Nearly 78 million Americans volunteered their time for an organization in 2019—that’s about 30% of the population—according to AmeriCorps. Nonprofit organizations and other companies that rely on volunteers should be developing and managing volunteer programs that benefit the organization and volunteers. It all starts with a well-designed plan.

This Library topic is called “Developing & Managing Volunteer Programs” to emphasize that, for the organization and its volunteers to benefit the most from each other, volunteers should

be managed as part of an overall, systematic program, somewhat similar to the systematic approach that should be used to managing employees. Certainly, there are differences between how employees and volunteers are managed, but the differences are probably much less than most people realize.

The following links are to sections in this overall topic and the sections are organized in the order in which they might be needed in an organization that is starting a volunteer management

program—the order of the links themselves suggest the systematic nature of a well-designed volunteer management program. Organizations that already have established programs can use this overall topic by going directly to the sections that are relevant to current priorities in their current program. The links below present a wide variety of perspectives and materials about volunteer management programs or systems.

Sections of This Topic Include

Planning Your Volunteer Program

- Considerations in Establishing or Modifying Volunteer Management Systems

- Online Tutorial About Volunteer Management Programs

- Role of Volunteer Managers

- Staffing Analysis (Deciding Whether Volunteers Are Needed)

- Legal and Risk Considerations

- Policies and Procedures

- Volunteer Job/Task Descriptions

Operating Your Volunteer Program

- Volunteer Recruitment

- Screening Volunteers

- Selecting (“Hiring”) Volunteers

- Orienting and Training Volunteers

- Supervising (delegating, evaluating, addressing issues, rewarding, etc.)

- Volunteer and Staff Relations

- Assessing Your Volunteer Management Practices

Additional Information

Also consider

Learn More in the Library’s Blogs Related to Volunteers and Volunteer Programs

In addition to the articles on this current page, also see the following blogs that have posts related to Volunteers and Volunteer Programs. Scan down the blog’s page to see various posts. Also, see the section “Recent Blog Posts” in the sidebar of the blog or click on “next” near the bottom of a post in the blog. The blog also links to numerous free related resources.

Planning Your Volunteer Program

Designing & Operating Your Volunteer Management System

Considerations in Establishing or Modifying Volunteer Management Systems

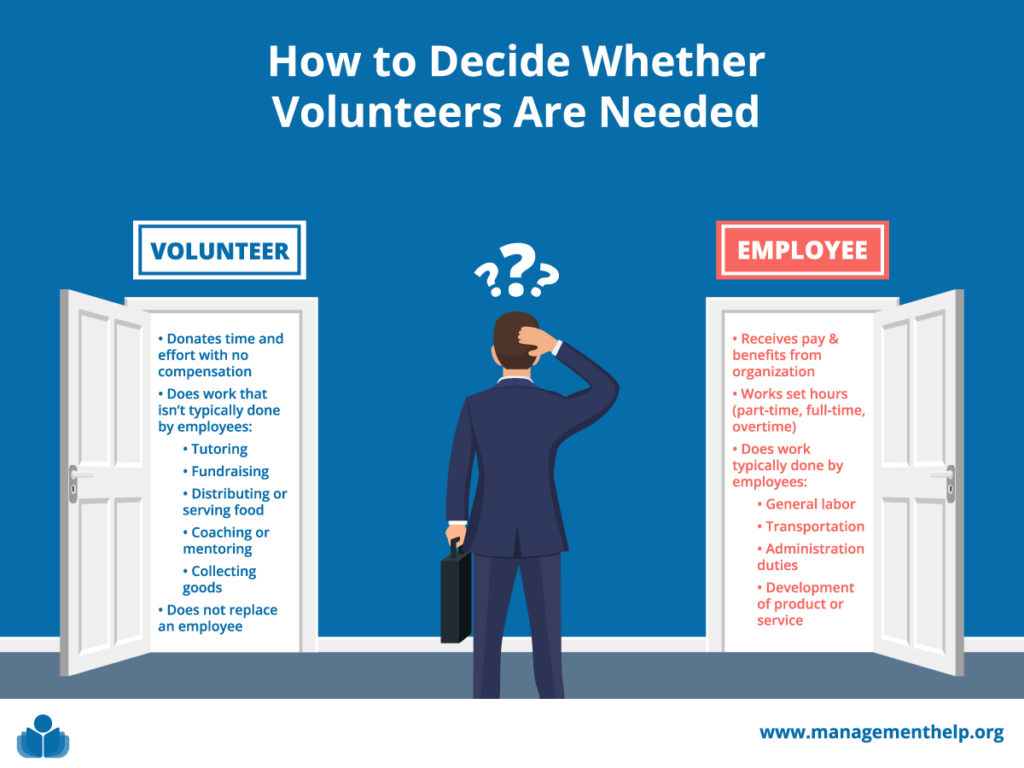

Any organization that develops a volunteer program should first identify the difference between a volunteer and an employee and then create appropriate boundaries. A company should also take into consideration what a volunteer wants or needs out of their experience. According to a study by Sterling Volunteers, 83% of volunteers want to make a positive impact on their community, but volunteers can get even more from their time and effort.

Recruiting volunteers is also a crucial part of developing and managing a volunteer system. There are plenty of online resources that can help you find micro-volunteering individuals or long-term volunteers. In fact, 80% of volunteers plan to give their time again to an organization they believe in, according to an NCVO survey.

Note that the extent to which an organization develops and implements a volunteer management system depends on the nature of the activities to be conducted by the volunteers. For example, an organization that uses many volunteers, some of whom directly serve people, will probably use a very comprehensive system. In contrast, an organization that occasionally uses volunteers to stuff envelopes might do a brief solicitation to recruit any volunteers that the organization can get and then do a very brief training, afterward leaving the volunteers alone to perform their task.

- Definition of Volunteer

- Managing Volunteer Boundaries

- Guide To Volunteering

- The concept of micro-volunteering gains momentum

- Volunteer Recruitment and Management

Online Tutorial about Volunteer Management

Role of Volunteer Managers

The primary role of the volunteer manager is to establish and operate the volunteer management system. This leader is also responsible for mediating and advocating for volunteers when necessary. Susan Ellis was one of the strongest advocates for volunteer programs and, specifically, volunteer managers. Learn more about the role of volunteer managers in her content below.

- Susan Ellis’ resources for volunteer managers

- Volunteer Managers and the Time Management Trap

- Resources and Research for Volunteer Managers

Staffing Analysis (Deciding Whether Volunteers Are Needed)

Also consider the topic for employees: Workforce planning (including succession planning)

Legal and Risk Considerations

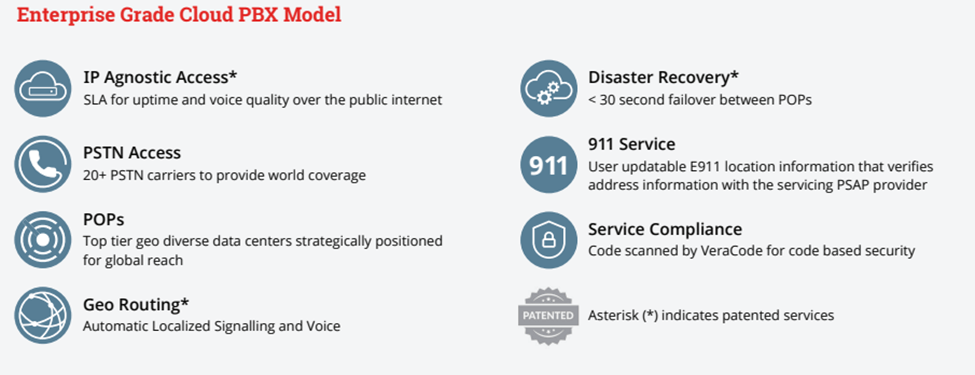

There are a variety of types of legal and risk considerations when using volunteers in an organization, e.g., what insurance is needed, what rights volunteers have in the workplace, what employment laws also apply to volunteers, and how can you ensure that volunteers act ethically, etc. The reader will get a more clear understanding of legal and risk considerations by reading the topics in the following section about management policies and procedures.

- Federal Law Protects Nonprofit Volunteers

- Myths of Risk Management: Part 1

- Myths of Risk Management: Part 2

- Myths of Risk Management: Part 3

- Insuring Volunteers

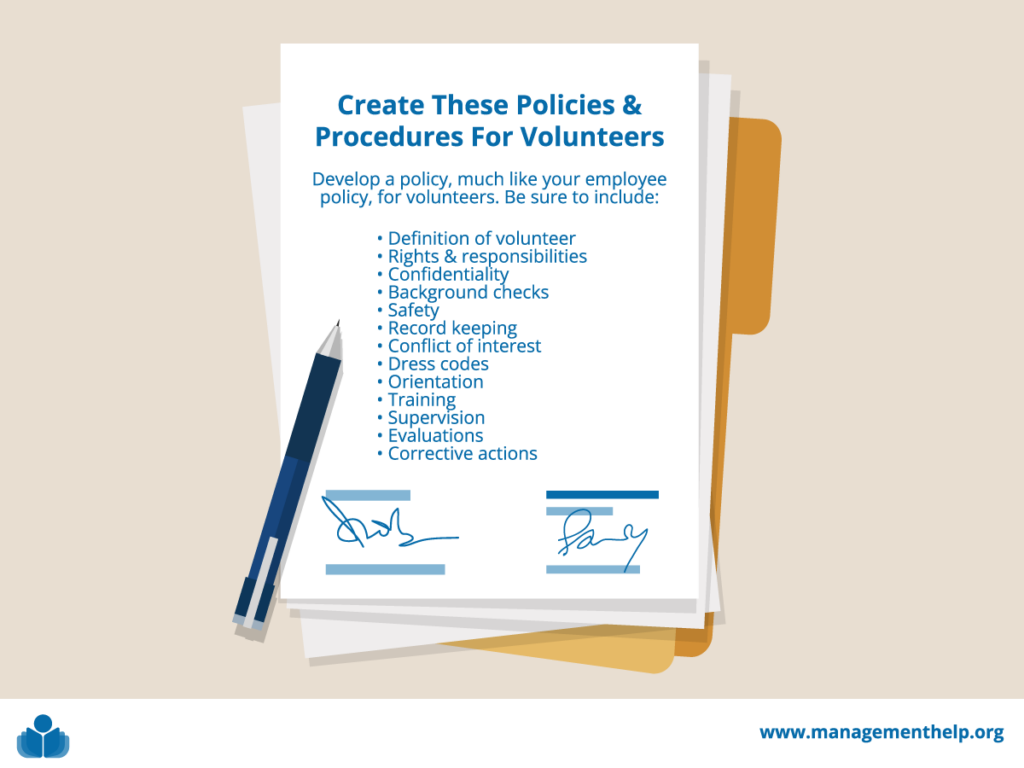

Policies

Policies are general guidelines that personnel can reference in order to make decisions and get guidance on how to act in certain situations, e.g., a policy about dress codes. Procedures are specific step-by-step directions regarding the completion of a specific task, e.g., powering up a computer. Policies help ensure that volunteers are supervised and that they act according to a legal, ethical and organizationally-preferred manner in the workplace.

Policies are often in regard to, e.g., the definition of volunteer, rights and responsibilities, confidentiality, background checks, safety, record-keeping, conflict-of-interest, dress codes, orientation, training, supervision, evaluations, corrective actions, etc.

The astute reader will recognize that the policies in regard to volunteers are very similar in nature to the policies for employees.

Volunteer Job/Task Descriptions

You should be clear about what you expect from each of your volunteers. Volunteers deserve to know what you expect from them, as well. To recruit volunteers for a specific role or job, you will need a clear job description from which to develop the advertisements and to show them to any potential candidates. Therefore, each volunteer should have a job, or task, description.

The description should specify at least whom the volunteer reports to, any general duties and responsibilities, and any specific tasks to perform. Job descriptions might include additional information, e.g., level of expertise and education needed for the job, minimum requirements of expertise, etc.

- Sample job description

- Guidelines and Sample Job Description

- How to Write a Job Description That Your Volunteers Will Love

- Volunteer Job Description Worksheet

Also consider the topic for employees: Specifying Jobs and Roles (analysis, description, and competencies)

Also consider the topic for employees: Job Descriptions

Operating Your Volunteer Program

Volunteer Recruitment

Recruitment usually involves identifying the most likely sources of suitable candidates for volunteer positions, how to approach those sources, and then approaching each source. Sources might include, eg, advertisements in the newspaper, word-of-mouth of employees, recommendations from clients, online (or virtual) sources, professional placement advisors (“headhunters”), volunteer fairs (events in which many organizations that need volunteers attend to recruit volunteers), etc.

Candidates who are interested in certain positions often complete an application form, including providing a resume.

General Guidelines

- Successful Recruitment Techniques

- Recruiting Boomers, Gen-Xers, and Millennials

- Big Brothers/Big Sisters: A Study of Volunteer Recruitment and Screening

Advertising

- Characteristics of Good Recruitment Message

- Where to Post Volunteer Opportunities: 15 Volunteer Recruitment Websites for Nonprofits

- 7 Super Steps to Recruit Volunteers

Online Recruitment

- 10 Reasons Why You Need to Recruit Online Volunteers

- Also consider the topic for employees: Recruiting (sourcing and advertising)

- Recruiting and Engaging Volunteers Online

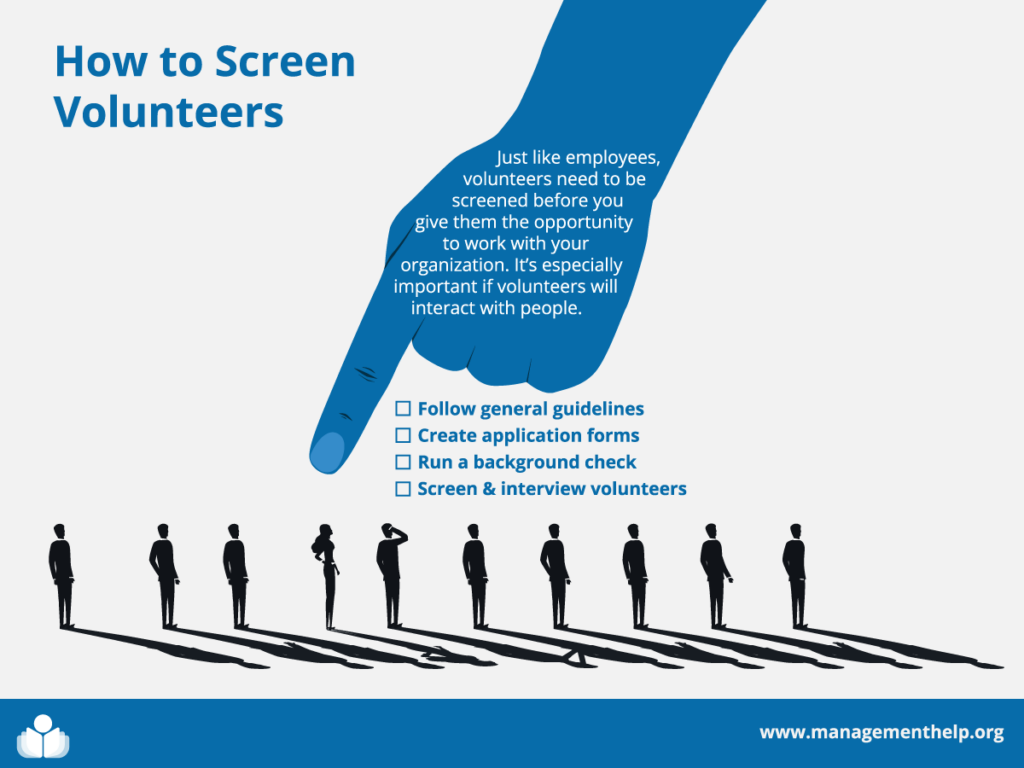

Screening Volunteers

Each potential candidate for a volunteer position is usually screened. The extent of screening for each position depends on the nature of the tasks to be performed by the volunteer, e.g.,

whether the volunteer will be working directly with people in a health facility, etc. Screening often involves carefully examining each application, conducting background checks (e.g., to verify

information in the resume, identify any legal problems, etc.), and interviewing the most suitable candidates.

General Guidelines

Also consider the topic for employees: Screening Applicants

Application forms

Background Checks

- Criminal Records Checks for Prospective Staff and Volunteers

- Volunteer Background Checks: Giving Back Without Giving Up on Privacy

Interviewing

Also consider the topic for employees: Interviews

Selecting (“Hiring”) Volunteers

After candidates have been screened, ideally there is one candidate that seems to be the most suitable for each unfilled volunteer position. Each suitable candidate should be formally (or officially) approached with an offer letter that describes the terms that the organization is offering and the activities that the organization wants the volunteer to conduct. The offer might include any benefits, e.g., free training, use of facilities for private use, etc.

Also consider the topic for employees: Selecting (Hiring) New Employees

Orienting & Training Volunteers

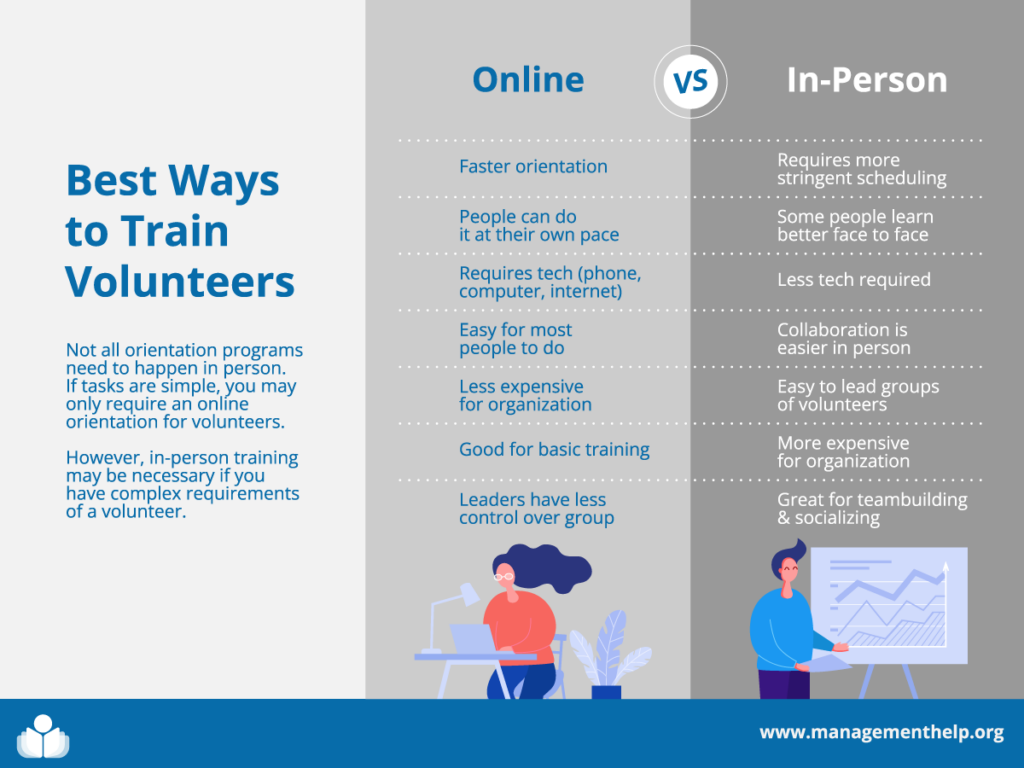

If the nature of the volunteer’s work is very basic and routine, then a volunteer might require only a very basic and general introduction to the organization and the task they are to complete. In contrast, if the nature of the volunteer’s work is rather complex, e.g., supervising patients in a particular setting in a health facility, then the volunteer will likely require a complex orientation to the organization and also training about, e.g., policies and procedures, how to respond to particular situations, when to ask for help, how to use certain facilities, etc.

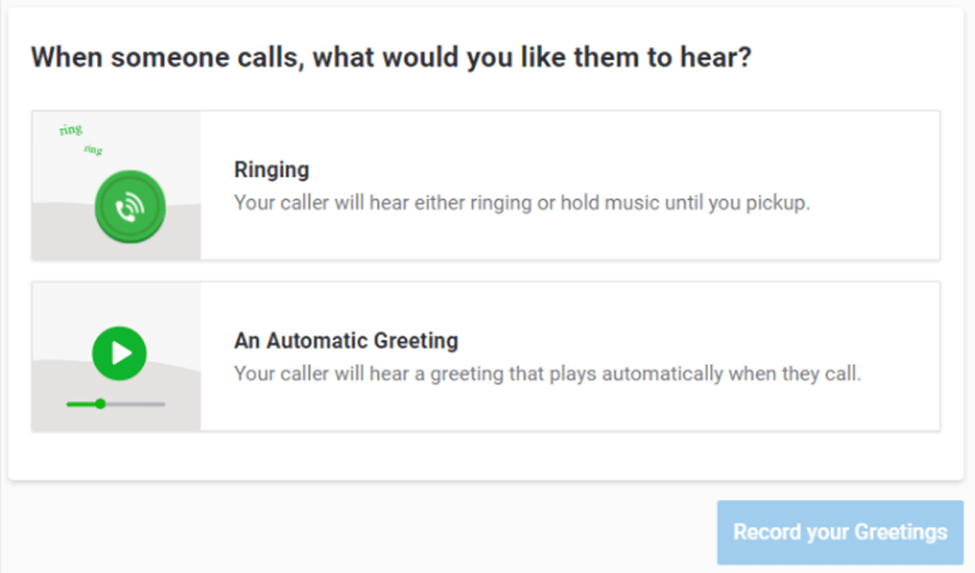

If it’s a simple orientation, consider creating a volunteer training program online. Volunteers can complete the orientation in their own time at home, and then they’ll be prepared to get to work with your organization when they show up for their first day.

Also consider the topic for employees: Employee Orientation Programs

Also consider the topic for employees: Training Basics for Supervisors and Learners

Supervising Volunteers (Retaining, Feedback and Motivation, Evaluating, Rewarding, and Firing Volunteers)

Supervision includes a variety of activities, e.g., establishing goals with the volunteer, observing the volunteer’s activities to achieve the goals, and providing guidance so the volunteer achieves

the goals effectively and efficiently (i.e., has strong “performance”), evaluate the volunteer’s performance, reward strong performance, address any performance issues, and fire the volunteer, if necessary. Some supervisors are also closely involved in staffing analysis, development of job descriptions, recruiting, selecting, orienting, and training, as well.

The activities to establish goals and provide guidance are usually considered to be the activities

of delegation. If the goals are specifically assigned to the volunteer, with little or no involvement from the volunteer, and the supervisor closely watches the volunteer (rather than generally guides them) and provides specific directions, then those activities might more aptly be described as work directing, rather than delegating.

Supervision and Delegation

- Supporting, Recognizing and Challenging Volunteers

- Seven Steps to Effective Volunteer Support

- How to Effectively Manage Volunteers

- Management and Supervision

- Strategies for Dealing with Unreliable Volunteers

- Setting Goals for Your Volunteer Program

- 5 Critical Questions for Your High Performing Team of Volunteers or Employees

Also consider the topic for employees: Delegating

Also, consider the topic for employees: Establishing Performance Goals

Retaining Volunteers

- Volunteer Retention

- Volunteer Management Practices and Retention of Volunteers

- Volunteers, Part I: What Makes them Stay?

- Volunteers, Part II: What Makes them Leave?

Also, consider the topic for employees: Retaining Employees

Giving Feedback and Motivating

Also consider the topic for employees: Observation and Feedback

Also consider the topic for employees: Coaching

Also consider the topic for employees: Morale (Boosting)

Also consider the topic for employees: Motivating

Evaluating

Also consider the topic for employees: Evaluating Performance

Rewarding

Also consider the topic for employees: Rewarding Performance

Addressing Performance Issues

Also consider the topic for employees: Performance Plans

Also consider the topic for employees: Recognizing Performance Problems (“Performance Gaps”)

Also consider the topic for employees: Performance Improvement / Development Plans

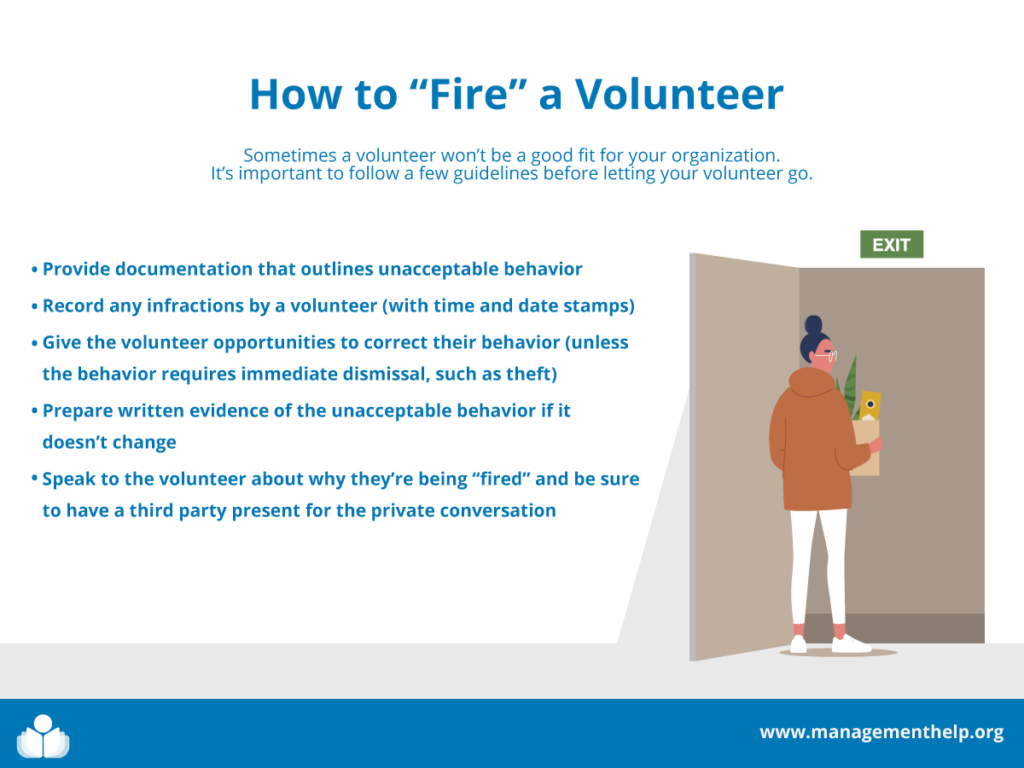

Firing

- When and How to Fire a Nonprofit Volunteer

- How and When to Let a Volunteer Go

- Dealing with Difficult Volunteers

Also consider the topic for employees: Firing Employees

Volunteer and Staff Relations

Sometimes employees and volunteers can perceive themselves to be so different from each other that they spend little time together, don’t communicate with each other, and eventually experience conflict between each other.

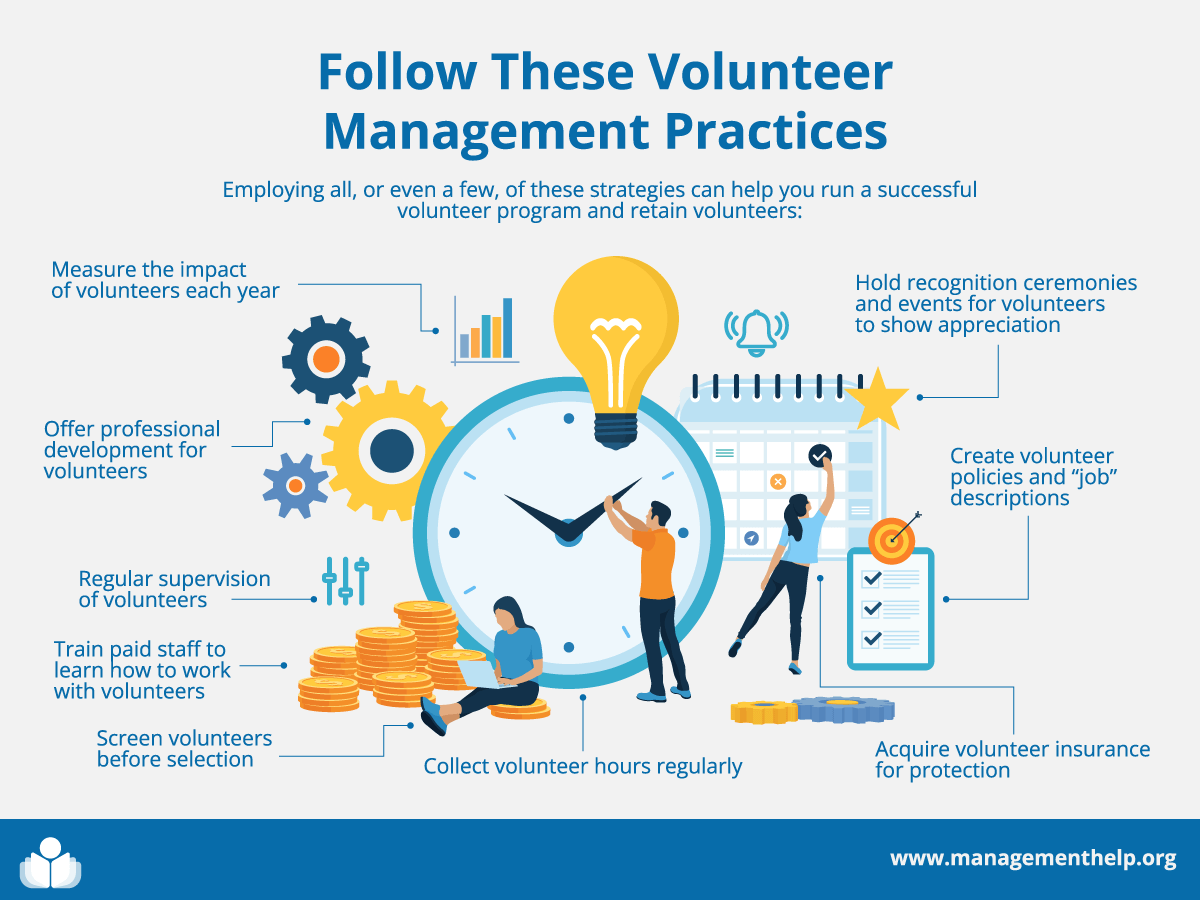

Assessing Volunteer Management Programs

To ensure that the volunteer management system remains high-quality, including that the organization and its volunteers are benefiting a great deal from their relationship, it’s necessary to regularly assess the quality of each activity (eg, developing job descriptions, recruiting, training, supervising, etc.) to conclude if the activity is being conducted effectively and efficiently. Results of this overall evaluation should be used to adjust activities. Thus, the cycle of the volunteer management system starts over again.

Virtual Volunteering

Virtual volunteering is when the volunteer provides their donated services entirely over the internet or from a home computer. Information about virtual volunteering can be about the entire range of activities in a volunteer management system.

- Virtual Volunteering Research

- Virtual Volunteering Guidebook

- Wikipedia entry regarding Virtual Volunteering

General Resources

- Susan Ellis’ comprehensive Volunteer Management Library

- Ellis’ extensive list of general resources

- International Center for Volunteer Effort

- VolResource

- Volunteers of America

- Points of Light Foundation

- Innovations in International Youth Volunteering

For the Category of Human Resources:

To round out your knowledge of this Library topic, you may want to review some related topics, available from the link below. Each of the related topics includes free, online resources. Also, scan the Recommended Books listed below. They have been selected for their relevance and highly practical nature.

© Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC.

Adapted from the Field Guide to Leadership and Supervision in Business

and Field Guide to Leadership and Supervision for Nonprofit Staff.