Are you looking for a suitable financial institution for your business banking needs? With a range of online and traditional banks offering different interest rates, fees, and lending options, enter credit unions, making the choice much more complicated. We bring you the best banks and credit unions for small businesses to help you choose the right place to house your money.

Best Banks & Credit Unions of 2023

- Bluevine – Best Overall

- Axos Bank – Best Full-service Online Bank

- Alliant Credit Union – Best Overall Credit Union

- Consumers Credit Union – Best for Eligibility Requirements

- America First Credit Union – Best for Business Lending

- PenFed Credit Union – Best for Federal Insurance

- Capital One – Best for Unlimited Digital Transactions

- Wells Fargo – Best for Biggest Branch Network

- Bank of America – Best for Traditional Banking

We considered several different factors when evaluating the best banks and credit unions to create this list. These include fees, deposit and lending interest rates, lending options, and accessibility. Check out our complete methodology below for a closer look at how we pick the best financial institutions.

Financial Institution

Fees

Interest Rates

Lending

Features

Support

No monthly fee

Checking – up to 1.5%

Lines of credit up to $250K

Bill payment, unlimited transactions

Business hours phone support & email

No monthly fee

Interest Checking – up to 1.01%

SBA loans

Free cash deposits, unlimited ATM fee reimbursements

24/7 phone support

No monthly fee

- Checking – 0.25%

- Savings – 0.75%

Auto loans, mortgages

Extensive ATM network

24/7 phone support

No monthly fee

- Power Checking – 0.05%

- Money Market – up to 0.75%

Commercial mortgages, secured lines of credit, equipment financing

60,000 free ATM locations, competitive APY

24/7 live chat, business hours phone support

No monthly fee

- High-Yield Checking – 0.05%

- Savings – 0.05-0.15%

Lines of credit, SBA, term, & commercial vehicle loans

Wide range of lending options, 30,000+ free ATM locations

Business hours phone support & email

No monthly fee

- Access America Checking – up to 0.35%

- Savings – 0.15 to 0.75%

Only personal lending options

NCUA-insured, easy to join

Business hours phone support, 24/7 online support

Basic Checking – $15/month*

Savings – 0.2% APY

Lines of credit up to $5m

Unlimited digital transactions

Full-service support

Starting at $10/month*

Business Market Rate Savings – 0.01%

Lines of credit up to $500K, SBA loans

4900+ branches across the US

24/7 phone support

Starting at $16/month*

Savings – 0.01%

Lines of credit, loans, SBA loans

Integrated with Zelle money transfer, offers payroll services

Small business specialists, plus resources

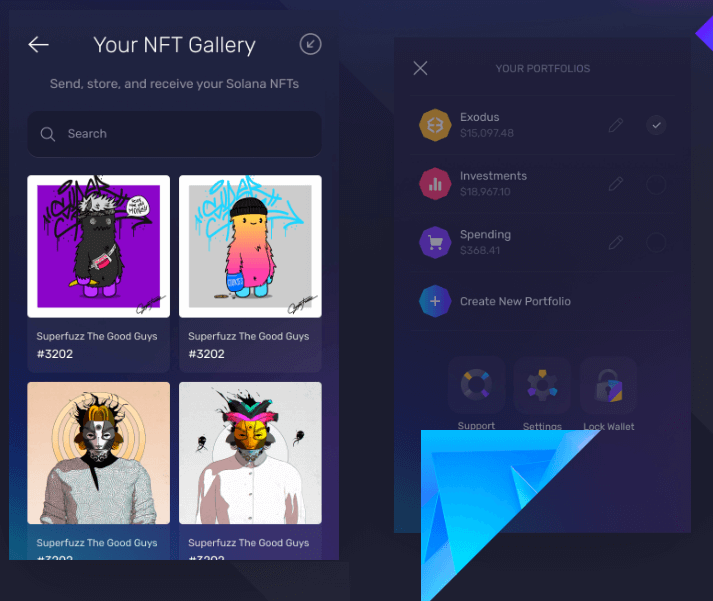

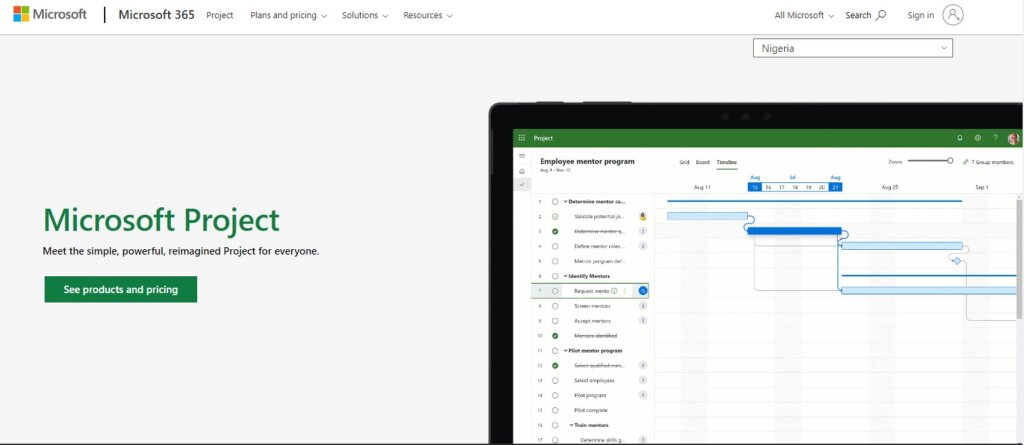

If you want a well-rounded business checking account that comes with very little limitations, Bluevine is one of the best fintech companies you can choose to bank with. Although it’s not a full-service bank, Bluevine offers all the services a business might avail of from a regular bank plus a wide range of benefits.

All Bluevine deposits are FDIC-insured which gives you peace of mind. Apart from no monthly fees, no transaction limits, and a very high APY, Bluevine also lets you pay all your bills online. However, note that Bluevine only has a checking account offering. It doesn’t offer savings accounts.

Why we chose it: With no monthly fees, a very lucrative interest rate, and no minimum balance requirements, Bluevine is our top pick for small business banks.

- No minimum deposit

- Unlimited transactions

- Two free checkbooks/year

- Virtual bank (through Coastal Community Bank).

- Only allow cash deposits through Green Dot Services

- No business savings accounts

Fees

Bluevine charges no monthly maintenance, NSF (non-sufficient funds), or overdraft fees, which go well beyond the industry standard. With unlimited transactions, you will never incur additional fees no matter how many transactions you initiate. It has no minimum deposit or minimum balance requirements either.

Interest Rates

Bluevine’s lucrative checking interest rate is one of its strongest selling points. You will rarely find another bank offering an APY as high as 1.5% on balances up to $100,000. Note that users must meet a monthly activity goal to avail of this.

Lending Options

Bluevine’s Business Loans offers business lines of credit of up to $250,000 on rates as low as 4.8%. The application process is fast and easy and you can have your application decision within five minutes.

One of the best free business banks, Axos Bank is a unique financial institution in that it’s a full-service bank in its own right but has no physical locations. You can only avail of its wide range of business banking and lending services online. It offers several types of business bank accounts including small business checking, savings, and money market accounts.

This online bank is a great choice if you often have to deposit cash into your business account. You can make free cash deposits from any one of the MoneyPass and AllPoint ATMs across the US.

Axos is an FDIC-insured bank which means it offers greater deposit protection than other non-FDIC-insured fintech companies. Being an online-only bank, Axos online and mobile banking is very easy to use. If you’re looking for a combination of banking services and want to keep your business banking digital, go for Axos.

Why we chose it: Axos is a full-service online bank and is a great option for any business that wants to bank online. With low fees, free cash deposits across MoneyPass and AllPoint locations, and a great online presence, it’s the best online bank on this guide.

- No monthly fee and unlimited transactions

- Cash deposits allowed via MoneyPass and AllPoint ATMs

- Wide range of interest-bearing options

- No physical locations

- Limited integrations

- Doesn’t offer the highest APY

Fees

Just like Bluevine, Axos Basic Business Checking has no monthly fee, but Business Interest Checking will cost you $10 per month. The basic Savings account has a monthly fee of $5 while its Premium version is free.

Interest Rates

Axos offers a range of interest-bearing accounts however the APYs it offers aren’t as high as some of the other competitors on this list. It can go up to 0.20% on Basic Business Checking and up to 1.01% on Business Interest Checking accounts. Axos’ Savings and Money Market options all offer 0.20% APY.

Lending Options

Axos Bank partners with Centerstone SBA Lending to offer SBA loans. They come with a federally backed guarantee and flexible terms. But that’s about it when it comes to lending options for small businesses. Axos offers commercial lines of credit and term loans but these work for large businesses only. Read the full Axos review to learn more about its lending options.

Alliant is a Chicago-based online credit union with more than 80,000 ATMs across the US. Joining the credit union is fairly straightforward. You can join it if you donate to Foster Care to Success, Alliant covers your $5 joining fee so you don’t have to pay the charity directly.

You can also join if you’re an employee, retiree, or member of select organizations, live in particular areas in Illinois, or are a relative of an existing Alliant member. While Alliant has a vast network of free ATMs, it will also reimburse up to $20 per month if you use out-of-network ATMs.

Note that Alliant has no physical branches and operates entirely digitally. Its mobile and online banking platforms are well-developed. Members can use a range of features with Alliant’s mobile app. The fact that Alliant provides no business-specific services may put you off, but you can still find a way around it to benefit your business from its low fees and high APYs.

Why we chose it: Alliant has one of the most extensive ATM networks when it comes to credit unions. Plus, its competitive APYs on checking and savings accounts make it a lucrative institution to bank with.

- Extensive ATM network

- High APYs

- Easy to join

- No special offerings for businesses

- No physical branches

- No lines of credit or SBA loans

Fees

Alliant Credit Union’s most business-relevant products, its High-Rate Savings, and High-Rate Checking accounts, have no monthly fee. The credit union also refunds up to $20 per month in ATM fees.

Interest Rates

You get one of the highest savings and checking account APYs with Alliant. High-Rate Savings let you earn up to 0.75% APY which is much higher than the savings rates offered by any bank. High-Rate Checking has an APY of 0.25% which comes with minimal or no fees.

Lending Options

Alliant Credit Union offers no business-specific lending options like lines of credit or SBA loans. However, you can still find auto loans and mortgages.

Consumers Credit Union has more than 15 branches in and around Chicago and Illinois, and access to more than 5600 shared branches and 60,000 free ATMs via the Co-op network. The credit union offers different types of business checking and savings accounts plus business loans, and other services.

It stands out because of the many attractive rewards it offers for using its checking account. If you frequently use your debit card, you can earn a higher APY on your checking deposit. The interest rate can go even higher if you use Consumer Credit Union’s credit card but note that is only offered for personal accounts.

Joining the credit union is very easy. All you have to do is pay a nominal $5 membership fee and keep $5 in your Consumers savings account. Consumers CU offers several different checking and savings accounts including a Community Checking account for Non-Profits.

Why we chose it: Consumers Credit Union is a great choice for its extensive Co-op shared branches and ATM network. It’s one of the easiest credit unions to join and offers competitive APYs on deposits.

- No monthly service fee

- Unlimited ATM fee reimbursements

- Competitive APY

- $10 overdraft transfer charge

- Limited customer support

- Interest compounds monthly

Fees

The basic Freedom Business Checking account has no monthly fee and offers up to 100 free transactions per month. The more advanced Power Business Checking has a monthly fee of $20 but it can be waived off with an average daily balance of $5000.

Interest Rates

Consumers Credit Union offers competitive interest rates on checking and savings accounts. Freedom Business Checking doesn’t offer an APY but Power Business Checking does offer a 0.05% yield. Its money market accounts offer an APY of up to 0.75% on balances exceeding $100,000.

Lending Options

You can avail of a handful of lending options including commercial mortgages at competitive rates, secured lines of credit, and equipment financing.

Ranked among the best credit unions for business banking, America First is a Utah-based credit union. As a part of the Co-op ATM network, it has more than 30,000 ATM locations across the country which members can use for free. Unlike Alliant Credit Union, America First does offer business-specific accounts and lending options albeit with lower APYs.

America First Credit Union’s range of business lending options makes it stand out among others. Be it a line of credit, auto loan, unsecured capital, equipment and machinery, business acquisition or franchise, or a commercial real estate loan, you can find all types of financing with America First.

But joining AmFirst Credit Union isn’t as easy as joining Alliant. The membership eligibility criteria are more constrained. Only people who live, work, volunteer, worship, or go to school in particular areas of Arizona, Idaho, New Mexico, Nevada, Oregon, and Utah qualify.

Why we chose it: America First Credit Union stands out with its wide range of business services including a variety of financing options. It’s definitely a top choice for anyone who qualifies for eligibility.

- 30,000+ free ATM locations

- Wide range of lending options for businesses

- Offers business accounts

- Limited groups eligible for membership

- Money Market checking account has a high minimum balance requirement

- $25 overdraft fee

Fees

America First’s Basic Checking account is free. It offers 250 free transactions per month and any extra transactions are charged at $0.15 each. If you go with Premier Business Checking, you incur a monthly fee of $8 which can be offset by the interest you earn on your deposit.

Interest Rates

The credit union offers no interest yield on its Basic and Premiere Business Checking accounts. The High-Yield Checking account yields up to just 0.05% and only if you have a minimum opening balance of $10,000. When it comes to savings accounts, its Business Share Savings offering has an APY of 0.05%. It can go up to 0.15% if you go with Business Money Market Savings.

Lending Options

As mentioned above, America First offers a range of lending options for small businesses just like a traditional bank would. You can get SBA secured lines of credit from $50,000 to $100,000, SBA unsecured lines from %15,000 to $50,000, term loans of up to $15,000, and SBA commercial vehicle loans worth millions of dollars.

Also known as the Pentagon Federal Credit Union, PenFed was originally a military-affiliated credit union. Today, you no longer have to be military-affiliated to join this credit union and can easily be a member by opening a PenFed savings account with a $5 deposit and maintaining a minimum account balance of $5.

With branches in 13 states, the credit union also has branches in US military bases in Puerto Rico, Guam, and Japan. PenFed is federally insured by the NCUA and offers one of the highest savings APYs in the market.

Although it’s a good option for its competitive interest rates and low minimum balance requirements, PenFed has a few cons. It doesn’t reimburse ATM fees for out-of-network ATMs and doesn’t allow transferring from your savings account to your checking account for overdraft protection.

Why we chose it: PenFed is one of the few federally insured credit unions that are easy to join and offer some of the most attractive interest rates.

- Competitive APY

- $5 opening deposit

- No monthly fee

- No ATM fee reimbursements

- Compounds interest monthly

- No business accounts or lending options

Fees

PenFed’s Free Checking account has no monthly fees and no minimum balance requirements. If you go with the more advanced Access America Checking account, you have to pay a $10 monthly fee but it can easily be waived.

Interest Rates

The Free Checking account doesn’t yield interest but Access America Checking does. It offers a high interest rate of 0.15% on daily balances up to $20,000. The rate goes even higher to 0.35% on daily balances of $20,000 to $50,000.

PenFed’s savings offerings also have very lucrative APYs. The Regular Savings account offers an APY of 0.05%, while its Money Market Savings and Premium Online Savings accounts offer 0.15% and 0.75% APY.

Lending Options

PenFed has a variety of lending options available but none of them are for businesses. It offers mortgages, home equities, personal loans, and lines of credit. Check out the best mortgage lenders available if you’re interested in mortgages.

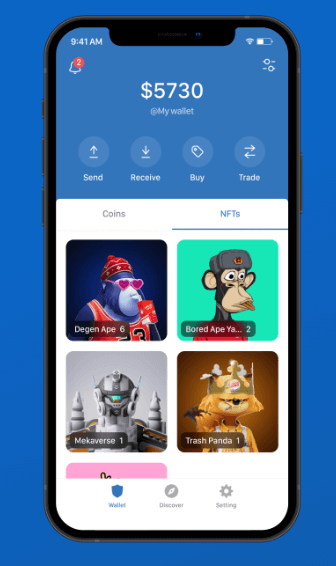

If you’re looking for a combination of attractive online bank features and a strong network of physical branches, Capital One is a good choice. The bank offers two business checking options including Basic and Unlimited Checking.

The Basic account offers unlimited digital transactions, online and mobile banking, and a low minimum balance to waive the monthly fees. If you go with Unlimited Checking, you get two Basic Checking accounts, free cash deposits, and free domestic wires. This makes it a great choice for businesses with complicated finances.

Although it’s a traditional bank, Capital One does really well when it comes to ease of use and an intuitive app interface. The bank’s experienced and robust customer service is a stand-out feature. If you’re interested in banking with Capital One, note that it has branches in a few states only. Since you must visit a branch in-person to apply for a business checking account, the service is only available in a few states.

Why we chose it: Like other well-established banks, Capital One offers a wide range of services and does a good job of providing them online. It’s an excellent option if you prefer banking via physical branches, only if it has a branch close to you.

- Experienced support from a large bank

- Self-service escrow services

- Unlimited checking includes two Basic accounts

- Relatively higher monthly fees

- Only available in some states

- Have to visit a branch to apply for a business account

Fees

Capital One’s Basic Checking account has a monthly fee of $15. It’s quite high compared to others but it can be waived if your balance averages $2,000 or more. You can deposit up to $5000 per month in cash for free. Standard wire transfer fees ($15/incoming and $25/outgoing) apply.

Unlimited Checking comes at a monthly fee of $35 which can also be waived with an average balance of $25,000. This includes unlimited cash deposits. All incoming wires are also free. When it comes to Business Savings, the offering has a low monthly fee of $3 which can easily be waived off with a minimum balance of $300.

Interest Rates

You will find no APY with Capital One’s Business Checking accounts. Its savings account, however, has a 0.2% promotional interest rate for the first 12 months.

Lending Options

Capital One offers business lines of credit and small business loans to its Business Checking customers. The bank offers one of the largest lines of credit of up to $5 million. It also has SBA 504 and SBA7(a) loans you can take if you’re looking for longer repayment terms, fixed rates, and low equity requirements.

Wells Fargo is a well-established banking institution with more than 4,900 locations across the US. Not only is it well-established, but its comprehensive set of business banking services makes it quite an attractive choice.

The bank offers a handful of different business checking and savings account options. It offers business lines of credits, loans, merchant services, and even payroll services. However, Wells Fargo charges monthly and ATM fees which makes it a relatively high-cost option compared to its competitors.

Although it’s primarily a brick-and-mortar bank, you can easily open a business bank account online. This along with easy access provided by its vast branch and ATM networks makes it a good institution to bank with. However, some customers are wary of banking with Wells Fargo because of a recent scandal.

Why we chose it: Wells Fargo’s wide range of business banking products and services plus its vast network of branches and ATMs make it a good choice for any business that’s looking for a well-established institution to bank with.

- 4900+ branches across the US

- Wide range of banking services

- Robust customer service

- Costs more than other options

- No ATM fee reimbursement

- Struggling reputation

Fees

Banking with Wells Fargo is set to cost you more than Bluevine and Axos. The most basic checking account, called Initiate Business Checking, has a $10 monthly fee. Fees go up to $75 for checking accounts. Wells Fargo’s Business Market Rate Savings has a monthly fee of $5. Waiving these fees off has fairly high requirements making Wells Fargo a more pricey option.

Interest Rates

None of Wells Fargo’s business checking options bear interest except for Navigate Business Checking. Still, the rates vary based on your location. All Savings options share a 0.01% interest rate. Still, the interest rate is not as high as Bluevine or Axos.

Lending Options

The bank offers business lines of credit from $5000 to $500,000 and offers fairly low interest rates on lines. Wells Fargo also lends SBA Term Loans including SBA (7a) and SBA 504 up to $5 and $6.5 million respectively.

Just like Wells Fargo, Bank of America is a traditional bank with a vast network of ATMs and branches. It offers a variety of business checking accounts among several other products that BofA offers for small businesses. Similar to Capital One, Bank of America offers two different levels of service for smaller and larger businesses respectively.

Bank of America is the most traditional bank you’ll find on this list. While it has developed online capabilities, we recommend it only for in-person banking. The apps and websites are still not as intuitive as those of Bluevine or Axos. We also note that the bank has a particularly costly fee structure and has high balance requirements to waive off fees.

Why we chose it: Bank of America is more of a traditional bank and lacks when it comes to digital banking. However, it’s a great option if your business deals with heavy cash flows.

- Integrated with Zelle money transfer

- Online account integrates with accounting apps

- Payroll services

- High balances to waive fees

- App isn’t as easy to use as other options

- High monthly service fees

Fees

Bank of America’s banking fees are the most expensive of all banks in this list. With a $16 monthly fee on its Fundamentals checking account, it also requires a high balance of $5000 to waive it off. However, the advanced checking account has no monthly fee but you have to maintain an average monthly balance of $15,000.

Interest Rates

Like all traditional bank accounts, BofA offers no APY on its checking accounts. When it comes to business savings, it has a low interest rate of 0.01%.

Lending Options

Bank of America offers several different lending options for businesses ranging from unsecured lines of credit and loans to secured ones. The bank also offers SBA loans, commercial real estate loans, and franchise financing.

Bank Vs Credit Union: What’s Better for Your Business?

You may be wondering what’s the difference between a bank and a credit union. For starters, you should understand that a bank is a for-profit financial institution and hence offers its services to everyone. On the other hand, a credit union is a nonprofit institution that only offers its services to particular groups.

Services

When it comes to services, both banks and credit unions offer the same products and services. This includes checking and savings accounts, credit cards, business loans, and other investment and insurance services. The exact product range can vary.

Monthly Fees

Generally, credit unions are cheaper than banks. Most credit unions have no monthly fees on their checking account offerings and those that do, don’t charge more than $20. On the other hand, banks are much more expensive with average checking account monthly fees going as high as $35.

Interest Rates

Credit unions offer higher APY on both checking and savings accounts. And they charge much lower interest rates on loans. This is all because credit unions are not-for-profit. Banks offer lower APYs and charge more interest on loans.

Accessibility

Credit unions are not as accessible as banks. Banks usually have a more extensive branch and ATM network which makes them more accessible.

Methodology for the Best Banks & Credit Unions

Choosing the bank or credit union to bank with is one of the most important financial decisions you will make for your business. Since the financial industry is not the easiest to understand, new business owners face a fair amount of difficulty when reviewing different options.

In this section, we spell out the most important factors we consider when evaluating the best banks and credit unions for small businesses. This will help you understand what to look for and how to compare financial institutions.

- Fees: You can see this as the price of banking. The higher the monthly fee for a banking product, the more it will cost you. Banks with no monthly fees rank higher than those that charge a fee.

- Deposit interest rates: Also known as the APY, this is the rate of interest at which you earn from your checking or savings deposits. The higher it is, the more advantageous it is for your business.

- Lending interest rates: Each bank or credit union offers different rates on the loans or lines of credit you acquire. The lower it is, the more you pay for a lending service.

- Lending options: What are the lending options that are available with a bank or credit union? Financial institutions with a wider variety of lending options give businesses more flexibility.

- Accessibility: Some banks operate entirely digitally, while others have physical branches and ATM networks. Banks with larger ATM networks are more accessible and are more convenient to bank with.

Frequently Asked Questions (FAQs) for Best Banks & Credit Unions

Bottom Line on Best Banks & Credit Unions

Bluevine is the best overall bank while Alliant Credit Union is our top pick among credit unions. Whether you go for a credit union, an online bank or a traditional bank for your business’s banking needs depends on your preference. If a credit union is easily accessible to you and you are eligible for membership, we recommend you capitalize on its low fees and high APY offerings.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.