According to the US Bureau of Labor Statistics, around 47 million people quit their jobs in 2021. Then, roughly 5.4 million new business applications were filed, a 53% increase from 2019. If you’re thinking about joining this entrepreneurial club, several crucial decisions lie ahead. Below are the best states for starting your business.

The Best States for Starting a Small Business in 2023

Different states use different attributes and statistics to sell themselves as the most business-friendly state. However, we used a wide-ranging and all-inclusive set of factors to level the playing field. We’ve considered several federal and state government reports, independent studies, and responses from real business owners from all over the US to evaluate the best states to launch a startup.

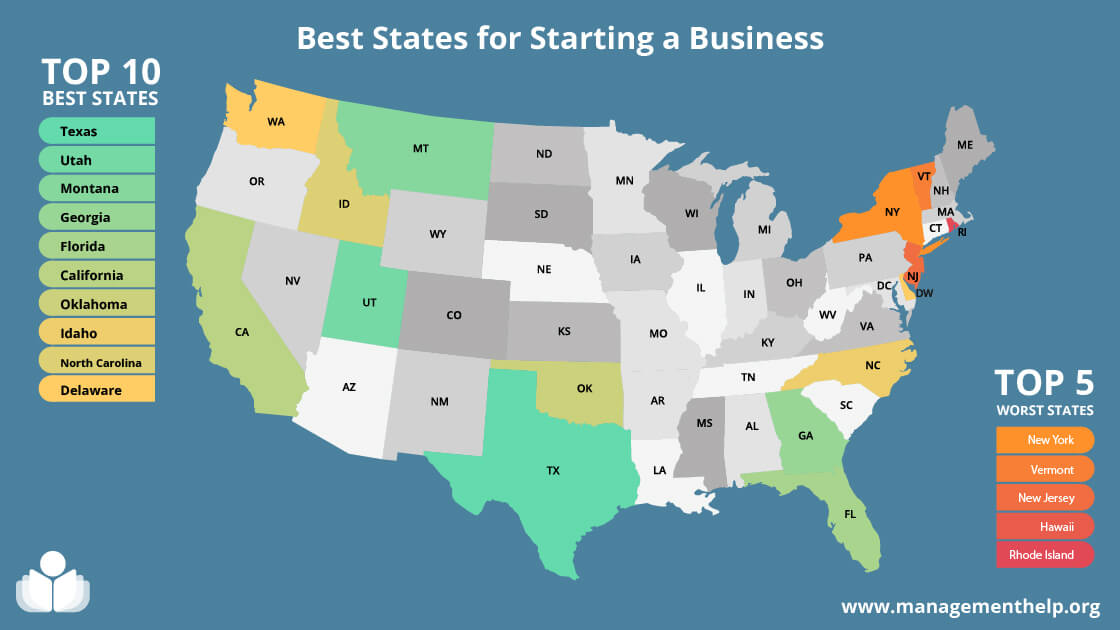

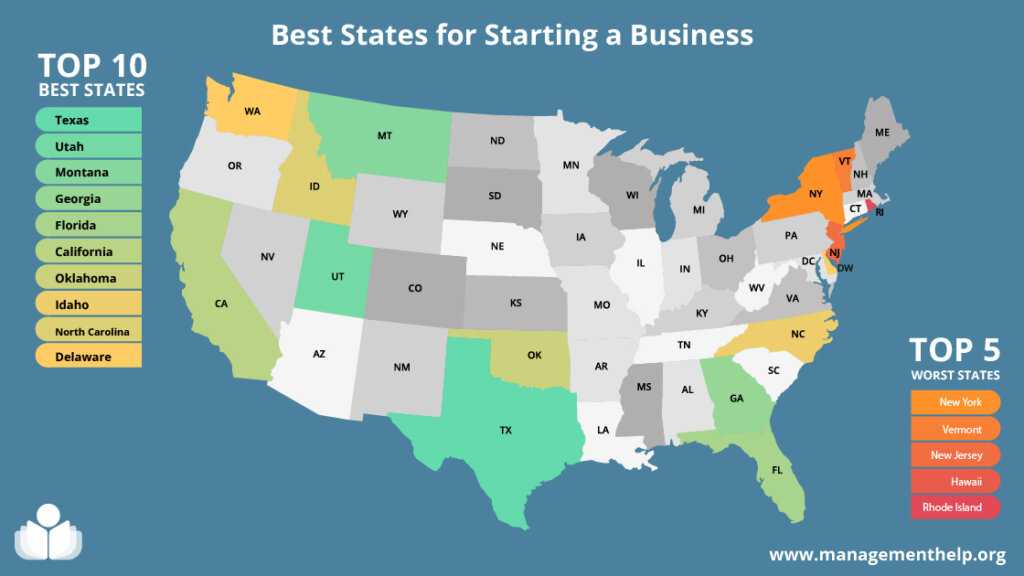

The 10 best states for starting a business in 2023:

- Texas – Best Overall

- Utah – Best for Business Financing

- Montana – Best for Business-friendly Policies

- Georgia – Best for Cost of Labor

- Florida – Best State for Starting a Business for Tax Purposes

- California – Best for Innovation

- Oklahoma – Best for Cost of Doing Business

- Idaho – Best for Real Estate

- North Carolina – Best for Starting an LLC

- Delaware – Best for Privacy Protection

1. Texas – Best Overall State to Start a Business

The Lone Star State ranks as the best state for starting a business for its business-friendly performance on all fronts. Texas has seen tremendous economic growth in recent years. An increasing number of new entrepreneurs are emerging in the state every month with an average of 400+ Texans opening a business every day.

It boasts one of the most favorable business climates in the country with no personal or corporate state income taxes. This makes it one of the best states for starting a business for tax purposes. Since Texas is the second-largest state by population, it has no shortage of labor. A large number of cities and universities also guarantee a young and skilled workforce.

Texas has one of the highest business survival rates in the US, a low risk of natural disasters, and a well-developed infrastructure to facilitate business growth. When it comes to drawbacks, starting a business in Texas has only one. The cost of running a business here is higher than in some other states.

2. Utah – Best State to Start a Business for Business Financing

Utah is the second-best state to register your business with a fast-growing working population and a well-developed economy. The Beehive State has a healthy supply of labor, a supportive regulatory environment, and easily accessible business financing. This is why it enjoys the second-highest growth in the number of small businesses. It was also ranked the No.1 state for entrepreneurs in 2020.

Utah is the best state to get money to start your business with plenty of venture capital available. When it comes to fiscal matters, the state is known for its small-business-friendly tax environment. Its individual and corporate income tax rates sit at 4.95% which is relatively lower than most other states.

Just like Texas, Utah isn’t the most affordable when it comes to the cost of labor and the overall cost of doing business. Still, it has excellent consumer spending and its five-year business survival rate of almost 50% speaks for itself.

3. Montana – Best State to Start a Business for Business-Friendly Policies

Also known as the Treasure State, Montana welcomes small businesses with startup-friendly policies, zero state sales tax, and a very good five-year business survival rate of 53.4%. It enjoys a fast-growing economy, reasonable labor costs, and safety from climate disasters.

The 6.75% corporate income tax rate isn’t the best, but it’s not too bad either. Montana doesn’t enjoy as much consumer spending as Texas or Utah, but spending is on the rise. Despite all that, the Big Sky Country’s relaxed regulatory environment and inexpensive property make it the third-best state for starting a business.

4. Georgia – Best State to Start a Business for Cost of Labor

Well-developed infrastructure, a strong economy, and a skilled workforce are the strongest selling points for Georgia, the Empire State of the South. The state government strives to help businesses grow and finance small businesses with ease.

It has one of the highest levels of venture capital available which makes it a great place to go if your startup needs financing. Georgia has easier payroll laws with one of the lowest state minimum hourly wage rates. The Peach state’s individual and corporate income tax rates sit at 5.75% and have a low cost of living, making it a great place to start a business.

5. Florida – Best State for Starting a Business for Tax Purposes

Home to four of the most small business-friendly cities in the country, Jacksonville, Orlando, Fort Lauderdale, and West Palm Beach, Florida is fast becoming an SMB heaven. It has no state income tax for individuals and only a reasonable 5.5% corporate income tax rate. Not just that, low rates on some other types of state taxes make it the best state for starting a business for tax purposes.

The rate of new entrepreneurs has steadily risen in recent years, but it’s hard to achieve sustainable growth in Florida. The Sunshine State’s five-year has a 49.5% business survival rate which means more than half of new SMBs will not make it here.

Plus, it has a higher risk of natural disasters. Despite the drawbacks, Florida is still a pretty good option with low labor costs and easy access to capital.

6. California – Best State to Start a Business for Innovation

Home to Silicon Valley, California is at the forefront of technological innovation. Apart from 53 Fortune 500 companies being based in the state, California is great for small businesses too with the second-highest number of new businesses formed.

The Golden State leads in innovation and availability of capital and has a highly skilled workforce. But starting a business in California has its downsides. The cost of doing business here is one of the highest in the country. The corporate tax rate is also very high at 8.84%.

7. Oklahoma – Best State to Start a Business for Cost of Doing Business

Oklahoma has the third-highest business survival rate in the US. Almost 82% of all new businesses survive the first year and almost 50% survive five years. With the lowest cost of doing business in the country, Oklahoma is an excellent option if you want to start a business with limited resources.

The Sooner State has plenty of venture capital available and a relatively longer average workweek which makes it one of the hardest working states in the US. Its weaknesses like a less skilled workforce and lower consumer spending bring it down to no.7 on our list of best states for starting a business.

8. Idaho – Best State to Start a Business for Real Estate

Also crowned as the best state for real estate, Idaho has one of the strongest state economies and most business-friendly policies in the country. It’s a great place to start if your business infrastructure needs a safe physical environment. With a very low risk of natural disasters, the Gem State has vast untapped potential that can act as a booster for your new business.

Idaho is one of the fastest-growing states and offers a healthy supply of skilled labor, good infrastructure, and the regulatory environment isn’t too strict. When it comes to taxes, both personal and corporate income tax rates are 6.93%. The cost of doing business is also a bit higher, placing Idaho toward the lower end of our list.

9. North Carolina – Best State for Starting an LLC

One of the best states to buy investment property, North Carolina has a robust economy, a strong workforce, and plenty of venture capital. Compared to other states on this list, North Carolina may seem an uninteresting choice. But several factors combine to make it a very practical state to start a business.

Apart from low business costs, plenty of labor, and relaxed compliance requirements, NC’s strongest selling point is the ease of starting an LLC in the state. At 2.5%, the state’s corporate income tax rate is one of the lowest in the country. The individual income tax rate, however, is not as low sitting at 5.25%.

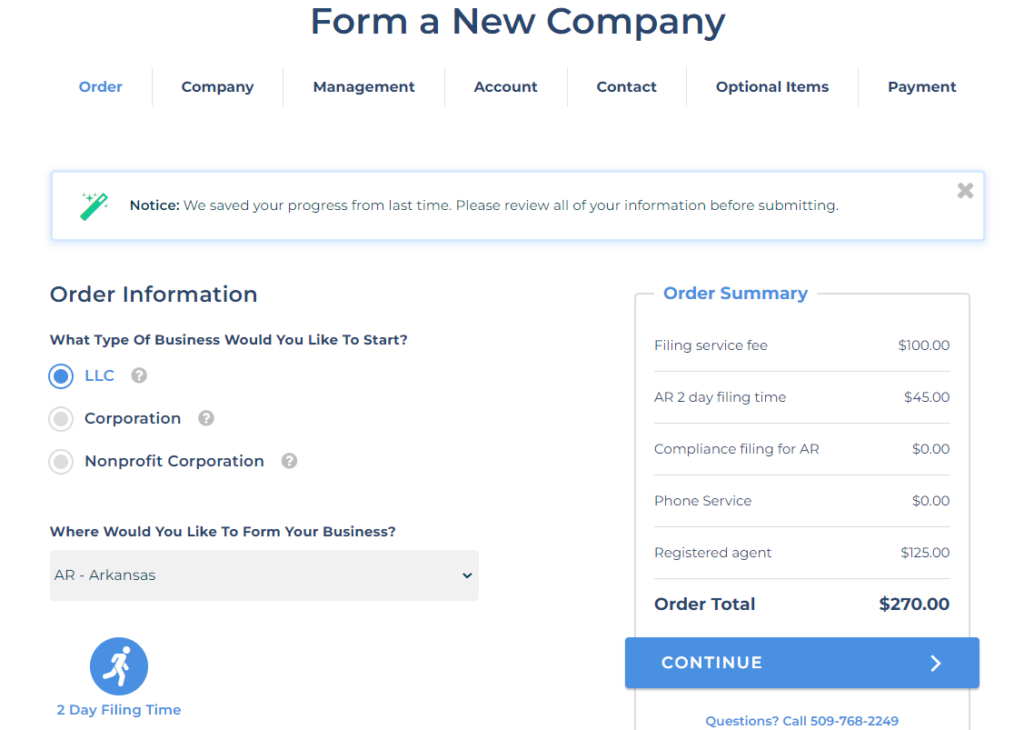

10. Delaware – Best State to Start a Business for Privacy Protection

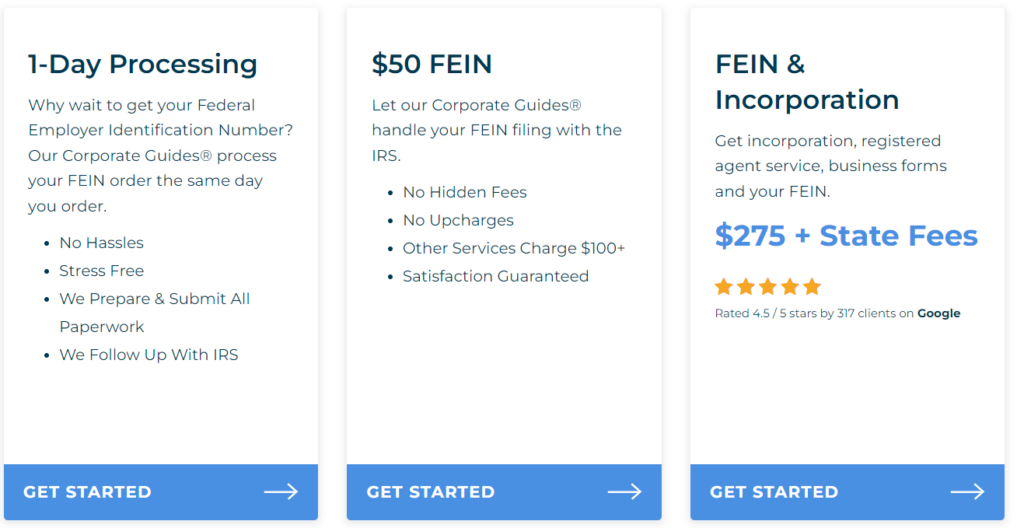

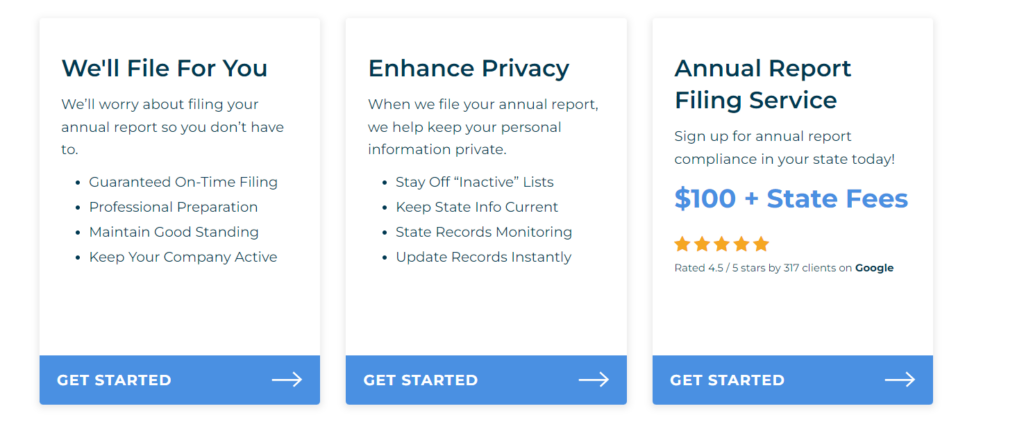

Technically, Delaware isn’t the most small-business-friendly state. However, many new entrepreneurs prefer registering their business here for a range of reasons. First, the state of Delaware doesn’t require LLCs to provide member names and addresses in their public filings.

Filing an LLC here makes sure your information stays private. This is also why many businesses prefer getting a Delaware-based registered agent service.

The First State also offers asset protection from lawsuits. It doesn’t have any sales tax, however, the corporate and individual income tax rates are pretty high at 8.7% and 6.6%, respectively. Apart from a strong state economy, Delaware doesn’t have much to offer. It still can be your top choice if you prioritize privacy and asset protection.

5 Worst States for Starting a Business

While we’re at it, we might as well discuss the worst states for starting a business in 2023, and why. We used the same set of factors to evaluate the worst states for doing business as we did for the best ones.

46. New York – High Costs of Living

New York has one of the highest costs of living not just in the US, but in the world. The state is also known for its high taxes with an individual income tax rate of 8.82% and a corporate rate of 6.5%.

Of course, the high costs of living also translate into the high costs of doing business in the Empire State. Starting a business in New York will cost you dearly, but there’s a silver lining because with high risk comes high reward.

47. Vermont – Aging Workforce

Vermont has very high tax rates with corporate and individual tax rates at 8.5% and 8.75%, respectively. Plus, finding financing in this state is like finding a needle in a haystack. Vermont suffers from a labor problem as the state has an increasingly aging workforce.

All in all, launching a startup in Vermont is a long shot. But you still have a chance at success as almost half of all new businesses survive five years in this state.

48. New Jersey – Worst State for Tax Purposes

With numerous higher education institutions based in New Jersey, its workforce has great potential. However, the tax rates in this state are even higher than in its neighboring state of NY. It has an individual tax rate of 10.75% and corporate at 9%. The cost of doing business is very high too as the highly skilled workforce demands high compensation to afford a living in the Garden State.

49. Hawaii – High Cost of Doing Business

Hawaii is beautiful, but it’s not a great place to start a business. The Aloha State has seen the highest one-year business failure rate with 25.4% of businesses not making it past 12 months. Coming across skilled labor is difficult as the remote island state lacks educational facilities.

Though the cost of labor is reasonable, acquiring raw materials and other costs associated with running a business touch the sky. Tax rates are also unreasonably higher than most other states. We would only recommend running a business here if it’s in the tourism industry or something that your area absolutely needs.

50. Rhode Island – Worst Overall

Rhode Island is the worst state to start a business. It has the oldest infrastructure in the country, expensive real estate, high labor wages, and a poor economy. The cost of living, and proportionately the cost of doing business is also very high in the Ocean State.

Less than half of all new businesses survive the first five years in Rhode Island. As the smallest state with a population of just over a million, the supply of labor is diminishing. It also faces diminishing consumer spending, making it a bad choice for starting a new business.

How We Ranked the Best & Worst States for Starting a Business

Ranking states on their suitability for starting a new business involves several factors varying in weightage. Before we get to them, it’s important to mention that different entrepreneurs have different preferences. While you might prioritize a low cost of labor, another business owner would prefer privacy protection or cheap real estate.

The ultimate decision on where to establish your business depends on what you find important. That said, here’s the list of factors we looked at while evaluating the best and worst states for starting a small business.

- Tax rates: The taxes you pay directly impact the profitability of your business. Higher individual and income tax rates make it difficult to reinvest and grow your business.

- Business survival rate: Statistics speak for themselves. This simple percentage gives a rough estimate of how likely a new business is to succeed in a state.

- Workforce: A young and skilled workforce is crucial to the business environment in a state. A growing workforce also results in lower costs of labor.

- Regulatory environment: Each state’s policies determine how it welcomes new businesses to open their doors. While some states go easy on small businesses, some make it unnecessarily difficult to set up shop.

- Cost of doing business: Business costs are the single most important factor when it comes to business profitability. A business that can’t cover its expenses is likely to fail soon after launching.

- Risk of natural disasters: Last but not least, you always want to consider how safe your investment is in the face of unexpected events. Climate change has put the United States at a higher risk of natural disasters, and some states are more disaster-prone than others.

Bottom Line on the Best States for Starting a Business

We rank Texas, Utah, and Montana as the top three best states for starting a business. Rhode Island is on the other extreme end of the spectrum as the worst state to launch your startup.

We considered several factors while preparing this guide. We studied federal and state government reports, independent studies, and responses from real business owners to acquire information. However, your ultimate decision on where to start your business depends on what you find the most important factor.