The best banks in California offer a combination of low account fees, convenience, and comprehensive banking tools. If you’re in California and want to find a new bank, this guide discusses your best options. Each bank is federally insured and carries a variety of products, including checking accounts, investment accounts, and loans.

Best Banks in California

- Bank of America – Best Overall Bank

- Chase Bank – Best for Checking Account

- Wells Fargo – Best for Small Business

- Ally Bank – Best for Savings Account

- US Bank – Best for Customer Service

- Bank of the West – Best for Regional Banking

In ranking the best banks of California, we looked at the factors most important to consumers, including fees (and whether they’re waivable), opening deposit requirements, and annual percentage yield (APY) on savings accounts. There’s more to consider when choosing a bank and we detailed our methodology below.

Bank

Pricing

Services

Opening Deposit

Savings APY

Number of CA Branches

Starts at $4.95 per month

Checking accounts, savings accounts, credit cards, home loans, car loans, investing

$25 to $100

0.01% to 0.04%

854

Starts at $12 per month

Checking accounts, savings accounts, money market accounts, CDs, custodial accounts, home loans

$0

0.01% to 0.05%

967

Starts at $10 per month

Checking accounts, savings accounts, money market accounts, CDs, custodial accounts, home loans

$25

0.01% to 0.02%

932

$0 per month

Checking accounts, savings accounts, auto loans, home loans, personal loans

$0

0.90%

0

Starts at $6.95 per month

Checking accounts, savings accounts, money market accounts, CDs, custodial accounts, home loans

$25

0.01%

481

Starts at $10 per month

Checking accounts, savings accounts, CDs, IRA CDs, credit cards, loans

$0

0.01%

224

Bank of America is a national bank with an extensive network of free ATMs and branch offices. Although Bank of America offers weak savings rates, you get access to premium traditional banking services and support. Bank of America offers a host of different checking and savings accounts, making it easy to find the best solution for your needs.

Why we chose it: Bank of America is the best overall bank in California because of its complete range of online and mobile banking tools. Furthermore, Bank of America makes it easy to waive the monthly fee on all three of its checking account plans and it’s also one of the best mortgage lenders.

- Three checking account options

- No overdraft fees

- Many physical branches

- Low annual percentage yield (APY)

- Low transfer limits

- Paper checks included for free only on Advantage Relationship

Pricing:

Bank of America offers three different checking accounts:

- SafeBalance: $4.95 per month, waivable if you are under 25 and qualify as a student, are under 18, or are enrolled in Preferred Rewards.

- Advantage Plus: $12 per month, waivable if you have at least one qualifying direct deposit of $250 or more, maintain a $1,500 minimum daily balance, or are enrolled in Preferred Rewards.

- Advantage Relationship: $25 per month, waivable if you maintain a combined balance of $10,000 in eligible linked accounts or are enrolled in Preferred Rewards.

Checking and Savings Options

Bank of America has three checking account plans and one savings account. The Advantage Plus account is $12 per month, but you can waive the service fee if you have at least one qualifying direct deposit of $250 or more, maintain a $1,500 minimum daily balance, or are enrolled in Preferred Rewards.

Fees and Requirements

Every Bank of America checking and savings account has a monthly maintenance fee, while Ally has none. However, you can waive each monthly maintenance fee if you meet Bank of America’s requirements. Furthermore, you can access Bank of America’s vast network of fee-free ATMs. There’s a $3 out-of-network ATM withdrawal fee.

Interest Rates

The Bank of America Advantage Savings account offers a low APY of 0.01% to 0.04% if you’re a Platinum Honors Tier Preferred Rewards Member.

ATM and Branch Access

Bank of America has hundreds of branches and ATMs across California. Therefore, it’s convenient to withdraw cash or get in-person help at a Bank of America branch.

Banking Experience

Bank of America stands out because of its easy online banking experience and digital tools. The website and mobile app are straightforward and offer everything you need to manage your bank account and make payments.

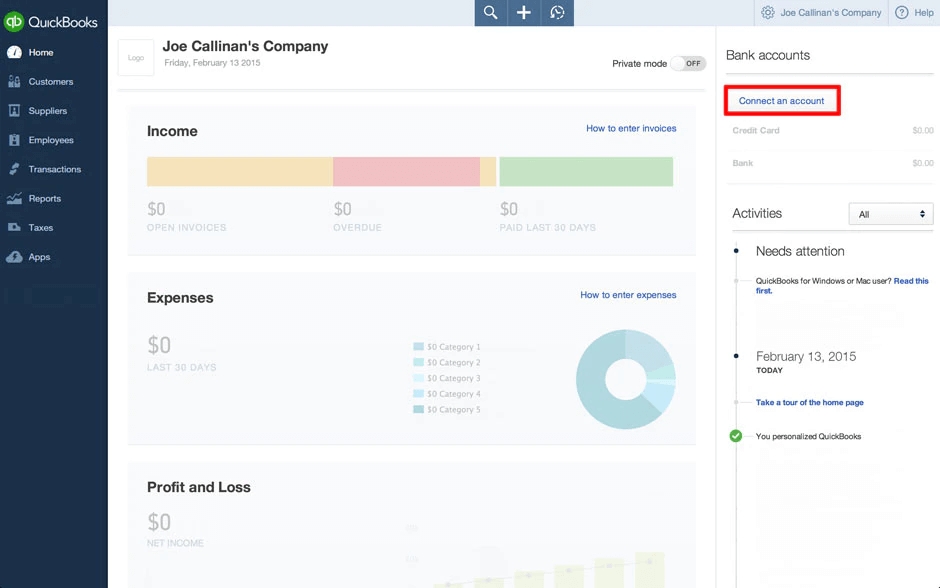

Chase Bank is the largest bank in the United States with over $3 trillion of assets. This bank offers a robust menu of banking products and services. Chase Bank’s website and mobile experience can compete with online-only banks. Furthermore, Chase offers five different checking accounts and two savings account plans. We have also review articles for other business banks like Novo Review and Bluevine Review

Why we chose it: Chase Bank is the best California bank for checking accounts because it offers five different account options. It also offers three additional checking account plans for kids and students.

- Wide range of checking accounts

- Regular cash bonuses for opening an account

- Many ATMs and branches

- Above average monthly fees

- Low rates on CDs

- Low rates on savings

Pricing:

Chase Bank carries five different checking accounts:

- Chase Total Checking: $12 per month, waivable if you have $500 in electronic deposits, maintain a $1,500 minimum daily account balance, or maintain an average beginning day balance of $5,000 or more in any combination of this account and link qualifying Chase accounts.

- Chase Secure Banking: $4.95 per month fixed fee.

- Chase Premier Plus Checking: $25 per month, waivable if you have an average beginning day balance of $15,000 or more in any combination of this account and linked qualifying Chase accounts.

- Chase Sapphire Banking: $25 per month, waivable with an average beginning day balance of $75,000 or more in any combination of this account and linked qualifying Chase accounts.

- Chase Private Client Checking: $35 per month, waivable with an average beginning day balance of $150,000 or more in any combination of this account and linked qualifying Chase accounts.

Checking and Savings Options

Chase Bank offers eight total checking accounts and two savings accounts. Therefore, there’s a good chance you’ll find a plan that meets your banking needs.

Fees and Requirements

Every Chase Bank account has a monthly service fee that can be waived if you meet the requirements outlined above.

Interest Rates

Chase offers low 0.01% to 0.05% APY on its savings account–Ally offers a slightly higher APY. Therefore, Chase Bank isn’t a great option if you want to earn interest on your account balance.

ATM and Branch Access

Chase has over 900 branches in California and 16,000 ATMs throughout the United States. Even if you’re not located near a Chase branch, you can handle all of your banking duties through Chase’s mobile app or online website.

Banking Experience

Chase has an excellent banking experience because of its many branch locations and great online banking tools. Furthermore, Chase customer support is easy to reach and helpful.

Wells Fargo is another major US bank offering a full array of banking services. These include checking and savings accounts, investing and wealth management services, home loans, auto loans, and credit cards. With nearly 1,000 branches in California, you won’t have trouble depositing money, withdrawing cash, or getting in-person help.

Why we chose it: Wells Fargo is the best bank for small businesses because it is one of the nation’s top lenders to small businesses, with transparent interest rates on loans.

- Many branches in California

- Wide range of savings options

- Comprehensive banking tools

- Low APYs

- Minimum opening deposit

- Service fees

Pricing:

Wells Fargo has four checking account options:

- Clear Access Banking: $5 per month, waivable if the primary account owner is 13 to 24 years old.

- Everyday Checking: $10 per month, waivable with a $500 minimum daily balance, $500 or more in total.

- Prime Checking: $25 per month, waivable with $20,000 or more in statement-ending qualifying linked balances.

- Premier Checking: $35, waivable with $250,000 or more in statement-ending qualifying linked balances.

Checking and Savings Options

Wells Fargo carries four unique checking accounts and two savings accounts. Wells Fargo is best for individuals who prefer access to branches and want to keep multiple accounts at the same bank. It also offers one of the best business checking account options on the market.

Fees and Requirements

Although each account has a monthly maintenance fee, you can waive them by following the guidelines above.

Interest Rates

Wells Fargo offers a low APY of 0.01% to 0.02% across both savings accounts.

ATM and Branch Access

Wells Fargo has hundreds of ATMs and branches across California. Therefore, you don’t need to worry about finding somewhere to withdraw or deposit cash.

Banking Experience

Similar to Bank of America and Chase Bank, Wells Fargo offers a complete suite of physical and digital banking tools. With Wells Fargo, you get access to contactless debit cards, 24/7 fraud monitoring, and 12,000 ATMs across the United States.

Ally Bank is a widely popular online bank for people seeking strong rates and an extensive set of digital banking features. Since Ally Bank is online only, it saves money on its overhead and can pass it on to customers in the form of minimal fees and high interest rates. The bank also offers convenient customer service options. Don’t forget these reviews as well; NBKC Bank Account Review and Axos Review.

Why we chose it: Ally Bank is the best California bank because it offers 0.90% APY on the Online Savings Account. You can also earn 0.25% APY on an Ally Interest Checking Account.

- High APY

- No fees or minimums

- Excellent customer service

- No physical branches

- No way to deposit cash

- 30 days to fund account

Pricing:

Ally doesn’t charge monthly maintenance fees and doesn’t have a minimum opening deposit

Checking and Savings Options

Ally offers one checking account and one savings account. However, Ally also offers a Money Market account and high-yield CDs.

Fees and Requirements

Ally shines because it doesn’t have monthly maintenance fees, overdraft item fees, or minimum balance requirement fees. The only fees Ally has are returned deposit item fees, expedited delivery fees, and outgoing domestic wire fees.

Interest Rates

Ally’s Online Savings Account offers 0.90% APY, and its Interest Checking Account offers 0.25% APY. These interest rates are well above the standard rates we see from most California banks.

ATM and Branch Access

Ally is an online bank without physical branches. However, account holders can access 43,000 fee-free Allpoint ATMs across the United States. You also receive $10 per month in ATM fee reimbursements if you withdraw from out-of-network ATMs.

Banking Experience

Since Ally is an online bank, it offers a comprehensive suite of digital banking tools. Furthermore, you get access to Zelle to easily send and receive payments.

U.S. Bank is the fifth-largest bank in the US by assets. As a well-known national bank, U.S. Bank offers convenient access to thousands of branches and ATMs across the United States. Furthermore, US Bank carries five different checking accounts, making it easy for you to find an option that suits your needs. Since you have read the U.S. bank review you might be interested as well to Lili Review and Capital One Review.

Why we chose it: US Bank is the best California bank for customer service because it offers 24/7 live phone support. You can get in-person help at one of the 500 California US Bank branches.

- Excellent customer service

- Wide range of banking services

- Hundreds of branches in California

- Low APYs

- Monthly fees

- Not as many branches as other banks

Pricing:

US Bank carries five checking account plans:

- Easy Checking: $6.95 per month, waivable if you have combined monthly direct deposits totaling $1,000 or more, you keep an average account balance of $1,500 or more, or you or another person on the account are age 65 or greater.

- Gold Checking: $14.95 per month, waivable if you have an open U.S. Bank personal loan, line, mortgage, or credit card

- Platinum Checking: $24.95 per month, waivable if you have $25,000 or more in combined personal deposits, credit balances with U.S. Bank investments through U.S. through Bancorp Investments.

- Student Checking: $0 per month

- Safe Debit Account: $4.95 per month, non-waivable

Checking and Savings Options

US Bank is unique because it offers five different checking accounts and five different savings accounts. These range from basic student accounts to a Platinum Checking account that includes all of US Bank’s banking tools.

Fees and Requirements

Easy Checking, Gold Checking, and Platinum Checking have monthly maintenance fees that are waivable if you meet the requirements. Furthermore, the Student Checking account is $0 per month, and the Safe Debit Account is a non-waivable $4.95 per month.

Interest Rates

US Bank offers low interest rates at a 0.01% APY. For this reason, we recommend Ally bank if you’re looking for a savings account with a high interest rate.

ATM and Branch Access

US Bank has a large physical presence across Los Angeles, Orange County, South Bay, Inland Empire, San Diego, and many surrounding communities.

Banking Experience

US Bank excels as one of the best banks in California when it comes to reach and access. In addition to the wide selection of branches and ATMs, US Bank’s customer service is available 24 hours a day by phone or social media.

Bank of the West is headquartered in San Francisco and is owned by BNP Paribas, a French international banking group. The bank has more than 500 branches in 19 states and mainly operates on the west coast. Bank of the West offers a wide range of banking and investment products for personal and commercial banking needs.

Why we chose it: Bank of the West is the best California bank for regional banking because it has a strong presence on the west coast and midwest.

- Convenient customer service

- Wide range of banking tools

- Good for small businesses

- Low rates

- Some accounts can’t be opened online

- Not available everywhere in USA

Pricing:

Bank of the West provides three different checking accounts:

- Any Deposit Checking: $0 monthly service fee with any deposit per statement ($0.01 or more) or if you’re under 25

- 1% For The Planet Checking: $0 monthly service fee with any deposit per statement ($0.01 or more) or if you’re under 25

- Premier Checking: $25 monthly service charge waived with minimum $25,000 average balance in eligible accounts

Checking and Savings Options

Bank of the West carries a wide range of checking accounts and one savings account. The downside of these accounts is the low interest rates they offer.

Fees and Requirements

You can waive the monthly maintenance fee on the Any Deposit Checking and 1% For The Planet Checking by making any deposit per statement. This can be as little as $0.01. However, the Premier Checking account has a monthly service fee of $25 that can be waived with a $25,000 minimum average balance in eligible accounts.

Interest Rates

Bank of the West savings account only offers 0.01% APY, which is relatively low compared to other options on this list.

ATM and Branch Access

Bank of the West has over 200 branches in California. We recommend checking if there’s a Bank of the West branch near your home.

Banking Experience

Bank of the West offers various ways to conduct your banking duties, including at physical branches, online, and in the Bank of the West mobile app.

Methodology for the Best Banks in California

In this section, we discuss the crucial factors offered by the best banks in California. By breaking down each feature into its own section, you can easily discover which bank has the right solutions for your needs.

- Checking and savings options: The most important feature of the best banks in California is their checking and savings account options. The best banks in California offer checking and savings accounts with low fees and

- Fees and requirements: Each bank has unique monthly service fees, which can be waived if you meet certain requirements. Choose a bank in California with a monthly maintenance fee you can easily waive. Furthermore, each California bank has a unique minimum deposit requirement.

- Interest rates: Some checking accounts pay interest while most savings accounts pay some interest. If you’re interested in earning interest on your account balance, you need to find a California bank with an above average annual percentage yield (APY).

- ATM and branch access: If you mostly use cash, you need a bank that makes it easy to withdraw cash at an ATM or branch. Furthermore, banks with many branches in California make it easy for you to manage your account and perform your banking duties in person.

- Banking experience: Banking experience describes how easy the bank makes it to perform different actions. For example, the best banks in California offer great mobile apps, excellent online websites, and simple ways to deposit checks, pay bills, send money, and monitor account activity.

Frequently Asked Questions (FAQs) for Best Banks in California

Choosing the best bank in California is an important decision as you’re looking to open a new account for a business. If you are an entrepreneur there are top banks for startups also. So let’s discuss a few questions you may have about California banks.

Bottom Line on the Best Banks in California

Bank of America, Chase Bank, and Wells Fargo are the best banks in California if you prefer traditional banking and a wide range of services. If you want to open a digital bank account, Ally and CIT Bank are great options. There are also banking accounts in the market that are free. Either way, you can’t go wrong with any bank on this comprehensive list. Look for features that suit your needs before making your decision. We also have other reviews like Kabbage Review and Oxygen Review that may help you create the right decision.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.