Every business, regardless of size, needs to run payroll to pay employees and payroll taxes to the government. For small businesses, one of the biggest time sinks and expenses will be payroll, but you can get help. Read on to learn more about how to do payroll, why it’s important, and the resources available to help.

What Is Payroll?

Payroll is the organized process of calculating the wages owed to employees, calculating and paying payroll taxes, distributing employee wages, and documenting the whole process. As a result, explaining how to do payroll can be a complicated topic.

It’s important to understand both what is required of you, as the employer, as well as what your employees need to do. Keeping up to date on federal, state, and local income taxes and payroll laws are also vital for a healthy business.

Unfortunately, the only thing more complex than explaining the payroll process may be actually running payroll. In the inevitable moments of frustration, it may be natural to ask a common question.

Do I Need A Payroll?

A payroll is the organized method used to pay employees and deal with the associated responsibilities. If you don’t run payroll and use an organized process, all that’s left is a disorganized process. The penalties for an error in payroll taxes or employee paychecks are no joke. Small business owners, even those with only one employee, should certainly invest time in a consistent method for running payroll.

However, there are many options available for managing aspects of payroll for you. Rather than trying to manage it by-hand, payroll software is available for any budget, from free offerings to more complex options. Payroll services will manage the entire process for you.

Payroll Volatility and Small Business

The fewer employees a business has, the bigger an impact any firing or hiring will have on that business. Since small businesses, by definition, don’t have very many employees. As a result, changes in payroll are both more likely to occur and more likely to affect the business’s overall health. Rapid changes in payroll is known as payroll volatility.

Payroll volatility can be difficult to control, as it can be the result of employees leaving unexpectedly. As payroll is frequently a large part of a business’s overall finances, payroll volatility can have a significant impact on financial health. As a result, taking steps to cushion the effects of payroll volatility, such as arranging business financing, can be wise.

How To Do Payroll

Processing payroll is a multi-step process that has multiple requirements, many of which may vary depending on your location and type of business. As a result, there’s no simple answer to the question, “how to do payroll.” Luckily for small business owners, there are a number of ways to get help with processing payroll.

In general, business owners have two options when looking for help with payroll. If they want to keep more personal control, a business owner may prefer to investigate options for payroll and bookkeeping software. Otherwise, you can find a payroll service that will handle almost everything for you.

While you can do payroll by hand without any help, the number of requirements and the frequency with which they change means it can quite literally be a full-time job all on its own.

Payroll Software

The number of business tools available today is exploding. Whether you’re looking for bookkeeping software, help with customer relationship management, or just communicating with your team, there are long lists of options. When it comes to payroll, employers can find anything from basic, free software that aids just in calculations, to options packed with helpful features.

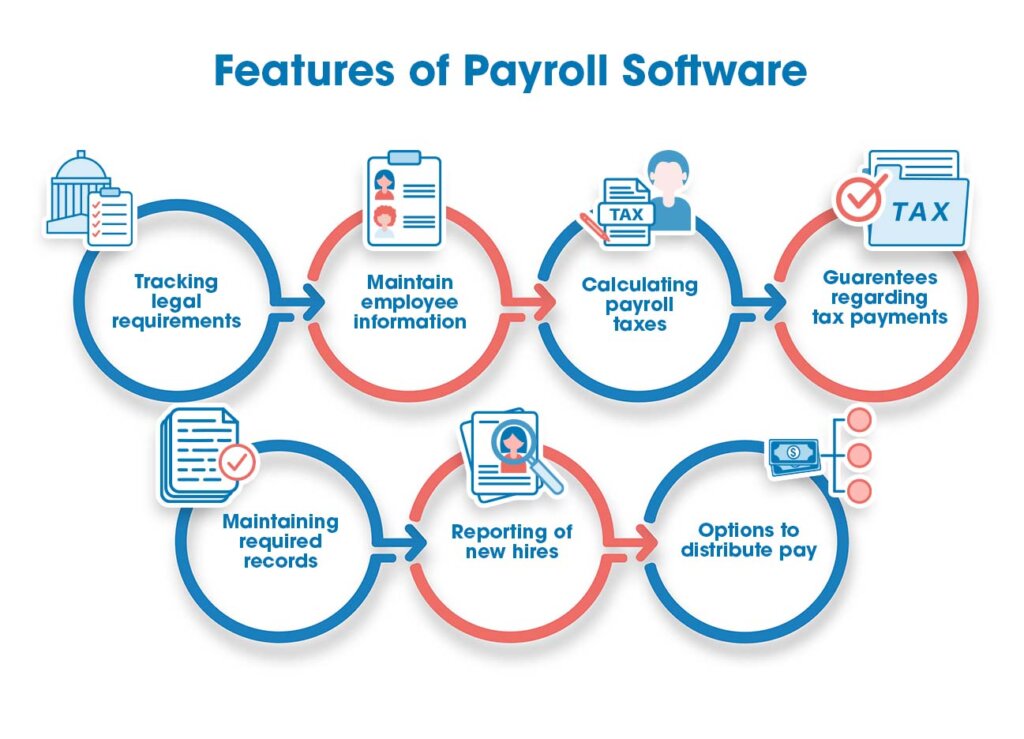

Some of the standard features include:

- Tracking federal, state, and local requirements

- Maintain employee information, ie. exempt vs. non-exempt, hours worked, OT hours, etc.

- Calculating and paying payroll taxes

- Guarantees regarding tax payments and calculations

- Maintain required records

- Required reporting of new hires

- Options for distributing employee pay

Like many business tools, payroll software has been moving to cloud-based apps for easier access and handling of information. Additionally, at this point some payroll software options are essentially equivalent to complete payroll services.

Payroll Providers

When employers want to focus more on business operations, they may opt to hire a service to wholly handle payroll processing. Obviously, a service is frequently going to be more expensive than a software solution. For some employers, the extra cost may be worth it. Payroll services will provide all the advantages of software, plus more.

Those additional services may include things like employee advances on future pay and providing an employee self-service portal. Employers may also be able to access HR reports, handling wage garnishments, and even employee training materials. Using payroll cards or direct deposit may be options for pay.

Payroll Taxes

Payroll can be stressful for a variety of reasons, but payroll taxes probably are at the top of the list for many people. Imagine the anxiety of your yearly personal taxes, only multiplied by the number of employees you have, and required to be filed several times throughout the year. That is one reason payroll software and services are so popular.

As we’ve mentioned, payroll taxes will vary depending on a number of factors, such as your location and type of business. Some aspects will remain consistent, however, primarily regarding federal taxes.

Requirements

Anyone who has received a paycheck has some idea how payroll taxes work. Your gross pay is calculated, then income taxes, FICA deductions, garnishments, etc. are subtracted to calculate your net pay, the amount you’ll actually receive. The employer is responsible for figuring all those amounts and paying them to the government.

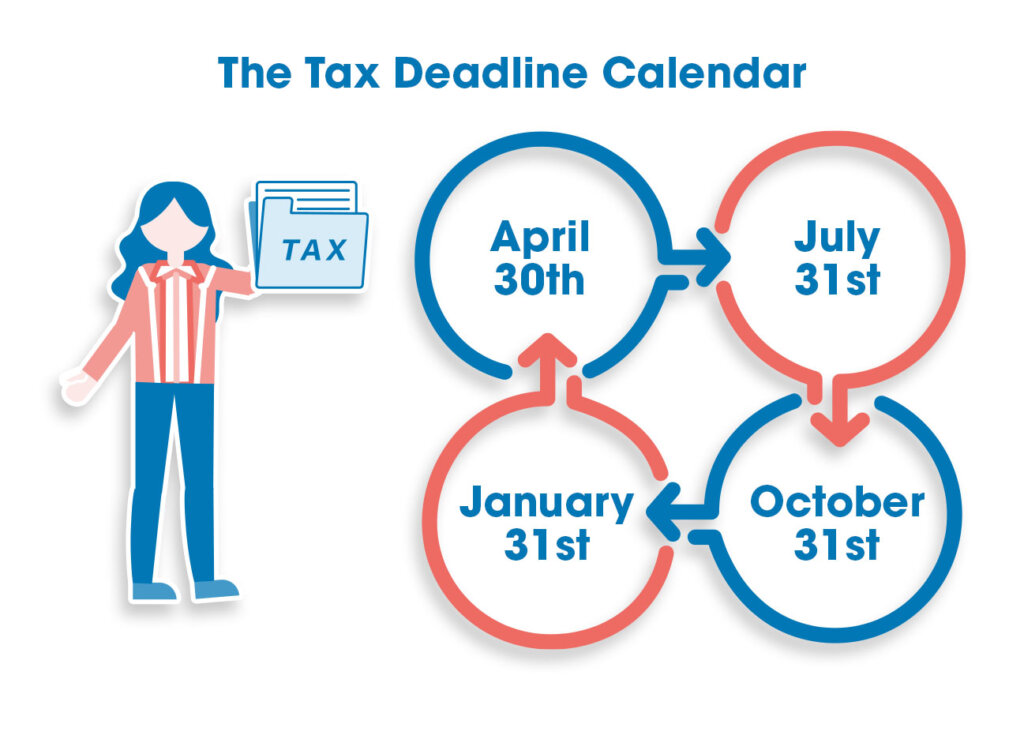

These payments can be made either monthly or semi-weekly. Payroll tax filings must be made on the quarterly tax filing deadlines. Those are:

- April 30th

- July 31th

- October 31th

- January 31th

There may be a grace period for some filings. Tax payments must be made in a timely fashion, however, to avoid penalties.

State and local governments largely follow the federal government’s lead, in terms of payment and filing deadlines. However, employers should certainly confirm their local requirements.

Penalties

If tax payments are late, the IRS charges a percentage of the late payment. The percentage increases the tardier a payment is:

- 1-5 calendar days – 2% of unpaid amount

- 6-15 calendar days – 5% of unpaid amount

- Over 15 days – 10% of unpaid amount

After that point, the IRS will send you a notice requesting payment. The penalty increases to 15% of the unpaid amount 10 days later.

That’s not the end of penalties, however. The IRS charges interest on unpaid taxes at a rate that varies. As a result, even a small penalty can become significant fairly quickly. There are ways to avoid interest charges, such as applying for a payment plan.

What Is Payroll? Frequently Asked Questions (FAQs)

Bottom Line: What Is Payroll?

Processing payroll for the first few times can be understandably intimidating. However, it will soon become just another aspect of your business. It may be a chore, but one far outweighed by the excitement of running a business.

Sections of this topic

Sections of this topic