Managing your business’s finance is no easy task–but it’s easier when you work with the right tools. An online business checking account with no credit check is one of the essential resources you need for your business to operate.

Opening a business bank account is necessary if you want to separate your personal finances from your company’s finances. It’s also a must if you want to get your business registered. The good news is that there are low-cost and efficient options to do it: Many banks offer business checking accounts that cost very little–or nothing at all–while also offering a broad set of banking services that fit small businesses’ needs just right.

Best Online Business Checking Account (No Credit Check)

- Novo – Best Overall

- BlueVine – Best for Earning Interest

- LendingClub – Best for Cashback

- Lili – Best for Tax Optimization

- Wells Fargo – Best for Full Banking Services

Product

Service

Fees

Credit Checks

Annual Percentage Yields (APY)

Support

Checking account integrates with other business tools

- $50 minimum opening deposit

- $0 monthly service fees

No credit check when opening an account

It doesn’t offer

E-mail only

Checking account with best Annual Percentage Yields (APY)

- $0 minimum opening deposit

- $0 monthly service fees

No credit check for LLC or corporation

Up to 1.5% interest for eligible customers

Phone or e-mail

Checking account with up to 1% cashback

- $100 minimum opening deposit

- $10 monthly service fees

Only when applying for loans

0.10% APY on balances of $5,000 and up

Online chat, phone or e-mail

Checking account with tax optimizer

- $0 minimum opening deposit

- $0 monthly service fees

No credit check when opening an account

Savings with 1% APY

E-mail only

Checking account with over 12,000 ATMs across the US

- $25 minimum opening deposit

- $10 monthly service fees

Second chance account available

It doesn’t offer

Phone or local branches

If you are looking for a cost-efficient business checking account with no credit checks, Novo is the best fit for you. Its features cover all the basic banking services your small business might be looking for, all at a very low cost. In addition, Novo discloses all its fees.

Users can easily access the checking fee schedule on the website. While your business won’t benefit from an APY interest rate, the Novo checking account offers a broad set of features that will take your business’s finances to the next level, without adding any complexity to it.

As far as credit checks go, Novo makes it very clear that it will not check your credit history once you apply for an account. In addition, having an account with Novo does not affect users’ credit scores.

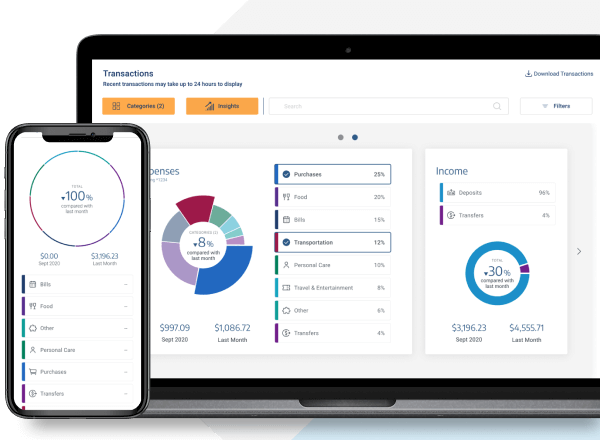

What really sets Novo aside is its integrations. Businesses can connect Novo with a number of tools, such as Shopify, Stripe, QuickBooks, and Xero. These features help businesses track their sales within payment platforms, sync transactions to accounting software, and easily send money overseas. Novo is also supported by Google Pay and Apple Pay–you won’t need to carry your plastic around when shopping for your business.

Also, Novo users get access to discounts and credits with partner companies such as Stripe, Booking.com, Google Cloud, and Gusto. However, Novo requires a minimum of $50 as an opening deposit. Also, there are charges for NSF (Non-Sufficient Funds) and UCF (Uncollected Funds) of $27 each.

Why we choose it: Novo is the best overall for small businesses as it offers an affordable business checking account, integration with business tools, and discounts with partner companies.

- Low costs and no hidden fees

- Easy transfers

- A broad set of integrations and discounts with partner companies

- Requires a minimum opening deposit

- A $27 fee for insufficient funds charges

- A $27 fee for uncollected funds returned

Pricing:

- $50 minimum opening deposit

- $0 monthly fees

Ranked as the best small business bank account for LLCs, the BlueVine business checking account comes in a close second in our ratings, as it offers a broad set of banking features at nearly zero costs–the company doesn’t require a minimum deposit to open an account and doesn’t charge monthly fees, insufficient funds fees or incoming wire fees.

One of the main benefits of the BlueVine business checking account is its competitive APY interest rate. While most services won’t even reach 1%, BlueVine allows businesses to earn up to 1.5% interest. This means that eligible users can earn 50x the US average on balances up to and including $100,000.

BlueVine lets you easily schedule one-time and recurring payments and manage bills. Furthermore, the mobile app allows you to check your balance, deposit checks and set up transfers. BlueVine can also be integrated with QuickBooks Online and sync your business’s bill information. The company also allows you to lock your card if it gets lost or stolen.

BlueVine falls short in a few things–the number of users for a single account. In other words, there’s no joint account, which might be a problem for multi-owner businesses.

Also, since it’s an online-only bank, account holders have no access to a physical branch, and in case you need to issue a deposit, there’s a $4.95 fee per deposit.

Why we chose it: BlueVine offers a free business checking account with interest-earning for users and unlimited transactions at no extra cost.

- No monthly fees, minimum opening deposit or minimum balance requirements

- Unlimited, fee-free transactions

- Up to 1.50% interest rate

- No joint accounts

- It charges a fee per deposit

- No branch access

Pricing:

- $0 minimum opening deposit

- $0 monthly fees

LendingClub offers a comprehensive business checking account. In addition to the complete set of banking services, it also offers APY–although its interest rate is lower than its competitors.

The company also goes beyond digital banking: it offers fee-free ATM access and point-of-sale (POS) solutions, which can be great for small local businesses.

Applying to LendingClub is quick and easy: Users can open an account in about 10 minutes. Regarding credit checks, LendingClub only pulls a hard inquiry when users apply for a credit card, mortgage, small business loans, or other sorts of credit–and only once the loan is approved. Being declined for a loan does not affect the user’s credit score. Users can also run a soft inquiry and check their credit score with LendingClub. However, check out this article if you’re interested in bad credit loans.

LendingClub offers a perk that not many checking accounts offer: a cashback of up to 1%. Users can earn back up to 1% of their money on online and signature-based transactions made with their debit cards. In addition, users can earn 0.10% interest on APY. However, both of these benefits are only available for users that maintain an average monthly balance of $5,000 or more.

Why we chose it: LendingClub offers 1% cashback, unlimited transactions, and no fee for ATM withdrawals.

- 1% cashback and 0.10% APY interest rate

- Unlimited transactions and fee-free ATM access

- Digital invoicing and POS

- A $100 minimum opening deposit

- A $10 monthly fee, waived with a $5,000 minimum balance

- Charges for both incoming and outgoing wire transfers

Pricing:

- $100 minimum opening deposit

- $10 monthly fees, waived with $5,000 minimum balance

The Lili Business checking account is perfect for one-person businesses who just need essential banking services. Lili has all the checking account features a small business might be looking for and a competitive APY interest rate.

But more than that, it also offers features that help small business owners manage their companies, such as tax optimization features and accounting tools. A fee-free overdraft of up to $200 is also available, which is excellent for managing cash flow.

The drawback of Lili’s business checking account is that it is only eligible for sole proprietors and single member LLCs. As an account with essential banking services, users won’t be able to access additional banking services such as additional debit cards and third-party integration. Like most online-only banks, users can’t make cash deposits.

Lili stands out from other checking accounts thanks to its exclusive features. The tax optimizer provides users with a write-off tracker, an estimated tax calculator, and automatic tax savings. In addition, Lili also comes with accounting tools such as invoicing software, transaction categorizations, quarterly expense reports, and receipt scan and save.

Concerned about bad credit or credit checks? Don’t worry–Lily discloses right up front on its homepage that opening an account will not hurt your credit score.

Why we chose it: Lili offers fee-free overdrafts at zero costs, no minimum balance requirements or minimum opening deposit, and exclusive features such as a tax optimizer and accounting tools.

- No account fees and no minimum balance

- Up to $200 fee-free overdraft

- Tax optimization tool

- Eligible only for sole proprietors and Single Members LLC

- No cash deposits

- No additional banking services

Pricing:

- $0 minimum opening deposit

- $0 monthly service fees

Wells Fargo offers a comprehensive set of banking services, which is a good option for businesses looking for broader features. The bank has different account plans too–you can start with the basic account and move up as your business grows. Its convenient payment options also allow businesses to pay vendors, employees, and bills using its full set of payment services.

With Wells Fago, businesses have access to a full range of services at the tip of their fingers: its mobile banking allows any time access to the account. Don’t want to carry around your wallet all day long? Simply add your debit card to your digital wallet and get access to fast and secure payments, as well as a variety of ATMs. Also, if you’re often on the go, Wells Fargo moves along with you–it offers alerts that help you monitor account balances, track purchases and cash withdrawals.

Finally, Wells Fargo offers “second chance” business checking accounts, meaning you can get access to basic banking services no matter your credit score.

For small businesses that are looking for a wider range of banking services, Wells Fargo is the way to go. In addition to a number of digital banking services, Wells Fargo also comes with the traditional perks small business owners might value: there are over 12,000 ATMs across the USA and approximately 4,900 branches from coast to coast in case there is any need for in-person attention. Withdrawals have a charge fee when using a non-Wells Fargo ATM.

However, the cons of opening a business checking account at Wells Fargo are the fees. As opposed to its online-only competitors, the bank charges a $10 monthly fee, unless users have at least a $500 minimum daily balance. Also, to open a business checking account at Wells Fargo, there’s a deposit of a minimum of $25.

Why we chose it: Wells Fargo makes an excellent option for businesses of any type and size that need several banking services and features at hand, it offers thousands of ATMs and branches across the country.

- 12,000 ATMs and 4,900 branches

- 24/7 fraud monitoring

- Customized cards and checks

- $10 monthly fee, waived with $500 minimum daily balance or $1,000 average leger balance

- $25 minimum opening deposit

- Charges fees when using non-Wells Fargo ATMs

Pricing:

- $10 monthly fee

- $25 minimum opening deposit

Methodology for the Best Business Checking Account with no Credit Checks

There are a number of online business checking accounts out there that companies in their early stages can rely on – some offer free business accounts. When writing this review, we chose the criteria on what we think are the most relevant aspects a business checking account should meet to cater to small companies’ needs.

Small businesses usually work on a budget, so fees we’re highly taken into account. Obviously, we took into consideration checking accounts that don’t run credit checks or don’t run a pull a heavy inquiry. Let’s dive into each one of them and the other criteria we considered for this rating.

No Credit Checks

Credit checks are exactly what their name suggests. It is a process that involves checking your credit score and credit history.

Some banks offer a “second chance” business checking account that does not run a hard credit check. Checking accounts are usually meant for everyday access to your own money and do not offer any sort of credit, applicants can easily open an account within minutes without facing any hurdles.

Low Costs & Transparency

Costs were highly taken into consideration–the lower the monthly fees, the better. We also took into consideration a low minimum deposit, as we understand small businesses don’t usually start off with high capital.

Another major criterion was transparency. Business checking accounts that ditch small letters and are open about their fee schedule got extra points.

Access to Basic Services

A good checking account should properly allow you to pay bills, make purchases, receive deposits, and carry out withdrawals. However, since most businesses these days are going fully digital, not offering these perks wasn’t considered eliminatory. We’d rather favor checking accounts that offer mobile banking with good UI/UX to get you going.

Extra Features

Managing a small business can be tough. So, one of the criteria we considered for this review was business checking accounts that offer features that help businesses manage their business, either via a wide set of integrations or other types of resources.

Business checking accounts that are able to connect and sync information with other software and services were highly considered, such as e-commerce platforms, accounting tools, and PoS machines.

Interest

We did take into consideration if the business checking account offered APY earnings. However, we consider this more of a perk.

Frequently Asked Questions (FAQs) for Business Checking Accounts

Do you have questions regarding business checking accounts? Here are a few Frequently Asked Questions answered.

So What’s the Best Online Business Checking Account (No Credit Check)?

For small companies that want to separate their personal finance from their company’s finance, a business checking account with no credit checks is the simplest, most efficient way to go. The options listed in this rating offer a complete set of banking services with low, near-to-zero costs–and they fit perfectly for the job.

We selected Novo as the Best Overall checking account because it has overall low costs and, most importantly, it is transparent about its fee schedule, which can be easily accessed via the Novo website. In addition, Novo does not run credit checks and offers a broad set of integration options, which take its service to another level.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.