If you rely on vehicles for your business to thrive, don’t shift into drive before picking up some commercial auto insurance. Personal coverage won’t cut it if you or a staff member has an accident while on the job. Keep reading to discover the best commercial auto insurance companies offering your vehicle or fleet the protection it needs.

Get your company vehicles insured with Embroker.

The 5 Best Commercial Auto Insurance Companies

- Embroker – Best Commercial Auto Insurance Overall

- Next Insurance – Best for Fast Coverage

- Hiscox – Best for Comprehensive Coverage

- The Hartford – Best for Large Businesses

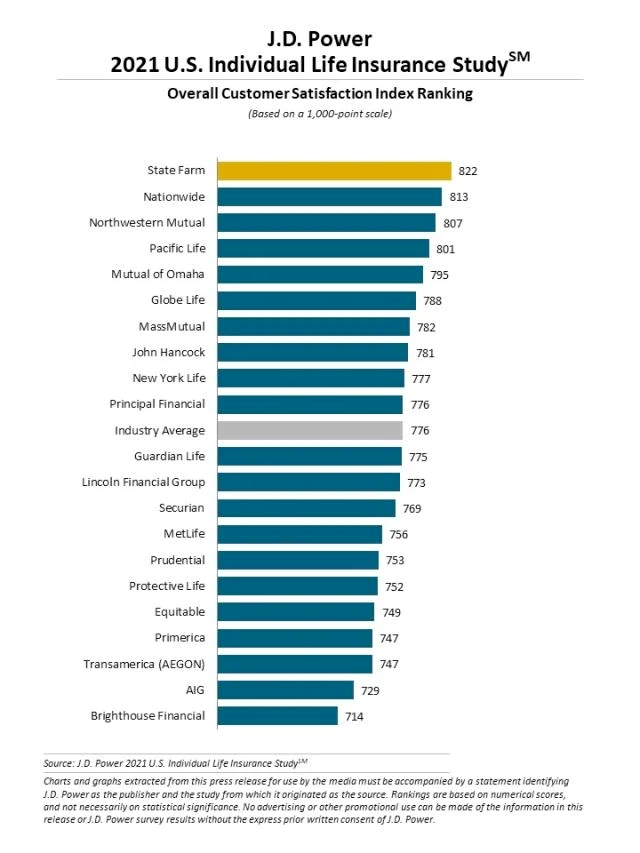

- Allstate – Best for Customer Service

When weighing the best commercial auto insurance companies, we looked at providers covering a wide margin of vehicles for current and future business use. We also considered coverage options, how easy the claims process was, and the amount of time it takes to receive approval for coverage. Finally, we wanted to make sure the insurance provider has a support staff that is quick to help and has all the right answers.

Click here for a more detailed understanding of our ranking methodology for picking the top commercial auto insurance companies.

Also ranked as the best small business insurance provider, Embroker has a speedy application process with complete coverage for automobiles and other aspects of your business. Plans typically come back affordable, but Embroker keeps pricing information close to its chest until you request a quote. The company works with brokers instead of supplying coverage itself and doesn’t have a mobile app to use on the road.

Why we chose it: With affordable coverage options for your fleet and drivers, Embroker is the best business auto insurance out there. Read our Embroker review to find out more about it.

- Affordable coverage

- Fast application process

- Complete coverage with customizable plans

- Unclear pricing information

- No mobile app

- Works with brokers

Pricing: Embroker isn’t forthcoming with pricing information, as many factors can affect the cost of a plan. For instance, a vehicle’s type, value, and mileage all play a role. So too does the number of vehicles in your fleet, any cargo they transport, and your employees’ driving records.

Vehicle Types Covered

Commercial auto insurance covers vehicles owned by the business itself or individuals using one for the sake of business. Vehicles typically covered by Embroker include:

- Passenger cars

- Pickups

- SUVs

- Vans

- Delivery Vans

- Cement mixers

- Tractor Trailers

- Flatbeds

- Cranes

Coverage Options

You’ll have to deal with any incident involving one of your business vehicles, so it’s important to have sufficient coverage. Embroker’s policies cover injury or property damage to third parties and any medical bills from your driver. Plans also pay for vehicle repairs or help bridge the gap in money owed in a lease. You can add protection from weather or theft and even tack on roadside assistance if you want more protection.

Claims

When filing a claim, the first step is to reach an Embroker through chat. A team member will help you provide the necessary information to eliminate any bumps in the road. Serious incidents may require a visit from an adjuster.

Approval Time

It doesn’t take too long to receive a quote for business auto insurance. Once you’ve provided the necessary data, Embroker should have some numbers for you within 15 minutes. The most time-consuming aspect is figuring out which types of coverage work best for your business.

Support

While Embroker has offices in four cities, the best way to deal with the company is online. Its website lists several phone numbers, email addresses, and even has a chat feature. Team members are standing by between 9 am and 9 pm eastern standard time.

With Next Insurance, you can get quotes faster than anywhere else and feel confident with your end result. The site doesn’t cover niche industries like food trucks but does provide a discount if you bundle auto with other policies. You’ll receive free digital insurance certificates to distribute as needed, but Next Insurance does not work in every state. Furthermore, some claims are handled out of state and bog down the process.

Why we chose it: Next Insurance’s easy application process will have a quote for you in under ten minutes while ensuring you’re getting the coverage you need. Read more about Next Insurance here.

- Quick and easy application process

- Can save up to 25% by bundling policies

- Free digital certificates of insurance

- Does not work with food trucks or mobile businesses

- Some claims are handled out of house, slowing down the process

- Not available in every state

Pricing: The Next Insurance website reveals commercial auto insurance costs can range from $62.50 to roughly $250 per month, depending on your vehicles and driving history. The company focuses on small businesses and may not have coverage to support larger ventures.

Vehicle Types Covered

Next Insurance doesn’t explicitly state what it does cover but mentions several things it does not. Motorcycles, vehicles with more than two axles, and food trucks are all off the table. Similarly, The company does not provide policies for passenger transportation businesses.

Coverage Options

Commercial auto with Next Insurance can help pay for medical expenses, collision repairs, damage to property from one of your vehicles, and legal fees along the way. Policies go on to offer money toward rental vehicles or towing as needed.

Claims

It’s most expeditious to file your claim online in the event of an accident, but you can also reach out to a Next Insurance team member via phone. In either case, you’ll have to provide photos and documentation of the event. Next Insurance usually makes a determination within 48 hours of submission.

Approval Time

Nothing tops Next Insurance regarding approval time for coverage. With carefully crafted questions, you can have a quote in mere minutes to approve and start protection on the vehicles you and your team use for business purposes.

Support

Customer support members are standing by between 9am and 8pm Monday through Friday. where you can reach someone by phone, email, or the online chat feature. The company does not have physical locations you can visit at this time.

Advertised as America’s leading small business insurer, Hiscox has coverage for just about every business need under the sun. Over 120 years of experience have helped the team develop specific policies for hundreds of industry types. The team tends to handle claims slowly and works best for small businesses. Anyone other than those in Alaska can try Hiscox risk-free for up to 14 days.

Why we chose it: Hiscox understands company risk not just in auto coverage but in many other areas of business as well.

- Several other types of business insurance to pair with

- Over 120 years in business

- 14-day money-back guarantee

- Slow to respond to claims

- Best suited for businesses of ten employees or less

- No coverage in Alaska

Pricing: There’s zero pricing information on Hiscox’s website, even for pre-built plans. The only way to get cost information is by applying for a quote through the application process.

Vehicle Types Covered

There’s no overt vehicle restriction on any of Hiscox’s best commercial car insurance policies. Plans state you can cover any owned, rented, hired, or employee-owned vehicles used for work purposes.

Coverage Options

Hiscox has policies for physical damage to owned, hired, rented, or employee vehicles working on your behalf. In the event of an accident, the insurer works to cover costs for your business, employees, and anyone else involved.

Claims

A few days may pass before Hiscox takes note of your claim, and then you’ll have to wait longer to be assigned an agent. All in all, the entire process can take close to a month before you have any resolution.

Approval Time

You’ll find several tailored policies for hundreds of business types on Hiscox’s web page. Should you need to customize one of these plans, it can take significantly longer to get coverage.

Support

Customer service works from 8am to 10pm eastern standard time to handle issues and claims with your service. Hiscox does not provide email or chat support for those looking to communicate through other means.

The Hartford has a FleetAhead program that works to improve fleet operations for large businesses alongside plans to cover large fleet operations. Getting a quote isn’t smooth, but it is possible to receive money toward alternative energy vehicles as you upgrade. You’ll need to speak with an agent to finish up the quote process, but over 1 million customers currently use the system.

Why we chose it: The Hartford’s fleet-focused plans can help businesses with several vehicles stay protected in any situation.

- Great range of plans for large numbers of vehicles

- Pays an additional 10% (up to $2,500) for replacing vehicles with hybrid, electric, or natural gas models

- Over 1 million business customers

- Convoluted quote process

- Requires talking to an agent to finalize a rate

- Focuses more on fleets of vehicles

Pricing: While you won’t find pricing information on The Hartford’s site, the company has special discounts for hybrid, electric, or natural gas vehicles. With a focus on larger fleets, it’s possible to save on multiple vehicles or pay in full up front.

Vehicle Types Covered

Policies with The Hartford represent any and all vehicles your company uses for business purposes. This includes cars or trucks you rent or lease and those used for transportation services. There’s no indication of a maximum vehicle size on the site, and the Hartford offers incentives for hybrid and electric automobiles.

Coverage Options

The Hartford’s best business auto insurance plans shield your company from costs due to bodily injury or damage to vehicles or property. You can extend coverage to include fire, theft, or natural disasters as well. There are options for gap coverage on leased vehicles, and the Hartford can cover rental expenses when an auto is in the shop.

Claims

You can report a claim either by phone or through the Hartford’s online system. In both scenarios, you’ll work with a claims handler to assess the damage and provide compensation due to loss. The process is thorough but can take a few weeks from beginning to end.

Approval Time

When dealing with commercial auto insurance quotes, you’ll need to call an agent to review all fleet details. While an online process may take less time, The Hartford team helps ensure you don’t miss anything you’ll need.

Support

Many offices in communities around the country affiliate themselves with the Hartford and can provide coverage details. These can be hard to distinguish unless you first look on the Hartford website. To avoid the hassle, you can call or chat from 8am to 7pm EST. The claims department is available all the time.

Allstate prides itself on keeping the front door open in each of its local offices around the country. The company wants to make an impact on each business owner with personalized service. There are limitations on how to submit claims, and qualifications for membership often vary from state to state. However, those in for the long haul can see discounts on higher than average prices over time.

Why we chose it: Allstate’s 9,000 physical locations and a personalized touch help the company stand out in a sea of online competition.

- Local agents in many locations around the country

- Personalized attention

- Discounts based on long-term use

- Must file claims over the phone or in person

- Prices can be high

- Qualifications vary from state to state

Pricing: Like many of the other best commercial auto insurance companies, Allstate isn’t clear on what costs will be until you’ve walked through the quote process. No two businesses are the same, and Allstate will provide a unique quote depending on your fleet, company history, and coverage limits.

Vehicle Types Covered

Allstate understands companies aren’t the same, offering customizable coverage depending on your business needs. In most instances, its insurance plans cover the following vehicles tagged for business use:

- Cars

- SUVs

- Vans

- Pickup trucks

- Box trucks

- Service utility trucks

Coverage Options

After obtaining insurance through Allstate, business owners can rely on cost coverage for bodily harm and repairs from a collision. Those wanting fuller coverage can pick up comprehensive insurance that protects from other types of loss and pays for rentals while other vehicles are in the shop.

Claims

There are multiple ways to submit a claim through Allstate, including via phone call or mobile app. If you’re not far from one of the company’s 9,000 locations, filing in person is possible.

Approval Time

When requesting a quote online or in person, the insurer will navigate you through a series of forms to determine the best protection for your company’s vehicles. After completing the process, you’ll have to wait a number of days for Allstate to provide costs for coverage.

Support

Getting in touch with an Allstate agent shouldn’t be much of a challenge. You can find a local business through the website or simply call the toll-free number for assistance. There’s also an app to stay on top of the latest happenings regarding your policy.

Ranking Methodology for the Best Commercial Auto Insurance

In this section we will spell out what we considered when we chose the best option. We will have one intro paragraph and in this section, we will spell out what we considered when we chose the best option. We will have one intro paragraph and then list out the criteria with what it is and how it was considered, like the following:

- Vehicle Types Covered: Your business may be a certain size now, but it likely won’t always stay that way. As you expand your fleet and add in new vehicle types, it’s important to make sure your carrier can accommodate them. You also don’t want to get stuck in a policy with a maximum number of vehicles you outgrow in time.

- Coverage Options: Coverage you purchase for your cars, trucks, and big rigs should pay for any repairs and damage to property caused while one of your workers was driving. If your driver or passengers were injured, the best commercial auto insurance companies should handle expenses there as well. Policies can also pay for legal fees and the cost of rentals while your vehicle is out of commission.

- Claims: Any claim you file should be part of a straightforward process that doesn’t take all day to complete. Once submitted, the insurance company should provide clear expectations about the documentation they need and the timeframe to receive a determination.

- Approval Time: The best business auto insurance keeps the application process brief and the approval time even shorter. They understand you can’t drive a car without insurance coverage and work hard to provide reasonable quotes you can approve right away.

- Support: Accidents can happen anytime, and getting matters resolved quickly is paramount. After all, a damaged vehicle could translate into delays and loss of income. The best commercial auto insurance companies have people on hand when you need them most.

Components of Commercial Auto Insurance

Be sure to consider the following components when choosing the ideal commercial auto insurance plan for your business.

Coverage

As you build your policy, you’ll want to weigh the types of incidents your vehicles might be exposed to and which circumstances are important to cover. This includes specific types of damage to the vehicle, medical expenses due to bodily injury, and even the destruction of property.

There’s no reason to limit commercial auto insurance to times on the road. More comprehensive coverage can protect you in case of theft, weather, or vandalism while your car is parked. If your business can’t afford to lose a vehicle to repairs, you can opt for rental expenses as well.

Policy Limit

No matter how great your policy is, your insurance company will assign a ceiling to the amount they’re willing to pay. This number may appear as a lump sum or come split between medical expenses, vehicle damage, and the like.

A more extensive fleet likely needs a higher policy limit, but raising the roof generally comes with higher monthly rates.

Deductible

The deductible represents the out-of-pocket amount you’ll need to pay upfront before your insurance provider steps in. Lowering the deductible amount for your vehicles typically increases the monthly amount you’ll need to pay.

Monthly Premium

You’ll need to pay a monthly premium in order to retain your coverage. Costs can vary greatly depending on how you set up your policy.

Does My Business Need Commercial Auto Insurance?

Nearly every state requires personal car insurance to get you from point A to B. These states also have specific guidelines surrounding what constitutes personal use and what’s considered a business purpose. If you ever use a vehicle for business reasons, you’ll need to have commercial auto insurance as well.

Personal auto policies won’t cover accidents while you or a staff member are on the road. What’s more, not having appropriate coverage could land you in legal hot water. Most states require bare-bones coverage, but it’s a good idea to pay a little more to get the protection you need.

Any company meeting at least one of the following points must have a business auto insurance policy:

- Your company owns, rents, or leases at least one vehicle

- You or someone in your business transports tools, equipment, goods, or people from one place to another

- Employees drive a vehicle designated for business

- You use an automobile only for work purposes

- Your vehicle is part of a business service

What Does Commercial Auto Insurance Cover?

Commercial auto insurance providers may offer pre-built packages for certain industries, but you’ll want to improve upon these policies to fit your business needs. Consider the following coverage types when customizing your plan:

Collisions: When your business vehicle makes contact with another car or object, collision coverage comes to the rescue. It can pay for some or all damages to the vehicle you or a staff member were driving.

Comprehensive: Comprehensive coverage goes beyond accidents, including reimbursements from fire, water, vandalism, theft, or similar events depending on your coverage.

Medical Expenses: Commercial auto insurance can pay for some or all of your medical expenses if you get hurt in an automobile accident. Policies can also offer assistance to passengers riding in the car with you.

Personal Injury Protection (PIP): Twelve states require personal injury protection, also known as no-fault insurance. It is a special form of coverage that pays for healthcare expenses stemming from an accident. Compensation extends to others in the vehicle, even if they don’t have insurance of their own.

With PIP insurance, medical expenses are taken care of no matter who is at fault.

Property Damage: Property damage coverage pays toward any destruction caused to another person’s belongings in an accident you were at fault for.

Bodily Injury: Bodily injury coverage pays for wounds another person receives resulting from an accident you’re responsible for.

Rental Reimbursement: When your normal business vehicle is undergoing repairs from a covered incident, rental reimbursement can pay toward a rental car, so business doesn’t stall.

Uninsured Motorists: If an uninsured motorist strikes your vehicle, having this coverage pays for any injuries you receive.

Best Commercial Auto Insurance Frequently Asked Questions (FAQs)

Want to learn more about commercial auto insurance? This section features answers to common questions on the topic.

Best Commercial Auto Insurance – Bottom Line

Commercial auto insurance is an imperative part of any company using vehicles for business purposes. The best providers cover a wide range of cars, trucks, and heavy machinery with one policy while considering the needs of your specific business model. Should an incident occur, you want to be certain both your team and vehicles are in good hands and your company doesn’t have to miss a beat.