Finance

Most Popular

A Limited Liability Company helps you separate your personal finances from those of your business. If you’ve formed one, you need a separate business bank account for your LLC. Making the right choices when your business is still young can go a long way. This is especially true when it comes to choosing the right …

Rental properties are a great way to earn income either full-time or on the side. However, some states are better than others regarding returns on these types of investments. This article looks at the 10 best states to buy investment property this year (and the worst states for real estate). 1. South Carolina One of …

Opening a business bank account with EIN only through a traditional bank may seem challenging. The banking regulations in the US stipulate that entrepreneurs must present specific documentation, depending on their business structures. Fortunately, opening a business bank account online is much easier, and you can use your social security number or EIN. Easily open …

What started as a joke, now has a $22 billion market value. Dogecoin collected a fanbase worldwide and despite its recent success it’s still possible to mine Dogecoin and make some profit. In this article, we’ll walk you through a step-by-step guide on how to mine Dogecoin. Mine Dogecoin with Hashshiny Cloud Mining! How Mining …

Asset management is a term that describes any process or procedure that an organization uses to keep track of mission critical assets, such as tools, equipment, and software. Due to the importance of asset management in many organizations, there’s a wide variety of software products available to help make the tracking of assets easier, which …

If you decide you don’t want to form an LLC or corporation, you’ll likely want a “doing business as” registered name for your sole proprietorship or partnership. A DBA checking account can be a game-changer for a small company looking to build a brand. It can facilitate business processes, saving time and reducing headaches. What …

CoinMarketCap reports the total number of cryptocurrencies in the world reaching a whopping 20,000. There’s bound to be a bunch of undervalued crypto coins, as well as overvalued ones, among the thousands of new and old projects. Smart investors know the art of identifying undervalued assets and holding on to them for incredible returns in …

The best banks in California offer a combination of low account fees, convenience, and comprehensive banking tools. If you’re in California and want to find a new bank, this guide discusses your best options. Each bank is federally insured and carries a variety of products, including checking accounts, investment accounts, and loans. Best Banks in …

Asset management is a term that describes any process or procedure that an organization uses to keep track of mission critical assets, such as tools, equipment, and software. Due to the importance of asset management in many organizations, there’s a wide variety of software products available to help make the tracking of assets easier, which …

A Limited Liability Company helps you separate your personal finances from those of your business. If you’ve formed one, you need a separate business bank account for your LLC. Making the right choices when your business is still young can go a long way. This is especially true when it comes to choosing the right …

Opening a business bank account with EIN only through a traditional bank may seem challenging. The banking regulations in the US stipulate that entrepreneurs must present specific documentation, depending on their business structures. Fortunately, opening a business bank account online is much easier, and you can use your social security number or EIN. Easily open …

If you decide you don’t want to form an LLC or corporation, you’ll likely want a “doing business as” registered name for your sole proprietorship or partnership. A DBA checking account can be a game-changer for a small company looking to build a brand. It can facilitate business processes, saving time and reducing headaches. What …

The best banks in California offer a combination of low account fees, convenience, and comprehensive banking tools. If you’re in California and want to find a new bank, this guide discusses your best options. Each bank is federally insured and carries a variety of products, including checking accounts, investment accounts, and loans. Best Banks in …

Opening a free business banking account is a safe, affordable way to manage your professional finances. A business account, which is separate from your personal account, lets you easily track your trade resources. Plus, having a business account is a prerequisite for the essential step of registering a business in the U.S. Read on to …

BlueVine Review is an online lender and financial tech company with several free features that make it easy to manage business funds. Its business checking and business loan services work separately or in tandem to provide you with opportunities to help your venture grow. Find out in this BlueVine review if it’s the right place …

Novo is a digital banking tech company ideal for entrepreneurs with small businesses or side hustles. The company allows you to separate your personal and business income and provides a reliable banking experience. Through a partnership with Middlesex Federal Savings F.A, the platform offers one of the best business checking accounts online. About 61% of …

Kabbage from American Express is an online lending platform for small businesses. It offers a range of financial solutions for small businesses including Kabbage Funding, Checking, and Payments. In this Kabbage review, we’ll cover its business bank account and business lines of credit for small businesses. Kabbage offers business lines of credit from $2,000 to $250,000 …

What started as a joke, now has a $22 billion market value. Dogecoin collected a fanbase worldwide and despite its recent success it’s still possible to mine Dogecoin and make some profit. In this article, we’ll walk you through a step-by-step guide on how to mine Dogecoin. Mine Dogecoin with Hashshiny Cloud Mining! How Mining …

CoinMarketCap reports the total number of cryptocurrencies in the world reaching a whopping 20,000. There’s bound to be a bunch of undervalued crypto coins, as well as overvalued ones, among the thousands of new and old projects. Smart investors know the art of identifying undervalued assets and holding on to them for incredible returns in …

Cryptocurrency has been around for long enough that almost every country has passed legislation on it. While some of the best countries for cryptocurrency took a more relaxed approach and allowed it to thrive, other countries have imposed strict crypto regulations. A few, including China, Egypt, and Qatar have even outright banned cryptocurrency. The 10 …

The Web 3.0 revolution has introduced several means of making money online. Buying and flipping NFTs is one of them. Know that NFT trading volumes in 2022 are not riding the same high as in 2021, but that doesn’t mean they’re no longer a viable asset to flip. These digital assets are definitely here to …

Cryptocurrency is a digital currency that you can directly buy, sell, or trade online on crypto exchange platforms. The benefit of virtual coins and tokens is that they can be circulated without supervision from a central monetary authority. The fastest growing cryptocurrencies may be the best choice for you if you’re looking to invest or …

Cryptocurrencies are primarily bought and sold on crypto exchanges. There are more than 600 crypto exchanges worldwide, but a major chunk of the daily trading volume stays in the top 25 exchanges. If you’re interested in trading crypto, here are the best crypto exchanges you can choose from. Best Crypto Exchanges in 2023 Coinbase – …

There are more than 19,500 cryptocurrencies in the world, but you will only find a small fraction of them listed on the most popular exchanges. This is because trading platforms only list a coin if it passes a thorough evaluation process. Choosing the best crypto exchange with the most coins is important, but so are …

Crypto wallets can provide security for the multitudes of digital assets currently available for purchase. However, not all cryptocurrency holders are created the same. This article offers the lowdown on the best crypto wallets on the market today. Best Crypto Wallets Exodus – Best Overall Coinbase – Best for NFTs Ledger – Best Physical Wallet …

Kabbage from American Express is an online lending platform for small businesses. It offers a range of financial solutions for small businesses including Kabbage Funding, Checking, and Payments. In this Kabbage review, we’ll cover its business bank account and business lines of credit for small businesses. Kabbage offers business lines of credit from $2,000 to $250,000 …

The COVID pandemic hurt a lot of small and medium-sized businesses. To compensate, the government offers employee retention credit to inject funds into companies meeting specific requirements. Is your business missing out on some much-needed funds? Read on to learn about how employee retention credit works and the best ERC companies and agencies that offer …

Your small business or startup idea could change your life as well as the lives of your customers – but you need the capital to get it off the ground. Small business loans are vital if you want to effectively develop a new business idea or expand an existing firm. But with so many different …

“Development” is, by definition, the process of creating and enhancing relationships with (potential) donors to ensure current and future funding; “Fundraising” is only about income generation. With “Development,” with the relationships you create, you take a major step toward ensuring future income; with “Fundraising,” income generation focuses on “now,” with no provision, no assurance, and …

(This is a follow up piece to the posting What Do You Call The Staff Person In Charge of Raising Charitable Contributions?) The title question is often asked by new/fairly young nonprofit organizations; and, depending on the age/size/mission/location/etc. of the organization, there can be many different answers. As noted previously, the simple answer to the …

This posting by: Hank Lewis There are two steps to take in answering that question. The first is asking, “Who cares?” Isn’t what we call that person largely irrelevant? Isn’t that person going to do what has to be done, no matter his/her title? Definitely not !! We are greatly affected by how we are …

Lack of capital is a leading reason many small businesses fail in their first year or soon after. Fortunately, the right business financing option can help your startup survive cash flow hiccups. A business line of credit is the ideal solution. What is a business line of credit, and why should you consider it as …

A credit union business account is a friendly alternative to opening a business bank account. It could work for you if you’re looking for the right hub for your business finances to push your venture to the next level. Similar to banks, credit unions are financial institutions that offer online business checking accounts, savings accounts, …

Due to the meteoric growth of the internet over the past decade, the needs of business owners have dramatically changed. However, the insurance industry has been slow to accommodate these rapidly changing needs. This is where Next Insurance steps in. Next Insurance is an insurance company dedicated to selling business insurance online. The company aims …

Many businesses don’t have the means to survive a product recall, lawsuit, or natural disaster. Luckily, online business insurance companies offer fast, comprehensive coverage to protect you if and when something bad happens. This Embroker review provides all the information you need to make an educated decision about whether the business insurance company is right …

© Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Insurance The D & O Diary : Directors and Officers Liability and Insurance Directors and officers liability insurance – Wikipedia, the free encyclopedia How to Determine Whether to Insure Directors and Officers | Inc.com 20 Questions Directors Should Ask about Directors’ and Officers’ Liability Indemnification and …

Buying life insurance is a key component of financial planning. However, it’s tough to choose the best life insurance with so many companies offering various policy types and features. If you’re looking to buy life coverage, look no further because we’ve got it all summed up for you. 7 Best Life Insurance Companies State Farm …

No small business can prevent all types of incidents in the workplace, no matter how hard it tries. Small business insurance can protect a company in the event of unforeseen circumstances, so long as you have the right coverage. Read on to learn about the best small business insurance companies currently available and what makes …

If you rely on vehicles for your business to thrive, don’t shift into drive before picking up some commercial auto insurance. Personal coverage won’t cut it if you or a staff member has an accident while on the job. Keep reading to discover the best commercial auto insurance companies offering your vehicle or fleet the …

Rental properties are a great way to earn income either full-time or on the side. However, some states are better than others regarding returns on these types of investments. This article looks at the 10 best states to buy investment property this year (and the worst states for real estate). 1. South Carolina One of …

The Web 3.0 revolution has introduced several means of making money online. Buying and flipping NFTs is one of them. Know that NFT trading volumes in 2022 are not riding the same high as in 2021, but that doesn’t mean they’re no longer a viable asset to flip. These digital assets are definitely here to …

Cryptocurrency is a digital currency that you can directly buy, sell, or trade online on crypto exchange platforms. The benefit of virtual coins and tokens is that they can be circulated without supervision from a central monetary authority. The fastest growing cryptocurrencies may be the best choice for you if you’re looking to invest or …

Cryptocurrencies are primarily bought and sold on crypto exchanges. There are more than 600 crypto exchanges worldwide, but a major chunk of the daily trading volume stays in the top 25 exchanges. If you’re interested in trading crypto, here are the best crypto exchanges you can choose from. Best Crypto Exchanges in 2023 Coinbase – …

Simply put, trading crypto is the act of buying and selling cryptocurrencies or digital currencies, for conventional fiat money via an exchange as a form to make a profit. For those who can keep up with the volatility of cryptocurrencies, trading crypto can give much higher returns than traditional investments. We’ve listed the six steps …

There are more than 19,500 cryptocurrencies in the world, but you will only find a small fraction of them listed on the most popular exchanges. This is because trading platforms only list a coin if it passes a thorough evaluation process. Choosing the best crypto exchange with the most coins is important, but so are …

Crypto wallets can provide security for the multitudes of digital assets currently available for purchase. However, not all cryptocurrency holders are created the same. This article offers the lowdown on the best crypto wallets on the market today. Best Crypto Wallets Exodus – Best Overall Coinbase – Best for NFTs Ledger – Best Physical Wallet …

Inflationary and deflationary cryptocurrencies are opposite sides of the same coin. The first one consists of increasing cryptocurrencies in circulation, while deflationary cryptocurrencies have a limited amount circulating (this amount usually remains the same, it doesn’t increase). Or, if they eventually do, it rises at a slower pace. What is a Deflationary Cryptocurrency? A deflationary …

It’s your responsibility to pay income tax by state if you earn a salary as an employee or profits through your own business. However, it can be challenging to compute your total state income tax because each state in the U.S. has its own taxation guidelines. No matter which state you live in, read our …

Corporations are responsible for a bevy of taxes on the state level across different mediums. Above that, each state sets its own rates for corporate entities to contend with. State corporate tax rate varies depending on which state from which you operate your business. Corporate State Tax Rates Explained Corporations are a type of business …

As a business owner, learning how to calculate payroll taxes are one of the most daunting tasks to tackle. Among all the other aspects of your business that you manage, it’s also essential you calculate your taxes correctly. Without accurate tax calculations, you can face legal and financial penalties if the IRS investigates your business. …

Tax Information for Nonprofits (including getting tax-exempt status) Assembled by Carter McNamara, MBA, PhD Applies to nonprofits unless otherwise noted. Sections of This Topic Include Do I Need Help to Get Started? Importance of Good Record Keeping Getting Tax-Exempt Status Federal, State, Sales, Payroll Taxes, etc. Preparing and Filing Form 990s (including about public disclosure) …

Yes, any capital gains you make from cryptocurrencies are taxable. As the U.S. Treasury calls for stricter crypto tax compliance, the IRS is coming after crypto tax dodgers. It’s crucial for investors to know their IRS cryptocurrency tax rate, how to file crypto taxes, and how to legally minimize their tax liability. What is Your …

U.S. Business Taxes for Small For-Profit Businesses Scope of Information in this Library Topic This library could include thousands of links to tax-related sites. As with other topics in the library, there are enough links included below to cover the basics and help the reader find more information if needed. Regarding federal taxes (the type …

Have you been investing in cryptocurrency? Maybe now it’s time to calculate and pay your crypto taxes. What is already a complicated activity can get a lot trickier if you don’t work with crypto tax software. In this article, we’ve wrapped up the best crypto tax software for 2023. Best Crypto Tax Software Our Methodology …

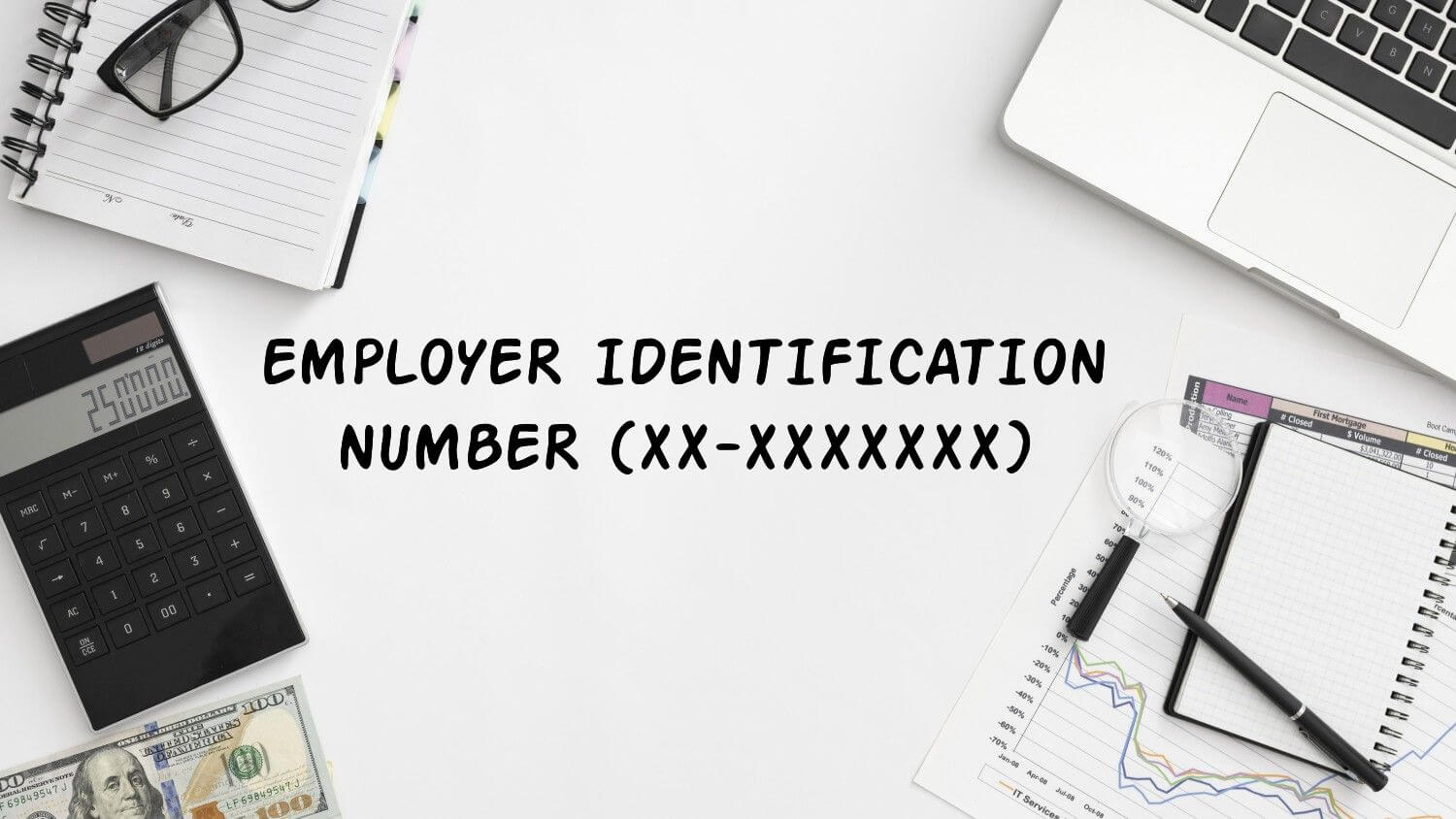

An employer identification number, or EIN, is like a Social Security number (SSN) for your company. It’s a unique nine-digit number the IRS uses to identify businesses for tax reporting purposes. Continue reading our What is an EIN Number guide to learn if your business needs one and how to apply online, by fax, telephone, …

More in Finance

As the world evolves, so do its financial markets. As such, major players in the industry must continually adapt their strategies to remain competitive. This week, two major financial institutions made announcements related to their operations. Citigroup, a multinational investment bank headquartered in New York City, announced plans to recalibrate its investment banking workforce. This …

Whether your corporation is large or small, keeping track of finances is paramount for success. A business bank account allows you to manage company funds in one place while taking advantage of additional features to help your business grow. Read on to learn how to open one in six easy steps. How to Open a …

Managing finances as a sole proprietorship is crucial for running a successful business. A business bank account makes it easy to track company funds while offering additional services to help your venture grow. Read on to learn how to open a sole proprietorship bank account in four simple steps. >>>Use Lili to open your business …

Every penny has its place in a small business. The last thing any business owner wants is to be tracking each one down to make ends meet. With a business bank account for your LLC, you can carefully manage funds and access extra services to help your business grow. Read on to learn how to …

A bank account is more than just a place to store money. When used effectively, it can become a money management tool to help you track your cash flow, analyze your performance, and even reduce your expenses. But the question remains, should you open a business bank account once you already have a personal one? …

After filing your employee retention credit, you’ll want that money to arrive as fast as possible. While you wait, you’ll undoubtedly be left wondering when that refund check will come. This article explains how to check the status of your employee retention credit and offers tips to avoid any delays along the way. Use Bottomline …

Many companies experienced lost revenue to the COVID-19 pandemic but chose to keep employees on the payroll. To compensate small and medium-sized businesses, the government offered employee retention credit to help them stay afloat. Did you miss the window to receive your reimbursement? Read on to find out. Use Bottomline Concepts for streamlined and speedy …