The Web 3.0 revolution has introduced several means of making money online. Buying and flipping NFTs is one of them. Know that NFT trading volumes in 2022 are not riding the same high as in 2021, but that doesn’t mean they’re no longer a viable asset to flip. These digital assets are definitely here to stay.

If you want to learn how to buy and flip NFTs and earn profits, read this guide to the end. We’ll explain everything there is to flipping non-fungible tokens in layperson terms and discuss tried-and-tested strategies that’ll help you flip for a profit.

What is NFT Flipping?

Before we get to the step-by-step guide on how to buy and flip NFTs, let’s understand what exactly is NFT flipping? Flipping is a recently coined term that refers to buying an asset and selling it quickly for a profit. It’s not limited to non-fungible tokens only, you can flip any valuable asset including trading cards, cars, real estate, or antiques.

When it comes to NFTs, to flip just means to buy low and sell high. It usually refers to a short-term trade. If you hold an asset for a long time before selling, that’s not exactly flipping.

There’s always a risk when you invest in any asset. Flipping is a relatively riskier means of earning money, but if you strategize, it can help you make a handsome amount of money in a short period of time. Remember that it’s not a sure-fire way to make money, but you’re likely to succeed if you tread carefully and follow a strategy.

How to Buy and Flip NFTs In 5 Steps

Is it possible to buy a non-fungible token in the morning and sell it at the end of the day and make a profit? Yes, absolutely. The key is to analyze the market properly and pick the right project before you buy. The entire process is really simple theoretically.

Experience is an important ingredient of success when it comes to NFT flipping. Ask any successful flipper and they’ll tell you that some things only come with experience. Remember to start small and work your way up to more expensive non-fungible token projects.

This guide will focus on “true” flipping. We won’t focus on creating NFTs, buying early, or minting non-fungible tokens because that can be a whole lot of trouble for starters. Although minting is more profitable, we will focus on buying and selling on a secondary platform like OpenSea or Rarible, which is flipping in the true sense.

Step 1: Pick the Right Time to Buy NFTs

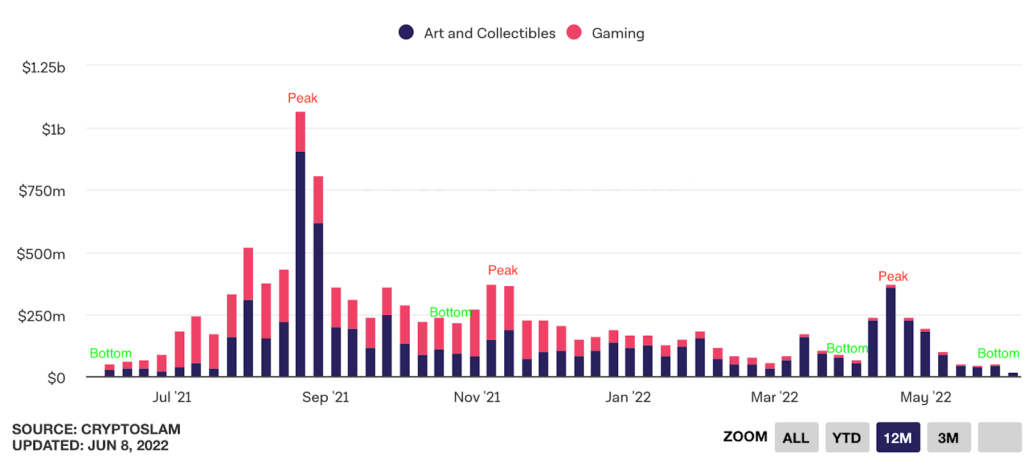

Just like the crypto trading market, the NFT market can either be going up (bullish) or be going down (bearish). You can easily analyze the market trend by looking at the week-by-week NFT trading volume on any credible website.

The best time to buy is when the market has bottomed out. In other words, when charts indicate that trading volumes have hit a record low and the trend starts moving up, that’s the best time to buy. This is because you are more likely to find non-fungible tokens at lower prices.

The key underlying principle is liquidity. When the market is trending upwards, it has higher liquidity, which in simple terms means higher demand. The higher the demand, the more likely you are to sell your digital assets at a profit. All in all, buy when the market has bottomed out and sell when the market is going up.

Step 2: Choose the Right NFT Project to Flip

The next step is to pick one or a few credible NFT projects. You’ll need to do your fair share of research, analysis, and decision-making to shortlist the best ones to flip. Here are a handful of factors that’ll help you choose a promising NFT project.

Number of NFTs in Circulation

You need to look at the basic rules of demand and supply here. Projects with a limited supply tend to have a higher value and hence, are more likely to earn you profit.

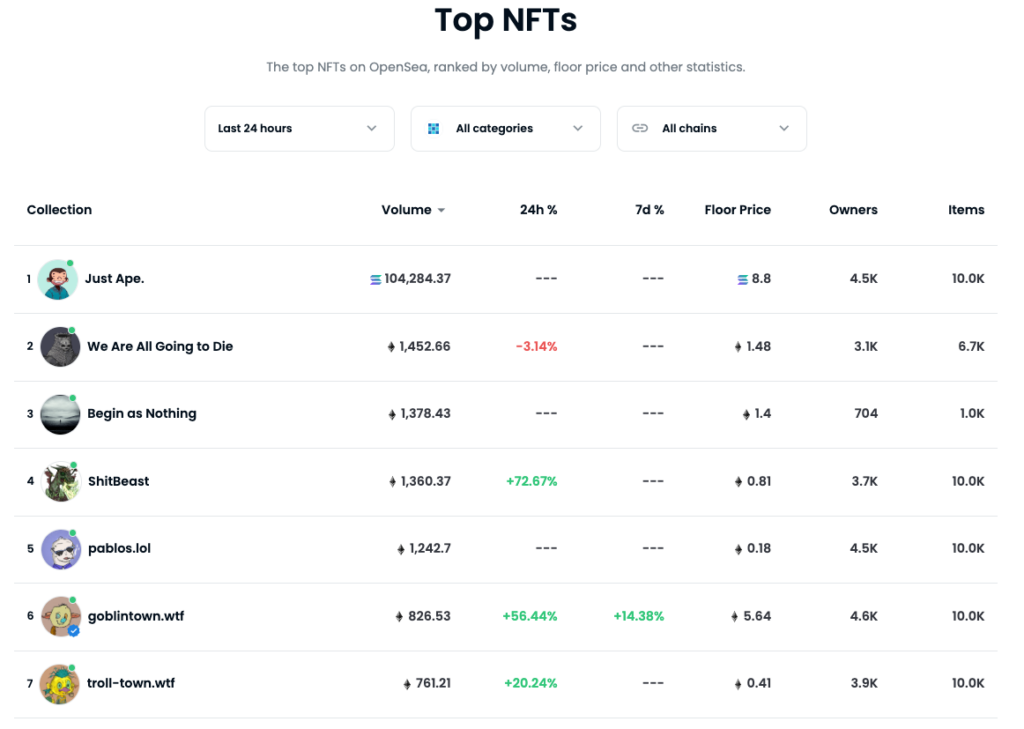

Floor Price

The floor price on a project is the lowest price you can purchase an item on. This should give you a general idea of how much each token costs and help you rule out projects that are out of your budget. If the floor price is above or near your investment budget, investing in that project isn’t financially viable. When you’re looking for new projects to flip, try to find a combination of a low floor price and a limited supply.

Utility

Does a project offer perks or special benefits to its buyers? For instance, some NFT holders get special discounts at select coffee shops while others get a chance to meet a celebrity. Such perks add to the credibility of projects and also make them more valuable.

Team Behind the Project

Best stay away from anonymous NFT sellers. A professional and trustworthy team behind a project adds to buyers’ confidence. This is much better than anonymously-run projects that run a much higher risk of loss or scam.

Quality of Art

Last but not least, every non-fungible token is essentially a piece of art. The more unique and high-quality the art, the greater its value.

Step 3: Buy Rare or Undervalued NFTs to Flip

Now that you’ve shortlisted projects to work with, now is the time to decide which NFT you are going to buy exactly. Purchasing is fairly simple. All you have to do is connect your cryptocurrency wallet to the NFT marketplace.

Note that you must have a compatible cryptocurrency to make a purchase. For instance, OpenSea works mainly on ETH. Most other non-fungible token platforms use any of the fastest-growing cryptocurrencies which makes the market more stable.

But things get complicated when it comes to deciding which to flip. Here are a few strategies to find the best NFTs to buy.

Explore the Trending NFTs Page

The trending page won’t always have the exact NFT you would flip but it gives you an overview of what projects are hot and what prices are tokens being sold at. If you’re lucky enough, you can stumble upon a good flipping opportunity right on the trending page. But in most cases, you will have to do your searching to make profits.

Find Undervalued NFTs

This is where you need to know that flipping NFTs is not a get-rich-quick scheme. You’ll have to spend tons of time on project pages and scrolling through hundreds of items a day to find potential NFTs. Essentially, you are looking for undervalued items or tokens that you think will increase in value in the near future.

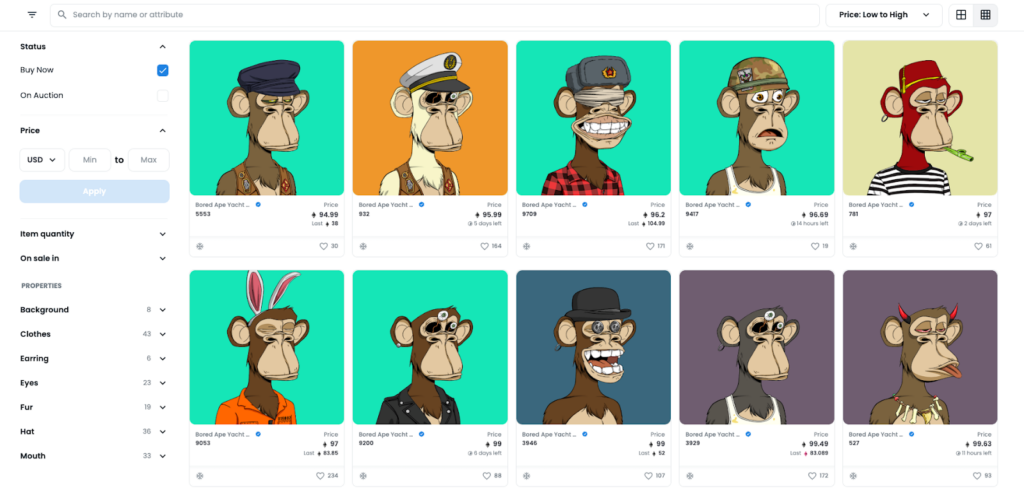

The best strategy is to first set the price filter from Low to High. This will display the cheapest NFTs on the project first. Not all tokens will be up for sale so click on Buy Now to see which ones are up for grabs.

Now scan the entire page to find outliers, items that are priced lower than others in the same project. For instance, if you see that the first couple of items cost 0.5 ETH and all the next ones cost either 0.9 ETH or more than 1, you have a chance at flipping 0.5 ones for a higher price. You could sell them at 0.89, for instance.

Sort NFTs by Traits

Here’s another method to find which NFTs to flip. Traits or Properties define how rare a non-fungible token is and hence determine its value. If less than 100 NFTs share the same trait, they are likely to cost higher than most other NFTs. Similarly, if you’ve spotted an undervalued item, always check out its traits to identify a specialty.

Suppose you see a Bored Ape NFT with a trait that less than 50 other items share, go to that trait page and see the prices of other items with the same rare trait. This will help you decide on a good selling price for your rare token.

Step 4: Set a Price

Buying the right article is only 50% of the job. Now you must set a reasonable price to make a profit successfully. For your digital asset to sell quickly, you want to price your item lower than the others while still making a profit.

Take the marketplace buying and selling fees into consideration when deciding the price. You don’t want to lose all your profit in fees. Use psychological pricing to increase the chances of selling as quickly as possible.

For example, if you want to sell something at 1.0 ETH, price it at 0.99 ETH. While this may look like a futile effort to you, charm pricing has pronounced effects. For starters, the value of 0.99 ETH is virtually the same as 1.0 ETH, but technically, the 0.01 margin helps you NFT appear before all the 1.0 ETH ones on an NFT marketplace. You want your item to appear as high on the left side of the page as possible when the price is set from Low to High.

Step 5: Flip!

If you follow the right pricing tactics and the market conditions are right, it won’t be long before you receive a buyer’s request. Until then you need to keep your digital assets in your NFT wallet. You can sell on the same day, but it can take up to 3 days for your NFT to sell at your asking price.

Best NFT Marketplaces for Flipping

As mentioned above, liquidity is the key to NFT flipping. You want to buy and sell your tokens on marketplaces that have a high enough demand so you can keep circulating and making profits. For this, you need to choose the right platform for flipping. Take a look at the top two NFT marketplaces and see which one you should work on.

- Blockchain: Ethereum

- Monthly trading volume: $5 billion+

- Fees: 2.5% of every sale

- Collection: 1,000,000+ assets

OpenSea is by far the best NFT marketplace for liquidity and security. It also has one of the most extensive NFT catalogs with almost every credible project present on it. As one of the largest marketplaces in terms of trading volume and asset collection, OpenSea is any NFT flipper’s first choice.

However, you must also note that since this is a popular marketplace, you will find a lot of competition. Almost every experienced flipper uses OpenSea to filter out promising assets so you may find it hard to find tokens to flip.

OpenSea is built on the ETH blockchain so you’ll find most tokens on it priced in Ethereum. However, it accepts more than 150 cryptocurrencies for payments.

- Blockchain: Ethereum, Flow, Tezos

- Monthly trading volume: $1.56 million+

- Fees: 2.5% of every sale and purchase

- Collection: 400,000+ assets

Rarible is a newer NFT marketplace that gives emerging artists a chance to share their work in a new way. The platform features a vast range of digital assets including digital art, photography, music, games, domains, and metaverse assets.

It’s one of the more expensive marketplaces as it charges a 2.5% fee on every transaction from both the buyer and seller. The good thing about Rarible is that it’s supported by multiple blockchains including Ethereum, Flow, and Tezos. Its strongest selling point is that it lets users buy tokens directly with their credit or debit card. But this may involve a lot of fees and is not recommended for NFT flippers.

Rarible is not as big a market as OpenSea as of now. The platform aims to be a decentralized autonomous organization (DAO) which means it wants its users to have control over Rarible’s decisions and governance. This is something that sets it apart from the top marketplaces and may even give it the growth it needs to compete head-to-head with giant players like OpenSea.

Frequently Asked Questions (FAQs) for How to Buy and Flip NFTs

Here are some of the most common questions new NFT flippers have when they start buying and selling non-fungible tokens.

Bottom Line on How to Buy and Flip NFTs

Flipping non-fungible tokens sounds like an easy way to make a lot of money. But it’s crucial for you to remember that there’s no such thing as a free lunch. You will have to research and spend the majority of your time finding promising projects and NFTs to flip. But yes, it’s a fun way to make money and will get easier with time as you gain more experience.

Start small and work your way up to minimize risk. Even if you do end up in a loss, you can still start over and try to avoid making the same mistake.