Although you are allowed to use a personal bank account for your business, creating a sole proprietorship account is highly recommended. A dedicated business bank account offers tax incentives, accurate recordkeeping, and improved business credibility. This guide covers why you should never mingle your personal and business funds together.

What is a Sole Proprietorship Bank Account?

If you’re a freelancer or a small business owner with a sole proprietorship, it’s not legally required for you to create a business bank account. Thus, you can legally use your personal bank account to run your business.

However, using your personal bank account is risky and inefficient. Even for sole proprietors, the IRS recommends creating separate personal and business bank accounts.

A sole proprietorship bank account is a separate bank account used to manage your business’s finances. It’s used to pay your suppliers and employees as well as receive payments from your customers. It also allows you to apply for small business loans.

Even if your business is completely new and doesn’t have any sales yet, it’s a good idea to create a dedicated business bank account immediately.

Unless you’re willing to keep meticulous records of your business transactions within your personal bank account, you need a sole proprietorship bank account. In fact, it’s suggested that you should open a business bank account even if your sole proprietorship is a side hustle or hobby.

Business Checking vs Personal Checking Account: What’s the Difference?

Personal and business bank accounts offer features such as debit cards and check writing. However, business checking accounts include an additional set of features to empower your business for future growth.

These tools help your business operate more efficiently. Let’s take a closer look at the key differences.

Features

Business Bank Account

Personal Bank Account

Check writing

Debit cards

Debit cards for employees

Payroll processing services

Bookkeeping integrations

Financial advisory services

Accurate expense and revenue tracking

Why is it Important to Create a Sole Proprietorship Bank Account?

After creating a sole proprietorship, your first task is to open a business checking account. If you combine your business and personal finances into one bank account, keeping accurate records would be challenging.

So let’s take a closer look into why you need a sole proprietorship bank account.

Tax Benefits

Separate personal and business bank accounts help with sorting out your expenses when tax season rolls around. It’s crucial to create a clear distinction between personal expenses and business-related ones to avoid tax penalties from the IRS.

A sole proprietorship bank account sets an unmistakable line between your business and personal finances. When it’s time to pay taxes, you’ll be able to see a comprehensive record of your business expenses. However, if your business expenses are mixed with your personal expenses, it will be a major inconvenience if you get audited by the IRS.

Tax penalties are a significant headache for anyone, and a dedicated sole proprietorship bank account ensures accurate tax keeping.

Accurate Bookkeeping & Analytics

Using a sole proprietorship bank account ensures accurate bookkeeping. By keeping your personal and business finances separate, you can easily identify your business’s performance. Therefore, a business bank account allows a better financial understanding of your sole proprietorship to empower future growth initiatives and optimizations.

Having a clear view of your business’s revenue and expenses is essential as you’re trying to expand your sole proprietorship. As your business continues to grow, the complexity and volume of your business dealings will also grow.

Keeping track of your books will become nearly impossible if you combine and use your personal bank account for your sole proprietorship.

Business Credibility

Creating a sole proprietorship bank account also boosts your business credibility. Rather than charging payments to a bank account labeled with your name, you can use your company’s name after opening a business bank account.

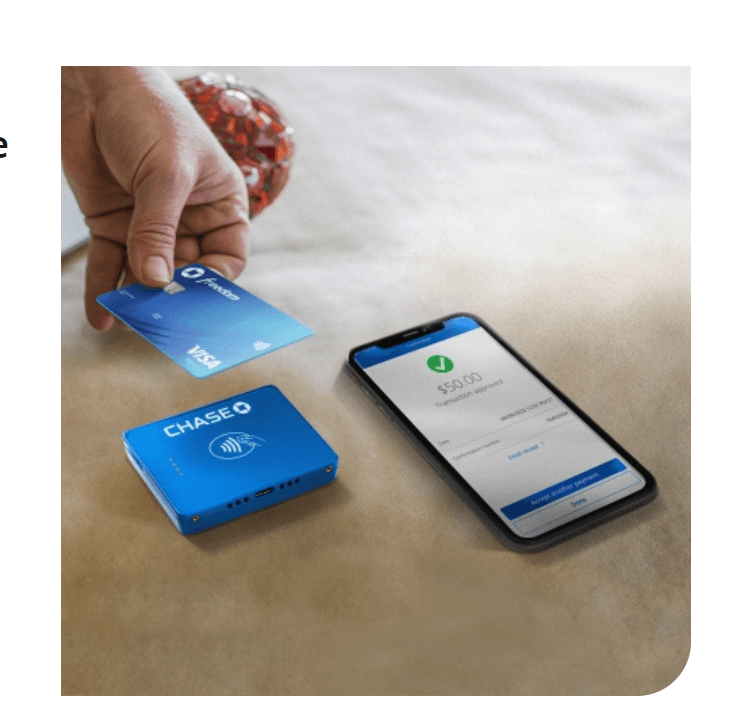

Image and branding are vital in the modern competitive digital age, and business bank accounts improve the legitimacy of your sole proprietorship. Additionally, a business bank account allows you to affordably accept credit card payments from your customers.

You can’t accept such payments through your personal bank account unless you use a payment service provider. This is suboptimal because payment service providers take a hefty pay cut as a transaction fee. On the other hand, being able to accept all forms of payment increases your chances of getting sales and appearing more professional.

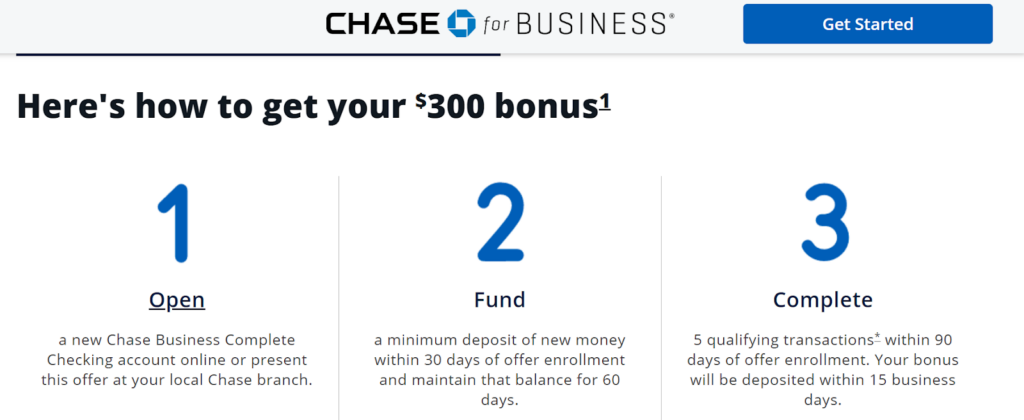

Best Banks for Sole Proprietorship Bank Account

Most banks offer business checking accounts for sole proprietors. To find the best one for your business, you need to consider a few factors.

These factors include:

- Cash deposit limits: Your bank might limit the amount of cash you are allowed to deposit into your business bank account for free each statement cycle. If your business primarily deals in cash, we recommend finding a bank account with a high cash deposit limit.

- Transaction limits: Your bank may also limit the number of transactions you can process for free each billing cycle. These transactions include ATM deposits, teller deposits, checks, and electronic debits and credits. The standard limit for most sole proprietorship bank accounts is 200 transactions. However, it varies from bank to bank.

- Fees: Business bank accounts typically have monthly maintenance fees. However, some banks waive the monthly fees if you meet certain requirements like a minimum account balance.

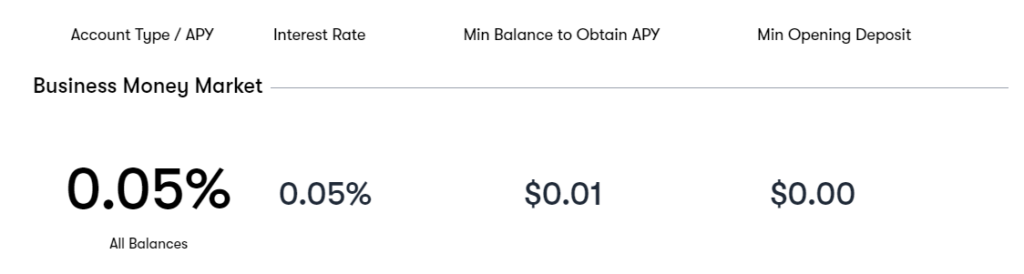

- Interest: Some business checking accounts pay interest on your balance, allowing you to earn more money each month.

Here are the best bank accounts for small businesses and sole proprietorships:

BlueVine is a digital banking solution that offers no monthly fees, no minimum balances, and unlimited transactions. In theory, this is the perfect sole proprietorship bank account. The main drawback is that there are no brick-and-mortar locations. However, you can still deposit cash and checks and Green Dot locations.

There are no minimum deposits with BlueVine, and you can earn up to 1.5% APY on balances up to $100,000.

Novo is another simple but robust business checking account provider. Similar to BlueVine, Novo is a digital banking solution that offers a simple online application process, no hidden fees, and free ACH transfers, mailed checks, and incoming wires.

Furthermore, Novo offers FDIC insurance through Middlesex Federal Savings and refunds on all ATM fees. You also get a virtual card immediately, which you can use for secure spending. However, where Novo truly thrives is through its comprehensive mobile app. You can pay bills, transfer money, and request invoices within seconds in the mobile app.

Axos is another virtual bank that offers business loans, checking accounts, and savings accounts. There are two small business checking accounts you can choose from, Basic Business Checking or Business Interest Checking. The Business Interest Checking account offers 1.01% APY on account balances up to $50,000.

The Basic Business Checking account does not have an initial deposit requirement, minimum balance requirement, or monthly maintenance fees. You also get your first set of 50 checks for free and unlimited domestic ATM fee reimbursements.

Getting a Loan as a Sole Proprietorship

If you’re interested in receiving a business loan or financing in the future, you’ll likely need a business bank account. Lenders require your sole proprietorship to have a business bank account to verify your business’s cash flow. If they can’t verify your business’s financials, you won’t be eligible to receive a loan.

The main goal of a lender is to ensure you have the needed cash flow or growth projections to pay back the loan.

The best small business loans are provided by:

- BlueVine

- SmartBiz

- Kabbage

- TD Bank

- Biz2Credit

These lenders offer high credit limits, low-interest rates, and variable repayment periods. Furthermore, these lenders have a fast and easy online application process in which you can get approved the same day.

However, small business loan lenders may require some qualities on your end. For example, to apply for a BlueVine small business loan, you need a FICO score of at least 600, be in business for at least six months, and have a minimum of $10,000 in monthly revenue.

How to Get a Sole Proprietorship Bank Account

It’s easy for sole proprietors to open a business bank account. Many banks allow you to apply online. All you need to provide is the proper documentation. However, requirements vary from bank to bank. So, we recommend contacting your bank to see what information you need to provide.

Generally, you’ll need to provide:

- Social Security Number (SSN) or Tax ID Number

- Driver’s license or passport

- Business address

- Type of business you own

- When the business was established

Sole proprietorship bank accounts don’t always require formal documentation since your business isn’t incorporated. If you operate your business under your own name, an SSN or Tax ID may be sufficient. You may also need to provide your driver’s license or passport, depending on the bank.

Your Employer Identification Number (EIN) is your SSN as a sole proprietor. As such, you can Open a Business Bank Account With EIN Only for your sole proprietorship using your SSN.

Suppose your sole proprietorship is operating under a DBA. In that case, the bank will ask for additional documents containing your name in relation to the business name and your Trade Certificate Name or Assumed Name Certification.

Frequently Asked Questions (FAQs) for Sole Proprietorship Bank Account

If you want to learn more about sole proprietorship bank accounts, here are a few common questions and answers.

Bottom Line on Sole Proprietorship Bank Account

While you aren’t legally required to create a business bank account for a sole proprietorship, we highly recommend it. Creating a sole proprietorship bank account lets you separate your business and personal finances. Therefore, it’s easier to keep your books clean and pay the correct amount of taxes.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.