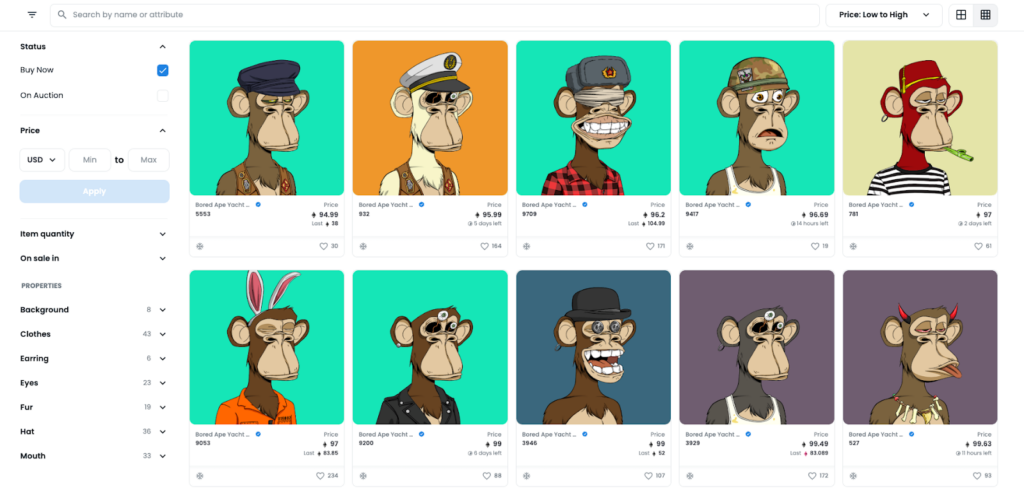

The first iterations of cryptocurrency appeared online in 2009, but the trend erupted in popularity several years later, as Bitcoin became a viable financial asset. The ascent of cryptocurrency intersected with the virality of memes when Dogecoin appeared on the market in 2013, introducing the world to one of the best meme coins.

Though they began as a joke, meme coins are now some of the most valuable, and fast-growing cryptocurrencies available. Find out which meme coins are best, and the best crypto exchanges where you can buy them.

6 Best Meme Coins

- Dogecoin: Best Overall

- Shiba Inu: Best Long-Term Investment

- Safemoon: Best for Exclusivity

- GamingDoge: Best for Community

- Akita Inu: Best for Sustainability

- Samoyedcoin: Best for Efficiency

Top 6 Meme Coins Comparison

Meme Coins

Accessibility

Value and Stability

Future Potential

Dogecoin is the most widely available meme coin.

Dogecoin typically boasts the highest and most stable valuation of any meme coin.

Dogecoin is the meme coin most likely to yield lucrative returns.

Shiba Inu is available on ShibaSwap, Coinbase, Binance, Kraken, and eToro.

Shiba Inu is second only to Dogecoin in terms of value and stability.

Shiba Inu is the best meme coin for staking your investment.

Safemoon is available on PancakeSwap and Binance.

Safemoon has been volatile thus far in both its valuation and its stability.

Safemoon doesn’t have a clear purpose or appeal beyond its exclusivity.

GamingDoge is available in PancakeSwap and Binance.

GamingDoge’s value and stability are not particularly volatile, but it’s too new to predict its potential.

GamingDoge is great for crypto investors who are dedicated gamers, too.

Akita Inu

Akita Inu will be available on its own decentralized exchange. It can also be bought via Binance, or indirectly on Coinbase.

Akita Inu is too new to make predictions about its value or stability.

Akita Inu’s pledge to carbon neutrality is great, but it does not necessarily translate to success for investors.

Samoyedcoin is available on its own decentralized exchange, but it has limited availability elsewhere.

Samoyedcoin has maintained a comparatively low value, despite major fluctuations.

Samoyedcoin’s use of the Solana blockchain makes it unique, and may set it up for future success.

Why Dogecoin Is Best Overall Meme Coin

Dogecoin is the original meme coin, and as the first of its kind, it’s also become the best. This is largely due to its strong foundation of backing tech. It utilizes the Scrypt algorithm to generate hash cryptography, and it draws on coding from Bitcoin to make it more secure.

Despite the currency’s origin as a joke, these features point to serious potential on the crypto market — and right now, it’s poised to exceed its potential.

Accessibility

When Dogecoin emerged, it was intended as a parody of Bitcoin, but its real potential became clear as its meme-ified facade drew buyers in. Indeed, Dogecoin has been called “the people’s crypto,” and it’s the most accessible of all the meme coins. It’s available to buy, sell, and trade on all major crypto platforms, such as Coinbase, Binance, Kraken, and eToro.

Stability

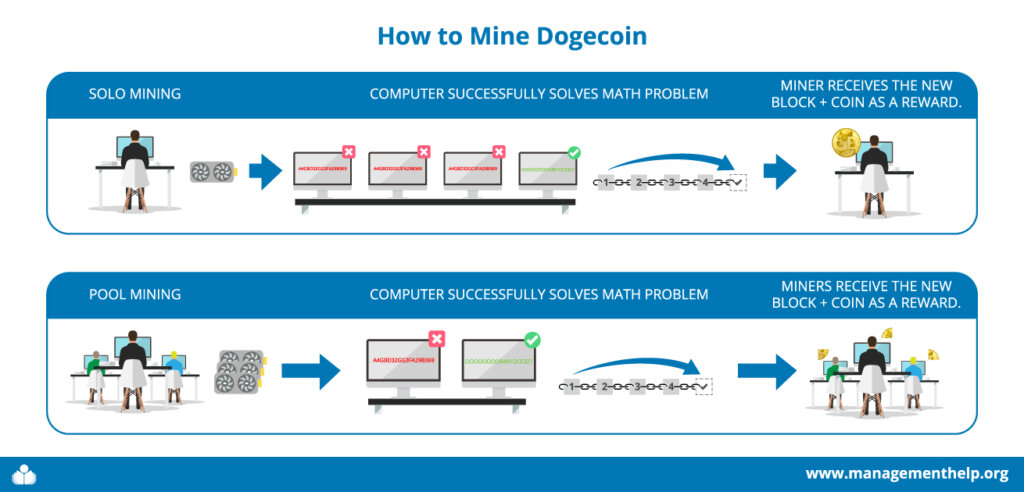

Its greatest weakness — and strength, some would say — is the unlimited Dogecoin mining capacity that users can exploit. This contributes to its accessibility, but it’s not beneficial to its overall stability. Indeed, it makes the currency vulnerable to massive inflation from so-called pump-and-dump schemes.

This happens when buyers invest in a large quantity of a currency in order to artificially increase its price, and then immediately sell in order to make a profit. Despite this, it’s remained relatively stable, thanks to many buyers who have held their investments long-term.

Value

Dogecoin’s value has fluctuated widely since its introduction, but it boasts one of the highest values of all the meme coins, indicating that it’s a good investment for potential growth.

Community

The Dogecoin community is known to be one of the most welcoming and newbie-friendly. Unlike many other cryptocurrency communities, it doesn’t take itself too seriously, and it encourages investors of all experience levels to get involved.

Anybody who’s new to trading crypto can find support and guidance from the Dogecoin community. Its only downside is that it’s smaller than many other crypto communities, meaning there may be fewer resources available.

Security

Dogecoin piggybacked off of many features of Bitcoin, including its robust security network and its maintenance of a dedicated blockchain. Its digital ledger is regularly updated, too, so that all transactions are unique and secure. Some users say that it’s second only to Bitcoin in terms of security.

- Recognizable “brand name” meme coin

- Community is constantly growing

- Can be traded via decentralized exchanges

- Coded similarly to Bitcoin, so it’s familiar

- No limits imposed on mining practices

- No mining limits, so no scarcity

- Technical support is lacking

- Not ideal for completing transactions

Why Shiba Inu Is the Best Long-Term Investment

Shiba Inu coin emerged in 2020 as the so-called Dogekiller because of its apparent aspiration to displace Dogecoin as the top meme coin. It hasn’t done that yet — or even come close — but that doesn’t mean it isn’t still a valuable investment.

In fact, it’s one of the best investments for those interested in long-term gains. Soon after its inception, strategists took note of several unique features that may make it the best meme coin for long-term staking and holding.

Accessibility

Like its predecessor and inspiration Dogecoin, Shiba Inu coin is a highly-accessible cryptocurrency. In addition to its availability on the internal ShibaSwap decentralized exchange, users can access the coin through Coinbase, Binance, Kraken, and eToro.

Each of these platforms has its own minimum purchase amount, though, so users should research their options before buying.

Stability

Yet another important feature of the Shiba Inu coin is its stability. Given the newness of the currency and its consistently low price — one coin has yet to hit $.01 in value — it’s demonstrated a remarkable resilience to inflation. This is largely due to the limits that are placed on the coin. Unlike its competitor, Dogecoin, the Shiba Inu coin’s supply is finite which makes it a deflationary cryptocurrency.

Users can mine a supply of just one quadrillion tokens, and there are currently only 550 trillion of those in circulation. This means that there is still plenty of work to be done in mining the rest of the supply; the Shiba Inu coin is likely to remain relatively stable in the meantime.

This stability — and the rewards users can earn for staking — make it the best long-term investment. Staking happens when users buy coins and lock them away to earn interest or garner a reward. Shiba Inu rewards stakers with 3% to 5% APR returns, making it a great option for those seeking a viable investment out of their meme coin.

Value

Unfortunately, Shiba Inu coin can’t compete with Dogecoin where it matters most — value. Despite all of its benefits, this meme coin has yet to break even $.01 per token in value. This means that users have to buy massive quantities to see meaningful returns, but it also means that it’s an accessible option for beginner investors.

Community

Shiba Inu has boasted a small, yet strong community since it was first introduced. Its proponents are vocal, and its internal platform is an easy-to-navigate home base. This community is arguably even stronger than that of Dogecoin, but it is smaller, making it less resourceful than the communities surrounding other cryptocurrencies and meme coins.

Security

Shiba Inu coin is a modulation of the ERC-20 token, meaning that it’s based on the popular Ethereum ecosystem. This lends the coin an ample security framework, and its blockchain is just as secure as the token itself. Its use of smart contracts further allows the coin to be used safely in conjunction with decentralized applications.

- Fixed supply protects from inflation

- Three different tokens in the ecosystem

- Users can gain rewards for staking

- Highly liquid, so it’s easily transacted

- Consistently low price and low value

- Low price may make it more volatile

- Considered a lesser knockoff of Dogecoin

Why Safemoon Is Best for Exclusivity

Cryptocurrency enthusiasts often fall into one of two camps — those who want to educate people, and those who want to gatekeep their success. Users who are in the latter category may be drawn to the exclusivity of Safemoon.

With its mysterious background and indistinguishable purpose, buying Safemoon tokens may feel like joining a secret club. It’s no secret, though, and there’s a lot more you should know about where Safemoon is headed.

Accessibility

Despite the air of exclusivity that Safemoon gives off, it’s not entirely inaccessible. In fact, because it’s processed on the Binance Smart Chain, it may even be easier to buy than some other tokens.

Users who want to buy Safemoon can do so via the project’s own decentralized exchange, PancakeSwap, as well as on Binance, but it’s currently not available on Coinbase, Kraken, or eToro.

Stability

One of the biggest risks associated with Safemoon is its questionable stability, which is one of the cons of all cryptocurrencies. It’s yet to be seen how well the currency will retain its value. Its history so far, though, indicates that it may be susceptible to pump-and-dump fluctuations.

This, of course, is both a benefit and a liability. Those users who get in on a massive rush can stand to make enormous profits, but those who don’t will be stuck with considerable losses. Safemoon may be too vulnerable to inflation to maintain its stability.

Value

Much like its stability, the long-term value of Safemoon can’t be determined yet, but there is some indication that it may be lower than other meme coins’. Many users have questioned the utility of the coin — and whether it has any clear purpose — which has led its value to flounder, when it’s not in the midst of a major spike.

Community

A Safemoon community certainly exists, but it’s not known as the most welcoming or resourceful within the crypto world. In fact, it reinforces the coin’s reputation as an exclusive token. Safemoon investors are incentivized to hold their tokens for long periods, and this can contribute to a lack of newcomers joining the community.

Security

Safemoon runs on the Binance platform, and utilizes a centralized blockchain to generate its tokens. This means that users will need to trust Binance — but luckily, there’s no reason not to. In fact, this feature may make it more secure than other offerings.

- Potential for massive profits

- Plans for positive social impact

- Educational resources available

- Creators regularly burn tokens

- No truly unique function

- Class-action lawsuit pending

- Allegations of internal fraud

Why GamingDoge Is Best for Community

There’s not much known about the soon-to-be-fully-launched GamingDoge coin. It’s an altcoin based on Dogecoin, of course, but it’s not yet popular enough to warrant much more information. That said, everything that is known highlights one standout feature — a focus on community.

The creators of the coin say, in fact, that they “want to make [the] Doge community and Gamers proud,” and it looks like they will. If the meme coin’s social media following is any indication, its community is already thriving.

Accessibility

GamingDoge coin can currently only be bought in two places — the PancakeSwap platform, and directly from Binance. This makes its accessibility somewhat lacking, compared to coins that can be bought on Coinbase, Kraken, or eToro — but it’s still easy enough to find, if you want to get your hands on some tokens.

Stability

GamingDoge was launched at the very end of 2021, and it’s still not fully up and running with the community and features that its creators have planned. For this reason, it’s hard to rate its stability — there just isn’t enough information. Investors should keep an eye out for signs of inflation.

Value

GamingDoge’s value is pretty low, but that’s what you’d expect from a brand-new meme coin that hasn’t fully launched yet. Investors shouldn’t be alarmed by the low conversion rate. There’s plenty of potential for its value to grow once it becomes a more established currency on the crypto market.

Community

Community is where GamingDoge truly shines. Its creators made this the central focus of the coin by providing investors with a self-contained ecosystem that supports gaming as much as it supports tokens.

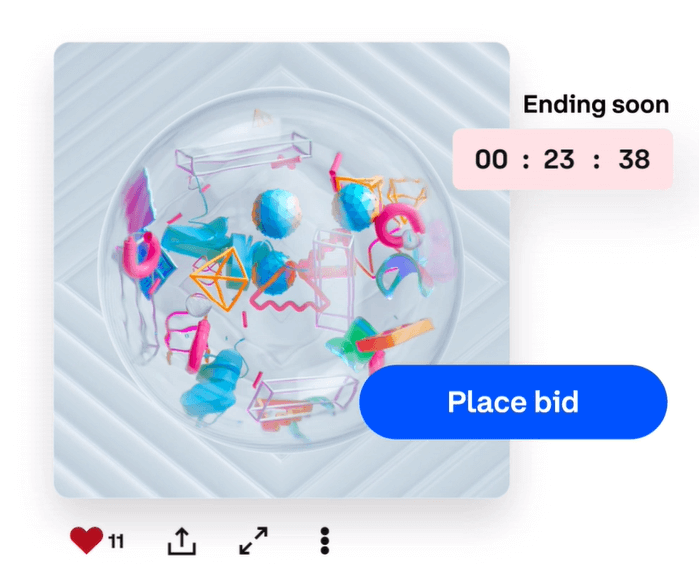

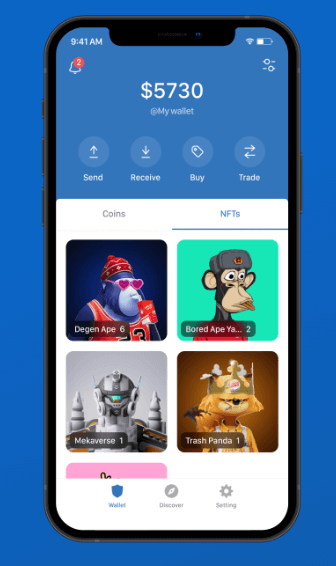

The ultimate goal of the community is the development of proprietary, crypto-based video games that will allow users to win NFTs and tokens in exchange for playing. This is a promising frontier for any token to enter, and if there’s any chance of success, it will likely be guided by GamingDoge.

Security

GamingDoge is based on the Binance blockchain, and, like Safemoon, employs a centralized system for mining. Its security isn’t as robust as more established cryptocurrencies, but there are no known security issues at this point, either.

- Focus on improving its community

- Ecosystem built on decentralized exchange

- Plans to integrate with NFT marketplace

- Not yet fully launched

- Little information available

- Not widely available yet

Why Akita Inu Is Best for Sustainability

Akita Inu is one of several altcoins that followed Dogecoin, and each has seemingly lost a portion of its novelty as the meme-coin format becomes increasingly mainstream. Akita Inu has found a way to revitalize this appeal by emerging as the first meme coin committed to carbon neutrality.

Indeed, the elimination of carbon emissions is the hallmark of its Algorand blockchain basis. This makes it the obvious choice for the most sustainable meme coin.

Accessibility

Akita Inu can be indirectly bought on Coinbase, directly on Binance, or via its own platform — but otherwise, it’s difficult to find. You won’t find tokens on top sources, such as Kraken or eToro.

Stability

Because it’s so new and still not widely accessible, it’s difficult to assess the stability of Akita Inu. It’s comparatively stable to other new meme coins, though, with its short history indicating both spikes and lulls.

Value

Akita Inu’s pledge to animal welfare and environmentalism understandably won the hearts of many investors. As a result, its value started off higher than what many other introductory meme coins could achieve. This value has not necessarily grown exponentially, though — and it’s still ultimately very low, compared to the rest of the crypto market.

Community

The Akita Inu community is united by its love of dogs and its passion for the environment. Unsurprisingly, a community with these shared values is remarkably strong.

It may be the most passionate meme coin community, but it’s not big enough to rival the likes of GamingDoge and other community-based coins. That may change in the near future, though, as Akita Inu continues to gain traction.

Security

Akita Inu’s security is comparable to any other meme coin, and is perhaps even marginally better. It’s based on the Algorand blockchain, which claims to have better cryptographic tech and security features than some of the other most popular platforms.

- Built on Algorand blockchain

- Community is completely decentralized

- Some proceeds go to animal-welfare charities

- Carbon neutrality

- Low fees

- Charity work is the main appeal

- Not necessarily a lucrative option for investors

- Too new to have much data about

Why Samoyedcoin Is Best for Efficiency

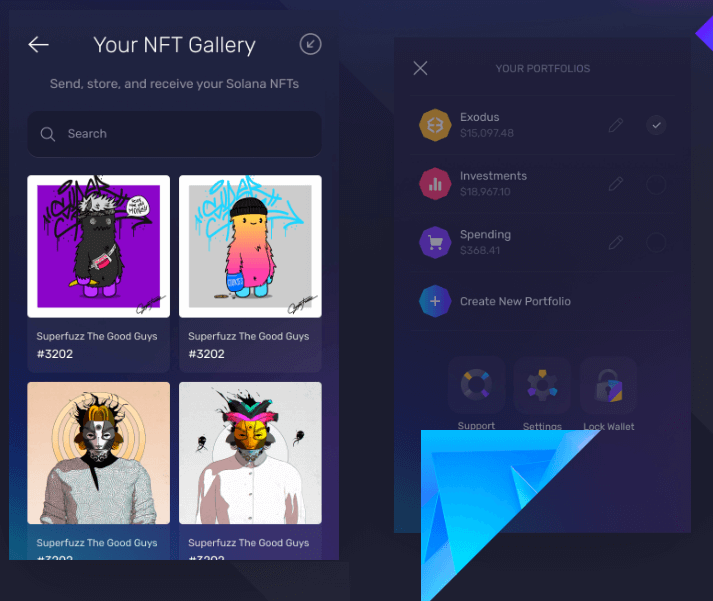

Samoyedcoin became the proprietary meme coin of blockchain Solana when it launched in mid-2021, and quickly became one of the network’s most successful launches to date. It mimicked the format and structure of similar meme coins, but, like Akita Inu, offered a series of altruistic pledges to draw in buyers.

Among these was a commitment to eco-friendly initiatives, as well as a partnership with animal-welfare charities. The most important feature of Samoyedcoin, though, is its claim to be the fastest-transacting dog coin on the crypto market. Samoyed is incredibly efficient, thanks to its utilization of the Solana network.

Accessibility

Samoyedcoin is available on both centralized exchange platforms and smaller, decentralized exchange platforms. This versatility gives buyers the advantage of choice, but it’s still not a widely-available coin. You won’t find it on Coinbase, Binance, Kraken, or eToro, but you have a better chance on crypto exchanges with the most coins.

Stability

One of the greatest vulnerabilities of Samoyedcoin thus far is its relative instability in terms of valuation. Upon its release, it achieved a higher-than-average initial value, but this has since fluctuated widely, making it difficult to predict the future of the coin.

Value

Despite an unpredictable valuation, Samoyedcoin offers a viable investment for anybody seeking an incredibly affordable entry into meme coins. Its volatile value may be scary for some investors, but it offers an opportunity to hit a home run if the conditions are right.

Prices are low enough to justify a low-stakes investment, and the potential is good enough to make it worthwhile.

Community

Samoyedcoin has a strong community, like many other meme coins based on idealistic goals. Its users are committed to animal welfare and environmentalism, just as the coin’s creators are.

If these causes don’t speak to you, though, that’s okay — there’s still room in the Samoyedcoin community. Users take pride in welcoming new members, sharing crypto tips, and providing guidance for investments.

Security

Like any other blockchain, Solana is vulnerable to certain compromises, but it’s been compromised more than some of its competitors. This could be a problem for Samoyedcoin in the future, but right now, there haven’t been any notable breaches to speak of.

- Built on Solana blockchain

- Designed to be highly scalable

- Available on centralized and decentralized exchange platforms

- Claims to offer the fastest transaction speeds

- Appeal is mostly based on its novelty

- Insufficient data available, due to newness

- Valuation has been highly volatile

How We Chose the Best Meme Coins

Choosing the best meme coins was difficult, but we carefully considered a wide range of factors before making our selections. Some of the various criteria that were brought into account include the following:

- The general history of each coin

- How widely available it is

- The strength of its blockchain

- Overall quality of its community

- Potential for future growth

- Ability to withstand fluctuations

- Association with special causes

These features were all considered carefully in relation to each entry on this list. Those meme coins that satisfied multiple criteria were selected as the best meme coins on the crypto market.

Best Meme Coins Buying Guide

Since the introduction of Dogecoin, the crypto world has been inundated with a wave of copycats seeking to recreate its success. Some of these are successful, and others have proven to be a fluke. The six meme coins contained on this list fall into the former category, though.

With unique features, robust security, and strong potential returns, you can feel good about exploring crypto investments with any of these meme coins. If you still have questions, though, check out the following FAQs for some answers.

Can You Make Money off of Meme Coins?

Yes, absolutely! Many people have seen substantial returns from investing in meme coins. Of course, the opposite is also true, so you should be careful about investing any sum of money that you would be uncomfortable losing. Investing in meme coins is a lot like gambling.

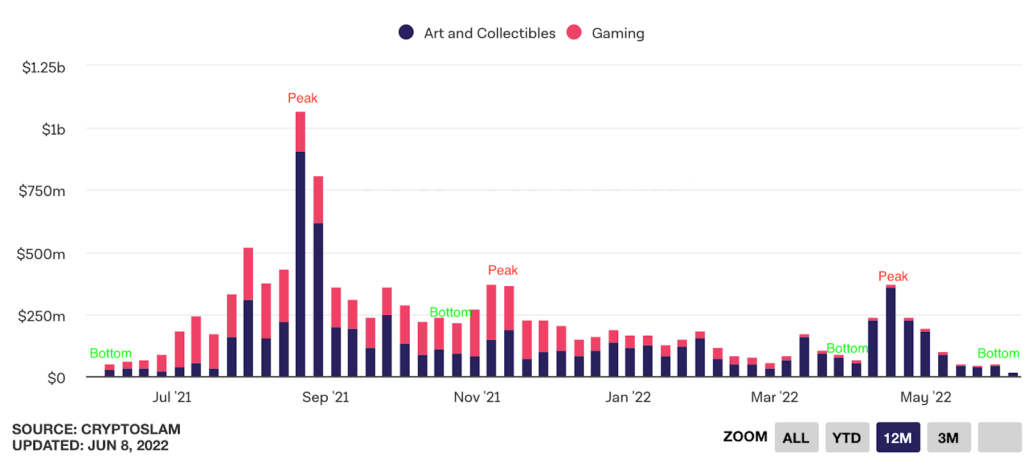

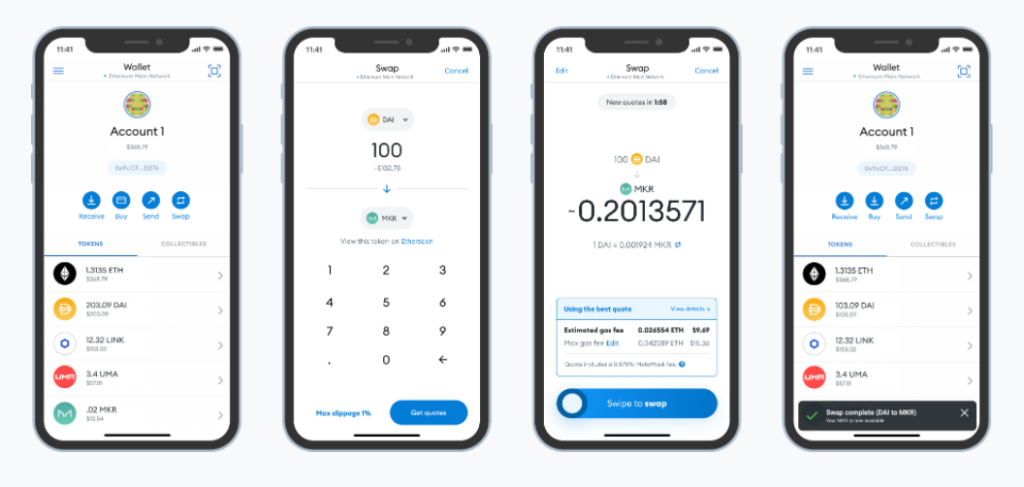

How Do Meme Coins Work?

Meme coins work essentially the same as any other kind of cryptocurrency. The primary difference is that they typically aren’t designed for use in commercial transactions and exist solely to be bought, sold, and traded within the crypto community. Because of this, they tend to be more volatile, but profits may also be higher.

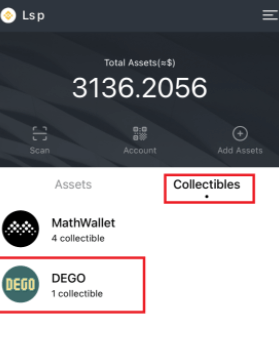

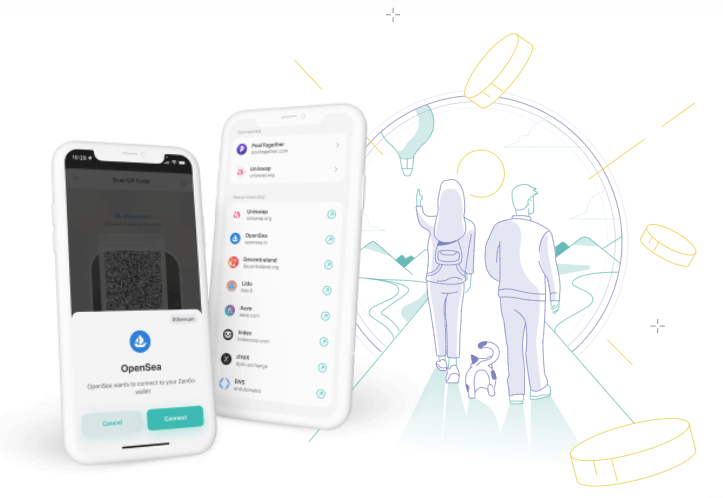

Meme coins can be obtained through centralized exchange platforms, which are typically managed by the blockchain provider, or decentralized exchange platforms, which are usually based on peer-to-peer transactions.

What Is the Best Meme Coin for Investors?

The best meme coin for investors depends on what kind of investor you are. You may get bigger returns from a meme coin that’s more unpredictable, but generally, the best bet is the most stable, and that’s the original Dogecoin.

Do Meme Coins Have an Unlimited Supply?

When they were first introduced, meme coins were notable for their unlimited supply of tokens. This is no longer standard, though, with meme coins such as Shiba Inu intentionally capping their supply. Shiba Inu also incentivizes users to burn their supply, so that the value is driven up further.

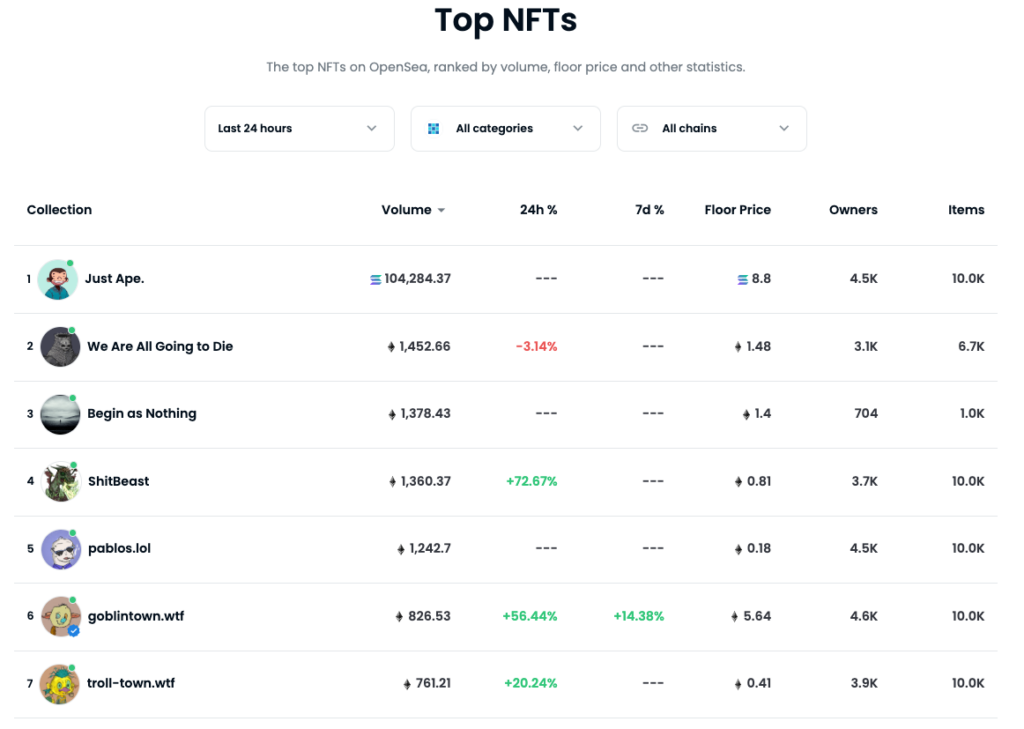

Where Do I Buy, Sell, or Trade Meme Coins?

There are many platforms you can choose from to buy, sell, or trade your meme coins. One of the first was Coinbase, which offers an array of resources to new and experienced buyers alike. Other platforms, such as Binance, Kraken, and eToro, offer attractive benefits and an array of meme coins to choose from, too.

How Do I Choose the Best Meme Coin for Me?

Choosing the best meme coin is a matter of priority. If you’re enticed by the idea of investing in tokens that allow a portion of proceeds to fund animal welfare, then Akita Inu or Samoyedcoin is the coin for you. Conversely, if you want to invest in the safest option on the market, Dogecoin is likely the best.

What the Best Meme Coins May Be the Future

Meme coins started off as a joke intended to subtly mock cryptocurrencies like Bitcoin. The joke is over, though, now that these currencies have become a substantial part of the crypto market themselves. If you’re looking for the best meme coins, any selection on this list will offer a promising entry into the world of crypto.