Opening a free business banking account is a safe, affordable way to manage your professional finances. A business account, which is separate from your personal account, lets you easily track your trade resources. Plus, having a business account is a prerequisite for the essential step of registering a business in the U.S. Read on to find out which of the five best free business banking accounts of 2023 is a good match for you.

Best Free Business Banking Accounts of 2023

- BlueVine – Best Overall

- Novo – Best for Ease of Use

- Brex – Best for Corporate Credit

- Axos – Best for Cash Deposit

- U.S. Bank – Best for Traditional Banking

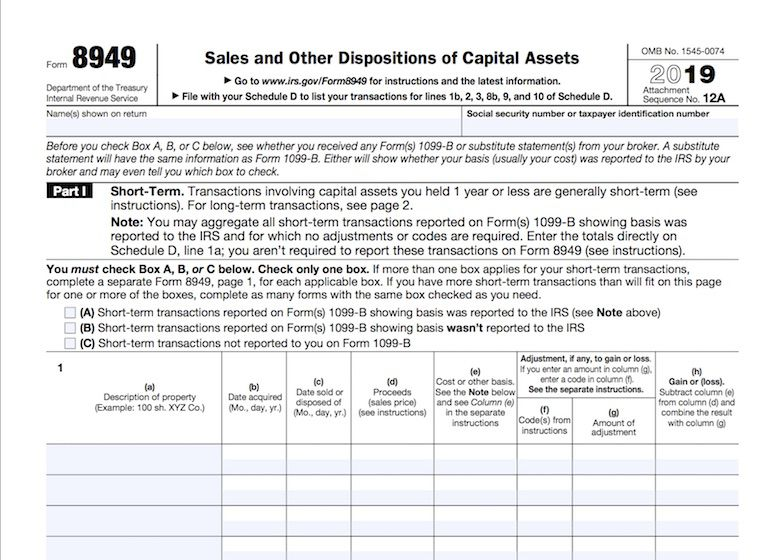

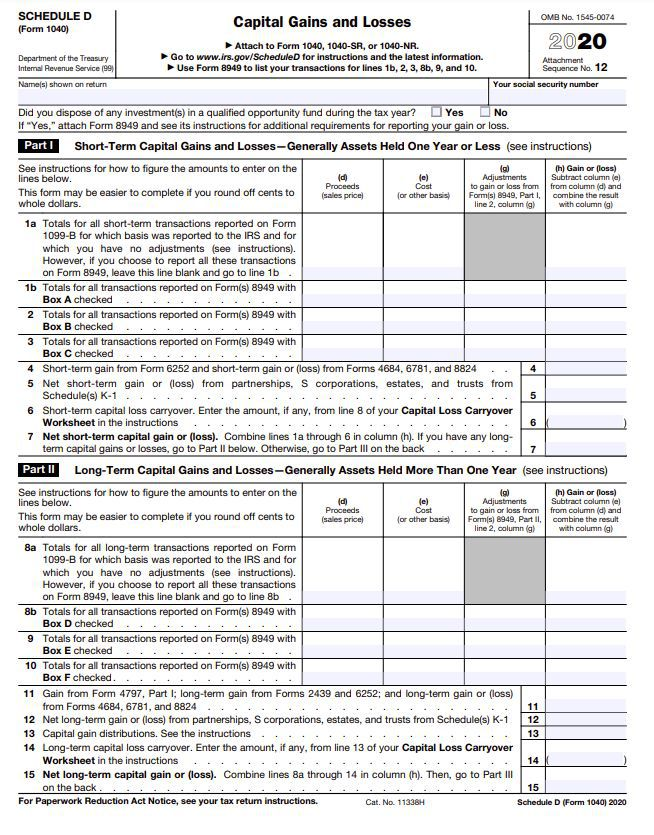

Product

Service Type

ATM Fee

Min. Deposit

Max. Transactions/Month

APY

Additional Features

App Process

Security

Business checking account w/ debit card

No ATM fees at 37,000+ MoneyPass locations

$0

Unlimited transactions

1.5% interest for eligible customers

Instant account transfers, dedicated account numbers & 2 free checkbooks

Online application

FDIC insurance up to $250,000

Business checking account w/ debit card

ATM fee refunds

$50

Unlimited transactions within the U.S.

0%

Virtual & physical cards, free invoices, Novo Reserves & Stripe integration

Online application

FDIC insurance & security features

Business account w/ credit card

N/A

$0

Unlimited ACH & wire sending but limited Brex-initiated ACH deposits & check deposits

0% for uninvested cash & 0.49% on money market fund

Create up to 8 accounts, automated monthly reports, investment options & live support

Online application

FDIC insurance via partner banks

Business checking account w/ debit card

Unlimited domestic ATM fee reimbursements

$0

Unlimited item processing for debits, credits & deposits

0% for basic business checking

Cash deposits, QuickBooks integration, free checkbook & dedicated relationship managers

Online application

FDIC insurance via Axos Bank

Business checking account w/ debit card

No ATM fees at U.S. Bank ATMs

$100

125 free transactions per month +

$0.50 fee per additional transaction

0% for basic business checking

Bill Pay, free mobile check deposits, check fraud prevention & overdraft protection

Online application or via virtual, phone call or in-person appointment

Automatic FDIC insurance via U.S. Bank worth $250,000 per depositor

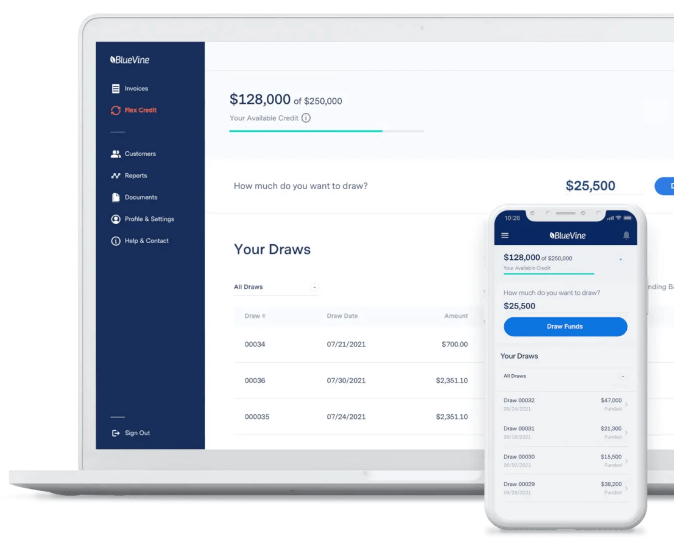

BlueVine shines among business banking accounts that are free because it combines minimal charges and maximum benefits. First of all, you don’t have to pay any monthly fees, transaction fees, or overdraft fees if you start a small business checking account. Also, you won’t be charged ATM fees if you withdraw at any of the 37,000+ MoneyPass locations in the U.S.

Plus, there’s no minimum initial deposit so you can open a business bank account even if your small business only has limited cash at present. You can deposit, withdraw, and make payments as often as you need. In addition to this, BlueVine gives you the chance to earn an Annual Percentage Yield (APY) of 1.5% on balances up to $100,000 if you meet one or both of the two monthly requirements.

Other benefits include instant transfers, sub-account options, dedicated account numbers, online application process, and two free checkbooks. Last but not least, your assets are protected because BlueVine deposits are insured up to $250,000 per depositor via the Coastal Community Bank, which is a member of the FDIC.

While BlueVine has a first-rate free business account, it does have a few limitations. For instance, it doesn’t have any physical branches because BlueVine isn’t a traditional bank but a financial technology company. Aside from this, you won’t earn any interest on excess amounts beyond $100,000. Finally, BlueVine doesn’t accept deposits of cash, paper checks, or foreign currency.

Nevertheless, our BlueVine review agrees that it’s one of the best deals when it comes to free bank accounts for businesses. Thanks to its strong feature set, it currently leads the pack when it comes to free and low-cost banking services.

Why we chose it: We award BlueVine as the best overall free business banking account because it provides an almost perfect balance between affordability and functionality. It’s a viable option for you if you want to experience the perks of online business banking without shelling out for costly monthly fees.

Pricing: $0 monthly fees & transaction fees

- No monthly, overdraft, or transaction charges

- Unlimited monthly transactions

- 1.5% interest rate for eligible depositors

- No physical branches

- Zero interest earnings beyond $100,000 balance

- No cash, paper check, or foreign currency deposits

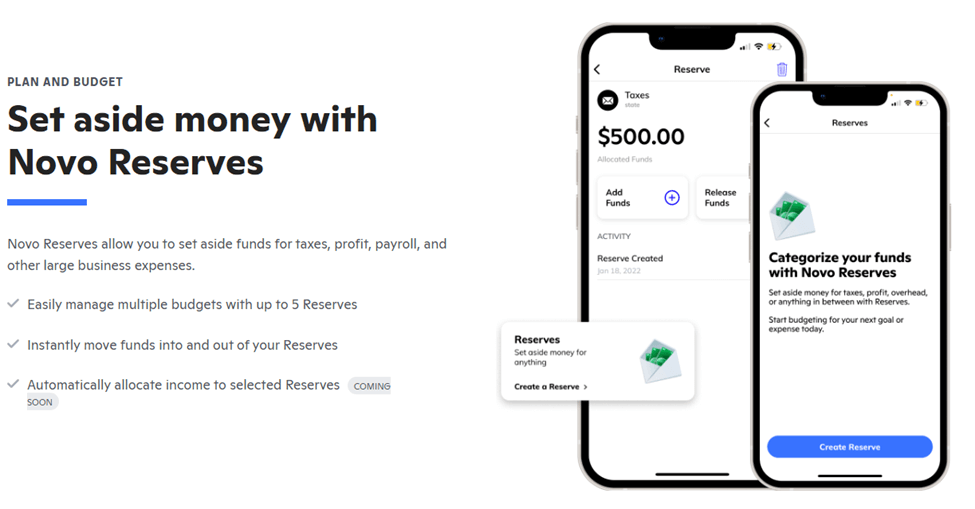

Novo is one of the most user-friendly business banking accounts that are free because it’s simple to set up in less than ten minutes. Plus, the online banking app allows you to make worldwide payments, deposit checks, transfer funds, and accept incoming wires. There are no monthly service charges, ACH fees, wire fees. Plus, you get free unlimited U.S. transactions and ATM fee reimbursements.

Aside from this, Novo has other features to make banking more convenient for you, such as physical and virtual debit cards, free invoice sending, Novo Reserves, Stripe integration, and payments via Apple and Google Play stores. Finally, Novo safeguards your resources through security features and FDIC insurance via Middlesex Federal Savings.

On the other end of the spectrum, it requires you to make a minimum deposit of $50 to open a checking account. In addition to this, it charges $27 each for insufficient funds and uncollected funds returned.

Also, it doesn’t give you a chance to earn interest through your deposits because Novo doesn’t provide an APY. Last but not least, you can’t directly deposit cash to your account, although you can buy a money order as a workaround solution.

Still, our Novo review concurs that it’s a free business account that’s worth considering, especially for beginners in business banking. Aside from its various handy features, it doesn’t require advanced banking knowledge or technical skills to begin using it. Check out also our review for other business banking accounts like Bank of America Review and NBKC Bank Account Review.

Why we chose it: We commend Novo as the best for ease of use among business banking accounts that are free because of its intuitive UI and fast application process. It’s a potential alternative for you if you’re a first-time entrepreneur because you can quickly figure out how to navigate Novo.

Pricing: $0 monthly fees & transaction fees

- 3-step application process

- Free unlimited transactions plus ATM reimbursements

- Extra features like Novo Reserves, Stripe integration & virtual card

- Minimum initial deposit amount of $50

- $27 fee for insufficient funds & uncollected funds returned

- No direct cash deposits

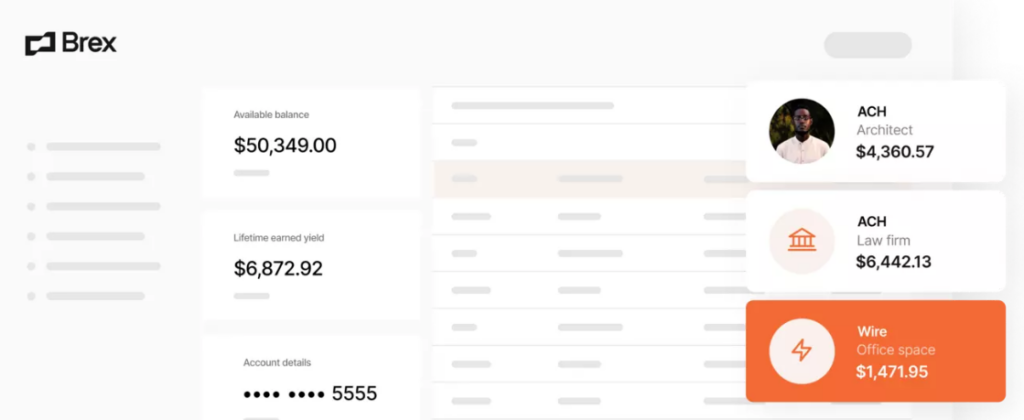

Brex stands out from other business banking accounts that are free because it provides you with credit options. It allows you to spend beyond your current balance so that you can fast-track the expansion of your business, compared to the typical online business checking account which only includes debit cards.

If you open a business account with Brex, you will get unlimited corporate credit cards which you can use for secure spending. Like a debit card, your balance can be paid automatically every day. However, it has an edge over a debit card because it enables you to build your business credit. Also, you can issue cards to your team with set limits so you can monitor their expenses. Plus, you can earn unlimited rewards without an expiry date.

To make things even better, Brex doesn’t have monthly fees, transaction charges, or minimum deposits. There’s free unlimited ACH and wires as well. Additional incentives include eight account creation, automated monthly reports, investment options, live customer support, and online application. Finally, you can store your assets with the partner banks of Brex so you can be eligible for FDIC insurance worth $250,000 at most.

On the other hand, the drawbacks of Brex include a lack of debit cards and limited Brex-initiated ACH deposits or check deposits. While there’s zero APY for uninvested cash, you can earn around 0.49% with the money market fund. Also, Brex doesn’t have physical locations since it’s a financial technology company, not a bank. Nevertheless, you can drop by any of its partner banks to deposit your uninvested cash.

At the end of the day, Brex is still an interesting alternative because it adds the flexibility of credit options to a business account.

Why we chose it: We acknowledge Brex as the best for corporate credit because of the broad range of credit services it provides. It’s a possible match for you in case you’re aiming to build your business credit as an entrepreneur.

Pricing: $0 monthly fees & transaction fees

- Empowering credit options

- Unlimited rewards via credit points

- Creation of up to 8 accounts

- No debit card

- Limited check deposits & Brex-initiated ACH deposits

- No physical branches

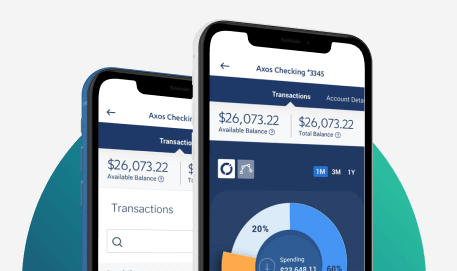

Axos has the upper hand over other business banking accounts that are free when it comes to cash deposits. It allows you to deposit paper cash to your account through MoneyPass and AllPoint networks, in contrast to similar services that mostly permit online deposits.

Since Axos is a bank and not a financial company, it offers specialized online banking services like free Bill Pay, image statements, mobile banking services, and the personalized assistance of a dedicated relationship manager. Plus, it’s cost-effective to open a basic business checking account with Axos via online application.

There’s no monthly maintenance fees, minimum deposit, maintenance amounts, while there’s unlimited domestic ATM fee reimbursements and unlimited debit, credit, and deposit processing. Extra perks include free 50 checks, QuickBooks integration, and FDIC insurance via the Axos Bank.

On the downside, the Basic Business Checking account doesn’t offer any APY at all. Plus, you need to pay for international and domestic wire fees, although you’ll be reimbursed for two domestic wires every month. Finally, Axos doesn’t have any brick-and-mortar buildings because it’s an online bank instead of a conventional one.

Overall, Axos is still a practical option because it opens up the possibilities of cash deposits for entrepreneurs like you. Read our in-depth review on Axos bank to learn more about its services. And visit also our other business banking account review like Oxygen Review.

Why we chose it: We selected Axos as the best for cash deposit among business banking accounts that are free because it permits you to deposit actual cash to your free account via AllPoint and MoneyPass networks. It could be a suitable fit for you if you often make cash deposits during your business operations.

Pricing: $0 monthly fees & transaction fees

- Cash deposits allowed

- Free 50 checks & QuickBooks integration

- FDIC insurance via Axos Bank

- Zero APY for Basic Business Checking account

- International & domestic wire charges

- No physical bank locations

The U.S. Bank’s Silver Business Checking Package is distinct from most business banking accounts that are free because it’s offered by an established bank, instead of a financial technology company. Unlike free accounts that are limited to online transactions, you can personally go to physical bank branches if you select U.S. Bank.

While the U.S. Bank allows you to apply online like most free bank account providers, it also gives you the choice to apply via virtual appointment, phone call, or face to face meeting. This personalized assistance is handy if you’re a newbie to business banking.

The other standout U.S. Bank features are online plus mobile banking, check fraud prevention tools, and Business Reserve line. Since U.S. Bank is a member of the FDIC, you will automatically get FDIC insurance worth $250,000 per depositor.

Nevertheless, U.S. Bank’s free business account comes with less freebies compared to the other banking accounts in this list. While there’s no monthly maintenance fees or U.S. Bank ATM charges, you only get 125 free transactions each month. Plus, you must deposit a hefty minimum of $100 to open a basic checking account. Other limitations include zero APY for the Silver account and no free checkbooks.

To sum it up, the U.S. Bank gives entrepreneurs like you the chance to experience the services of an orthodox bank even if you can’t afford all the expensive banking fees. Read our in-depth review on U.S. bank to learn more about its services. We also have reviews on other business banking accounts like Capital One Review and SoFI Review.

Why we chose it: We pick U.S. Bank as the best for traditional banking among free business accounts because it provides the basic perks of a conventional bank while skipping some, though not all, of the typical banking fees. It’s a good match for you if you prefer to sign up with an established bank rather than a financial technology company.

Pricing: $0 monthly fees & $0.50 fee per additional transaction beyond 125 free transactions per month

- Brick-and-mortar bank locations

- Various application method options, including in-person application

- Check fraud prevention & overdraft protection

- Minimum deposit amount of $100

- Zero APY for basic business account

- No free checkbook

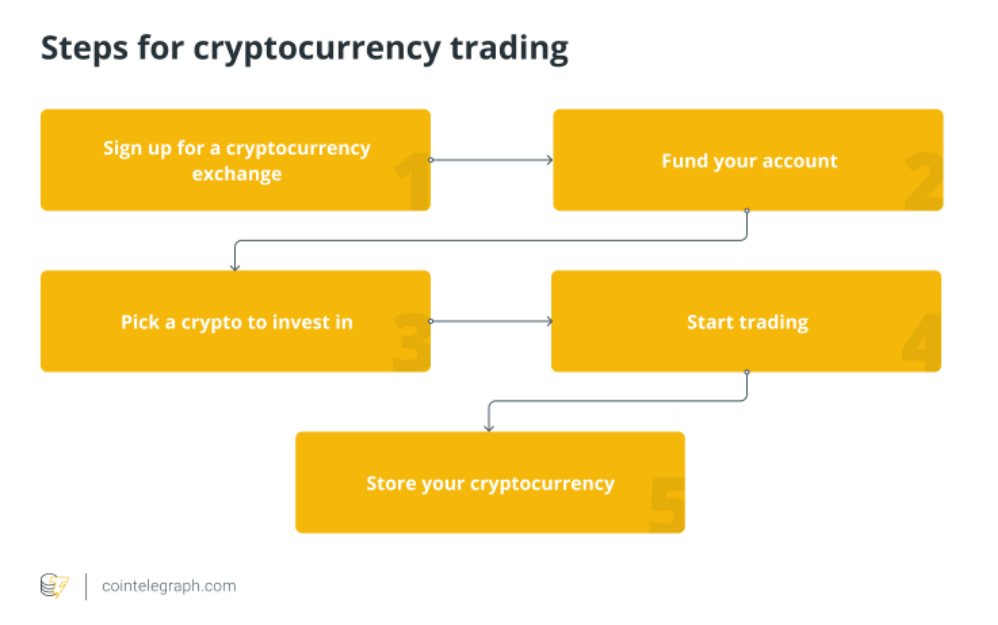

Methodology for the Best Free Business Banking Account

We considered important factors as we picked the best business banking accounts that are free of 2023. These aspects include the banking service type, monthly fees, transaction charges, ATM fees, minimum deposit amount, maximum transactions each month, Annual Percentage Yield (APY), notable features, application process, and security options.

- Banking Service Type: We examined if the free business bank account is a checking one or a savings one. Plus, we confirmed if it comes with a debit card or a credit card.

- Monthly Fee: We checked if you need to pay monthly charges or not for general services and maintenance as a depositor. After all, we only categorized a business account as free if there are zero monthly fees.

- Transaction Fee: We assessed if you’re required to pay fees or not to perform basic banking transactions like deposits, withdrawals, and transfers. Whenever applicable, we also analyzed if you will be charged for advanced types of transactions like wires and ACH.

- ATM Fee: We researched if you will be charged to use ATM machines, whether they be in-house, affiliated, or external ones. Also, we probed if the bank account provider will reimburse you for ATM fees or not.

- Minimum Deposit: We checked if there is any minimum amount of deposit or not required for you to open a business bank account. In case there is a basic deposit requirement, we pinpointed how much the amount is.

- Maximum Transactions per Month: We verified if you’re allowed to perform an unlimited or limited number of free transactions every month. In case there is a cap to item processing number, we confirmed how many free transactions you’re allotted on a monthly basis.

- Annual Percentage Yield (APY): We assessed if you have the chance to earn interest through the free bank account or not. In case it offers an APY, we researched what the average interest rate is each year.

- Additional Features: We analyzed what other extra features are included in the free business account. Some examples of handy offerings are Bill Pay, cash deposits, free checkbooks, third-party integrations, and live support.

- Application Process: We explored what type of application procedure you need to undergo to open a business bank account. Most providers require an online application process, although a few also offer other options.

- Security: We probed how safe your money is if you store it in a free business account. We confirmed if your deposit is covered by FDIC insurance, as well as if other security features are available.

Take note that this guide generally covers general banking, debit, and credit options. We already discussed alternatives for small business loans in another review.

Frequently Asked Questions (FAQs) for Free Business Banking Account

A free business banking account makes it simple for you to handle your business resources. Learn the answers to basic questions about a complimentary business account for startups.

Final Thoughts on the Best Free Business Banking Accounts

Starting a free business banking account is one of the necessary steps you need to take as an entrepreneur to ensure the financial success of your business. BlueVine is our top pick among the best free business accounts of 2023 because it’s freebie-rich and feature-packed at the same time. Don’t forget also to check out other business banking accounts and our reviews of them like Lili Review and Kabbage Review

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.