transactions.

CoinLedger provides free portfolio tracking and free data import for all plans. In addition, it supports international tax reporting and can calculate returns for thousands of cryptocurrencies.

Why we chose it: CoinLedger offers an easy-to-use and straightforward platform even for newbies. The customer service is rated as one of the best among its competitors, and trader have a 14-day money-back guarantee.

- Easy-to-use

- 14-day money-back guarantee

- Excellent customer service

- No Free plan available

- Not available in many countries

Pricing:

Plan

Number of transactions

Price per tax year

Hobbyist

100

$49

Day Trader

1,500

$99

High Volume

5,000

$199

Unlimited

Unlimited transactions

$299

Tax reports

Payment will be required for users who want to download and view their full tax reports. If you’re looking for a free option, you may choose ZenLedger, Coinpanda, or Tax Bit. However, CoinLedger allows users to import all of their crypto transaction history, view their net capital gains and losses, and track their portfolio for free.

Supported countries

CoinLedger provides international tax reporting. Users can generate crypto gains, losses, and income reports in any currency, then use these reports to complete the tax forms in their own country.

Supported exchanges

CoinLedger supports a wide set of exchanges, wallets and DeFi. Users can import their data from any platform. However, if you need a higher number of exchanges, Coinpanda and Koinly offer more options – 500 and 350, respectively.

Coinpanda is considered one of the best tax software tools among crypto users, especially for beginners, and we couldn’t agree more. Its Free plan offers all types of ready-to-file tax reports (based on traders’ activity) and supports up to 25 transactions.

However, if you want to try out other plans, or in case you increase the number of transactions, Coinpanda offers a free trial for every package: the Hodler ($49 per tax year), Trader ($99 per tax year), and Pro ($189 per tax year). If you ever decide to start a new life somewhere around the globe, Coinpanda will follow in at least 65 countries. In addition, the software supports a wide range of crypto exchanges, wallets, and blockchains–more than most of its competitors.

Another highlight of Coinpanda is the tax-loss harvesting tool and portfolio tracking– It allows users not only to pay less tax but also to track their crypto portfolio, learn about their trades, and how to maximize them.

With over 4,000 customers, Coinpanda offers a free portfolio tracker and tax preview. Its Free plan also comes with error reconciliation, margin trading, NFT transactions from OpenSea and DeFi and email support.

Coinpanda, however, falls short in a few aspects. The company hasn’t developed an app for its users, which forces users to access the platform in a browser. Also, Coinpanda offers competitive pricing on its Trader and Pro plans but if traders pass 3,000 transactions, they’ll have to purchase additional transactions in bundles of 100 for $0.69.

Unsatisfied with Coinpanda software of service? If you decide the software isn’t for you, you have a seven-day-refund policy.

Why we chose it: The Free plan works perfectly for beginners. Coinpanda offers affordable plans as you increase the number of transactions you carry out, and the software is available in 65+ countries.

- Free plan for beginners, and free trial

- Supports over 500 exchanges, 75 wallets, and 125 blockchains

- Available in over 65 countries

- No mobile app

- Expensive for frequent traders

- Lower transaction limit available in the Free plan when compared to competitors

Pricing:

Plan

Number of transactions

Price per tax year

Free

25

$0

Hodler

100

$49

Trader

1,000

$99

Pro

3,000

$189

Satoshi

20,000

$389

Satoshi (increased limit)

50,000

$596

Satoshi (increased limit)

75,000

$768

Satoshi (increased limit)

100,000

$941

Tax reports

Tax reports are one of the most–if not the most–important features for crypto tax software, as they streamline the process for taxpayers and take off a lot of the stress associated with a tax settlement. Coinpanda offers all tax reports even in its free plan. Although only available for up to 25 transactions, unlike 10,000 with Koinly, this crypto software offers affordable plans as you raise your game with crypto trading.

Supported countries

Crypto is borderless – and so should be crypto tax software. Coinpanda is available in over 65 countries – the software on the list that supports the largest number of countries, so this definitely adds points to its rating.

Supported exchanges

Coinpanda supports all major exchanges for tracking trades and tax calculations – and it’s the most complete software on the list. Users can easily import their historical transactions using API keys or CSV files. It also supports over 500 exchanges, 75 wallets, and 125 blockchains. In addition, it also integrates with 38 services.

Koinly aims to be a platform that is user-friendly and useful to as many different cryptocurrency users around the world as possible. The software generates complex tax reports in about 20 minutes.

Available in over 20 countries around the globe, Koinly is the crypto tax software designed for crypto enthusiasts, Koinly offers a comprehensive level of support for cryptocurrency exchanges and wallets. It accepts payments with BTC, ETH, DAI, and USDC and also supports over 17,000 inflationary and deflationary cryptocurrencies – meaning you can report your gains and losses for the most popular cryptocurrencies, altcoins, and stable coins–making Koinly the best option for frequent traders.

Furthermore, it also offers over six years of prices: historical crypto and fiat spot prices can assure users that their costs are accurate.

With Koinly, users can easily track their crypto assets and taxes and visualize their actual Return of Investment (ROI), income overview, and profit/loss & capital gains. In addition, crypto traders can also connect their accounts via API and add their BTC wallets using x/y/zpub keys and ETH tokens with their public addresses.

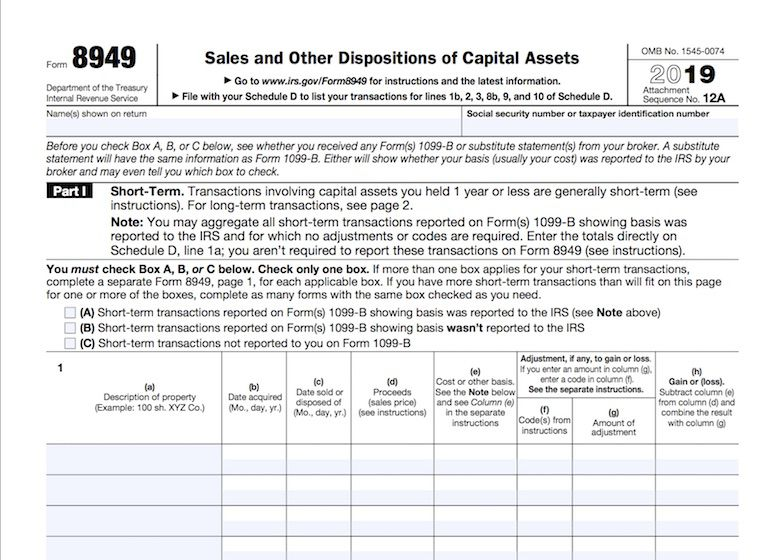

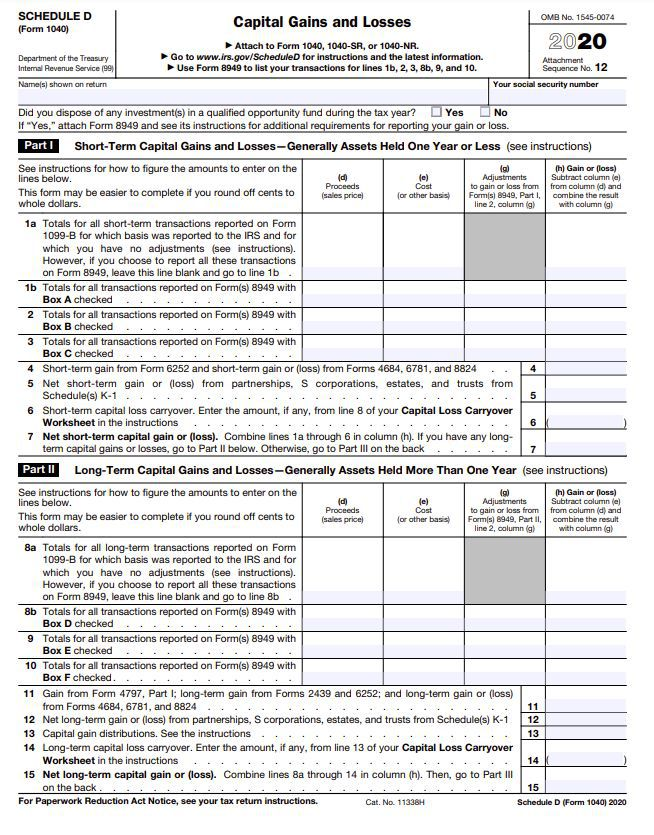

Even though Koinly is a great option for frequent traders, the tool doesn’t allow users to pay for its services using the cryptos from their crypto wallet. Instead, you’ll have to pay using fiat money. For those using the free version, be aware that the no-cost tier offers no tax reports (such as Form 8949, Schedule D, and international reports).

Why we chose it: Frequent traders who have a diverse portfolio can count on Koinly. The platform generates tax reports in 20 minutes and users can do it using its free app.

- Available in over 20 countries

- Free app

- Supports over 17,000 cryptocurrencies

- The Free plan does not support tax report download

- Email support is only available in the Trader plan

- Cannot pay for services using bitcoin or any other crypto

Pricing:

Plan

Number of transactions

Price per tax year

Free

10,000

$0

Newbie

100

$49

Hodler

1,000

$99

Trader

3,000/10,000+

$179

Tax reports

Opposed to Coinpand, Koinly does not provide tax report downloads for the Free plan – not even for as few as 25 transactions–which makes it not the best fit for beginners. On the other hand, frequent traders will have to commit to a plan no matter the crypto tax software they choose. So, they might as well go with one of the best and choose Koinly, for it provides multiple features and affordable prices compared to competitors.

Supported countries

Koinly is available in over 20 countries, while Coinpanda is present in more than 65. The company supports all countries that use Average Cost, FIFO, LIFO, HIFO, and more for calculating gains. In addition, Koinly also offers specialized tax reports for the US, Canada, Australia, UK, Germany, Norway, Denmark, and Sweden.

Supported exchanges

Koinly supports over 350 exchanges and no fewer than 50 wallets. The crypto software auto-syncs data from all sources without the need for a private key.

TaxBit offers data integration with over 500 platforms, current-year tax forms for all supported TaxBit network companies and a DeFi and NFT tax engine.

TaxBit integrates with over 500 exchanges, wallets, DeFi protocols, and the most popular NFT marketplaces such as OpenSea. This crypto tax software has supported an impressive number of over five million taxpayers.

TaxBit provides an Individual and Enterprise platform. With the Individual platform, users can easily automate their crypto tax forms for free. In addition, TaxBit can provide instant insights into users’ portfolio value and optimize tax-loss harvesting strategies.

Despite many benefits, TaxBit falls short in three major aspects: it doesn’t have a mobile app, the platform doesn’t accept crypto payments and access is limited to US users only.

Why we chose it: The thing that sets TaxBit apart from other crypto tax software is it offers unlimited transactions even in its Free plan. In addition, TaxBit also allows users to export tax reports for free.

- Unlimited transactions for all plans

- Free tax reports

- DeFi and NFT tax engine available in all plans

- No mobile app

- Does not accept crypto payments

- Limited to the US

Pricing:

Plan

Number of transactions

Price per tax year

Network

Unlimited

$0

Basic

Unlimited

$50

Plus

Unlimited

$175

Pro

Unlimited

$500

Tax report

One of the most significant aspects of TaxBit is it offers free tax reports for all users and unlimited transactions. This means that the Free plan can cater to beginners to frequent traders.

Supported countries

The downside to TaxBit, however, is it is localized to the US. This means international users will not entirely benefit from the platform’s features, in this case, we recommend Coinpanda, present in more than 65 countries.

Supported exchanges

TaxBit supports over 500 platforms, similar to our best overall pick, Coinpanda, indicating that any crypto trader settling with the US tax requirements can benefit from this software.

ZenLedger supports over 400 crypto exchanges, including more than 30 DeFi protocols and wallets via API or CSV. Furthermore, ZenLedger’s free plan provides detailed reports for up to 25 transactions. However, if you feel you want to take it up a notch, the Starter plan provides up to 100 transactions with prices starting at $49.

With ZenLedger, users can track their trades and their profits and losses. They can also import and review their transactions and download their forms easily. ZenLedger allows traders to access many features, such as audit reports, tax pro access, HIFO/FIFO/LIFO, unlimited exchanges, mining, donations, tax-loss harvesting, and ICOs.

For all the frequent traders out there that require more personalized assistance, ZenLedger’s Platinum plan offers two hours of premium support from one of their dedicated customer service agents. But, the good thing is that customer service is excellent in all-tier plans.

The bad news is that ZenLedger is only available in the US. users. Another drawback is that staking, DeFi, and NFTs aren’t accessible for Free and Starter plans – only Premium and above.

Why we chose it: ZenLedger stands out for premium customer support, no matter the plan the user has committed to. Another pro is that the free plan allows users to access all detailed reports.

- Premium support available in all plans

- Free plan comes with all detailed reports

- A personal consulting is available per request

- Supports only US requirements

- Not fit for international users

- DeFi, staking and NFTs are only available for the Premium plan and above

Pricing:

Plan

Number of transactions

Price per tax year

Free

Up to 25

$0

Starter

Up to 100

$49

Premium

Up to 5,000

$149

Executive

Up to 15,000

$399

Executive

Unlimited

$999

Tax report

ZenLedger provides users with all detailed reports, even if they are using the Free plan. This makes it an excellent tool for first-timers that carry out fewer than 25 transactions, unlike 10,000 Koinly offers.

Supported countries

ZenLedger tax reports are localized and will only support the requirements of the US. This means that international users might not take the most advantage of the platform. Traders wanting international support, Koinly and Coinpanda support multiple countries.

Supported exchanges

ZenLedger supports all crypto exchanges and wallets through API or CSV files. In addition, it is integrated with over 400 exchanges, similar to Koinly and Coinpanda, more than 40 blockchains, and no fewer than 20 DeFi protocols.

Methodology for the Best Crypto Tax Software

As you have seen in this article, there are a number of excellent crypto tax software that can help investors. But what makes Coinpanda our number one choice among the other platforms? Well, we’ve picked a platform that would be suitable for different profiles. This includes their trading activity, localization, and used platforms.

- Free tax reports: Our top pick must offer the option of a free tax report download, even if it is for a limited amount of transactions. We know that a large part of investors start off with very few transactions–and because the crypto world might seem like something new for them, being able to test crypto tax software thoroughly is essential for a smooth operation from end-to-end.

- Supported by multiple countries: As we mentioned previously in this article, crypto is borderless, and so should be a crypto tax software. Investors are located worldwide, and even US investors might eventually feel the need for a global platform: they might move out of the country and start a new life somewhere else or start an operation in a new region. Either way, having a crypto tax platform that supports multiple countries will come in handy in these scenarios.

- Supported by multiple exchanges: Our top pick should have the most comprehensive set of integrations with exchanges and wallets and blockchains. After all, there are hundreds of crypto platforms out there and integrating with every possible one is essential for users, especially considering many traders use multiple platforms.

How to Trade Crypto

You can make a crypto trade by exchanging one crypto for another (such as Bitcoin to Ethereum) or buying or selling crypto using fiat currency (like US dollar to Bitcoin). The process, however, despite being easy, can get complex if you don’t understand the crypto market, similar to stocks and other financial markets.

Before starting off, you should understand how blockchain technology and the market involved in trading crypto works. So, if you’re ready to venture into crypto trading, there are six steps to follow and we’ve detailed them in this complete guide on how to trade crypto.

Pros & Cons of Cryptocurrency

Cryptocurrencies are highly volatile, so it’s very common to see Bitcoin prices fluctuate over 10% in a single day. This is a great opportunity for high-risk profiles to make a profit quicker with crypto trading.

But is crypto worth investing in? Or is it something for you? If you can handle volatility and are okay with the risk of loss (in case you can’t access your wallet or private key) and security, cryptocurrencies have high return potential (oftentimes higher than the stock market), it gives users anonymity, and it’s very accessible and versatile–it only takes a few minutes to trade and transfer Bitcoin or any other crypto. If you’re sold on the idea of profiting from cryptocurrencies, check the fastest growing cryptocurrencies in 2023 and get ready.

Frequently Asked Questions (FAQs) for Best Crypto Tax Software

We have answered the most frequently asked questions so you can learn when and how you should report your gains and losses with cryptocurrency.

Bottom Line On Best Crypto Tax Software

Working with reliable crypto tax software can make reporting your gains and losses with crypto trading much smoother. When choosing the right platform, be sure to check if the crypto tax software is available in your country. Moreover, you should also check if the platform supports whatever exchange or wallet you will sync your data with.

If you are reporting your crypto gains and losses for the first time and aren’t a frequent trader, you might want to consider crypto tax software that offers free tax report downloads. This will streamline your tax settlement process while also providing accurate results. Most importantly, don’t forget about customer service: paying taxes is tricky as it is, so choosing a provider that will guide you through this process and answer all of your questions can make a huge difference at the end of the day.

Calculating and paying your crypto taxes doesn’t have to be painful. Crypto tax software such as Coinpanda, Koinly, CoinLedger, ZenLedger, and TaxBit offer a number of features that make tax reporting surprisingly seamless.