Your business has reached a point where you can’t handle everything on your own. Hiring employees seems like the obvious next step. However, doing so adds a layer of complexity to running a business that will forever change how you spend your time. One of your biggest new responsibilities and time sinks will be payroll.

What is payroll? Not all new business owners are familiar with this concept and it’s a good idea to start off with a brief explanation. Payroll is the organized process of calculating wages owed to employees, calculating and paying payroll taxes, distributing employee wages, and documenting the whole process.

How to Do Payroll with Payroll Software In 11 Steps

Since payroll is a broad concept that covers everything from payroll laws and taxes to documentation, it can be a bit too much to wrap your head around. It’s easy to run into errors if you’re running payroll on your own for the first time. Remember that the penalties for an error in taxes or employee paychecks are no joke.

Small business owners, even those with only one employee, should certainly invest in a consistent method for running payroll. Rather than doing payroll manually, we recommend you use payroll software. These payroll processing services will manage the entire process for you from paying your employees, calculating payroll taxes, paying and filing them, to managing employee benefits.

Although different payroll software may have slightly varying steps to run payroll, the overarching process is almost the same. So here’s your easy guide on how to do payroll for your small business with payroll software. We’ll be using screenshots from the Square Payroll setup process to help you along the way.

Step 1: Choose a Payroll Software that Suits Your Needs

The first and most important task on your hands is to choose the right payroll software. You’ve got plenty of options to choose from, but if you’re new to payroll, you can’t immediately tell which software is right for you.

Plus, some not-so-good payroll service providers run relentless ad campaigns and you might end up subscribing to them if you’re not well-informed about which one suits you best. To ease things for you, we’ve researched the market and enlisted the best payroll software for different kinds of businesses. Here are our top three picks.

Gusto

Built for small businesses, Gusto is a robust platform that unifies payroll, benefits administration, HR, and compliance functions into a single, easy-to-use package. It offers a range of payroll tools to simplify and automate the entire process of paying your employees. Plus, advanced plans have HR services to help you and your employees make the most of your time. Read our in-depth review on Gusto to find more about it.

Square Payroll

Square Payroll is an easy-to-use payroll software with a simple design and all tools accessible from the homepage. It lets you manage employees’ paychecks with ease and offers seamless timecard imports, automated tax filings, and a range of other helpful features. Check out our Square Payroll review to see if it suits your needs.

Rippling

Rippling is a high-end payroll service and is a great option for mid-sized businesses. It offers HR functionalities as well as powerful payroll tools which makes it great for personnel management. Rippling also offers loads of integrations with accounting, time tracking, attendance, and other tools.

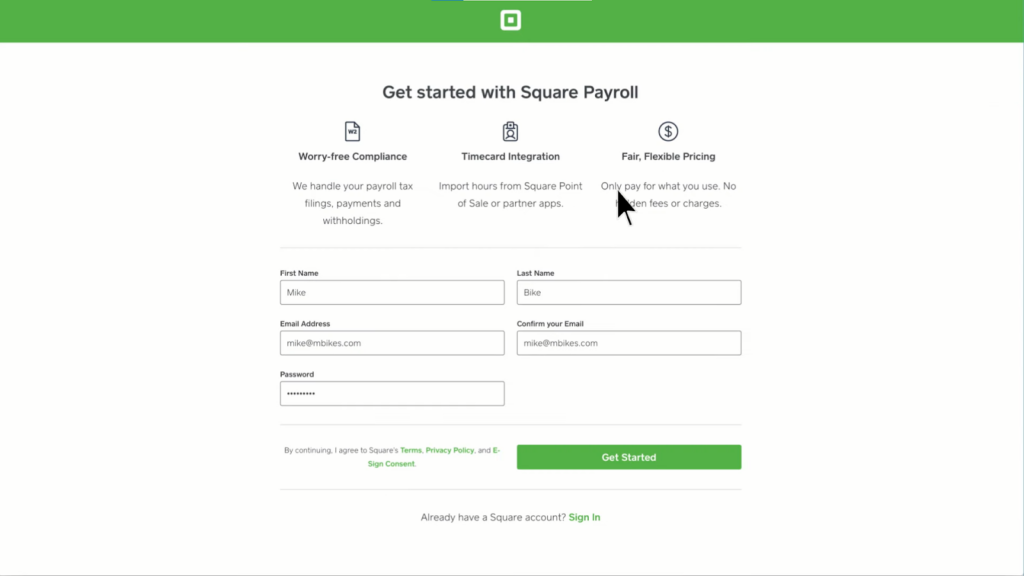

Step 2: Set Up Employer Account on Payroll Software

Enter your personal details and your business’s information to set up your account. You just need your business name, type, address, and contact information to complete this step. Once down, you can move on to adding your employees’ information.

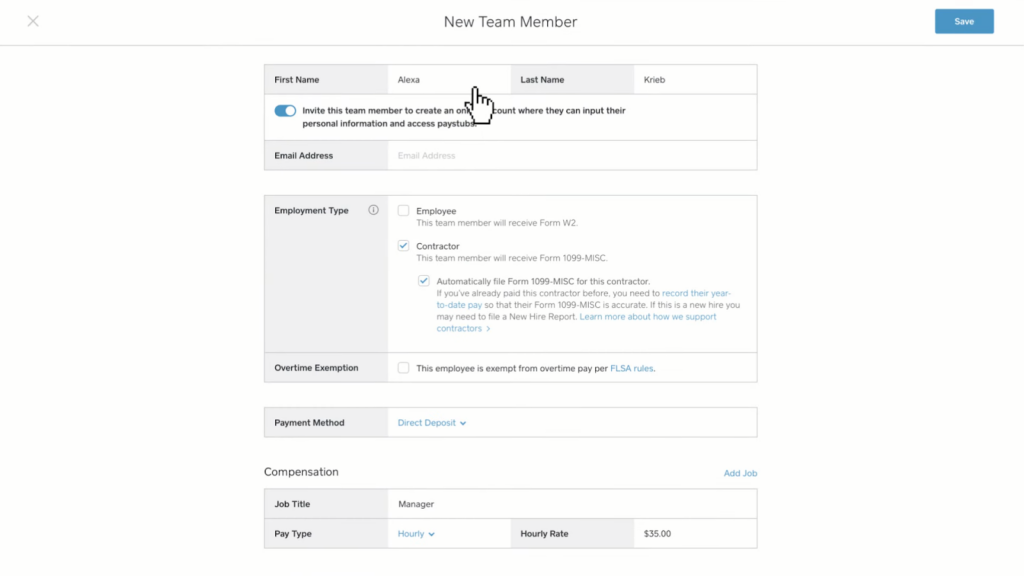

Step 3: Add Employees to the Payroll Software

Add your employees using basic information such as their full name, email address, and employment type. You don’t need to go into detail; all technical stuff is handled by the software on its own. Once you’ve added the employees’ basic information and email address, the software sends them an email invite so they can complete the rest of the process on their own.

This means according to their employment type, the payroll software requests them to fill in tax forms such as the W-4, I-9, or 1099s to process contractor payroll. If you’re not using payroll software, you need to gather this information and deal with all the paperwork on your own.

Using these employee-filled forms, the payroll software automatically sorts out exempt and non-exempt employees, information about taxes and employee benefits, and other important information to run payroll.

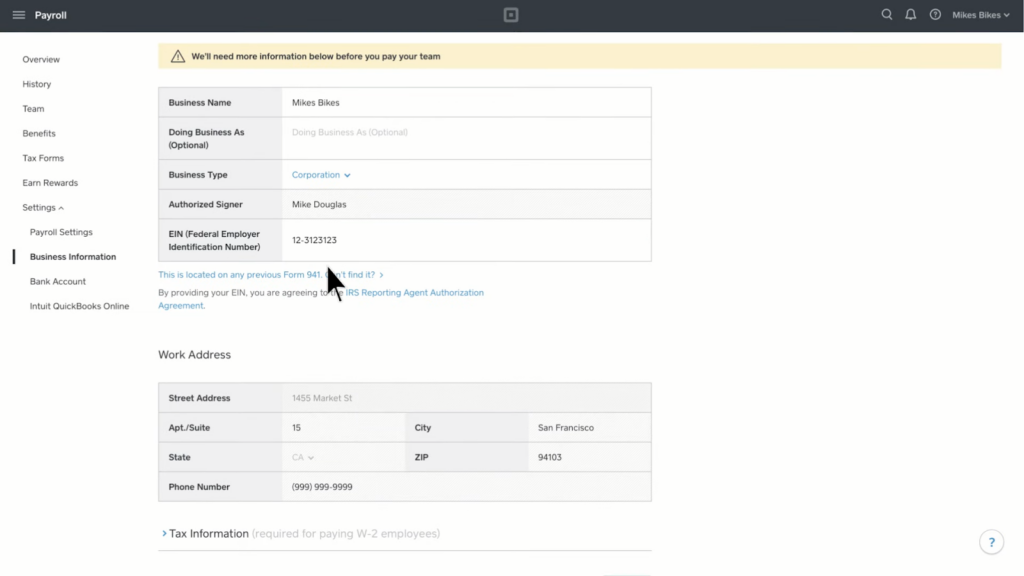

Step 4: Enter Tax Information

This is where you enter your business’s tax information such as the EIN number and state tax IDs so the payroll software can use them to file payroll taxes on your behalf. Find your employer identification number (EIN), if you don’t already have it, you can apply for it free on the IRS website.

Your EIN, also known as your business’s federal tax number, helps the IRS and the government identify your business. It’s just like your company’s social security number and is essential for you to file payroll taxes.

Also, check if your state or local government requires a different identification number such as the state income tax number, or state unemployment ID. Most states just need the EIN, but it’s a good idea to check before you continue. Once you have all the information required to set up your employer profile on the payroll software, it’s time to create your account.

Step 5: Select a Payroll Schedule and Payment Method

Once you’ve set up your account on the payroll software, you need to decide on a payroll schedule and the payment methods you’re going to offer. There are four types of payroll schedules. This includes weekly, bi-weekly, semi-monthly, and monthly schedules. But remember each state has its own pay period requirements.

For example, your state may require weekly or biweekly paydays, depending on the occupation. We recommend you check out your state payday requirements to ensure compliance.

In some states, the law mandates that you offer multiple payment options for your employees. Paper checks are becoming rare options for employee paychecks, and are being replaced by methods more convenient for both employer and employee, like direct deposit. Another option is pre-loaded payroll cards, similar to prepaid credit cards.

Step 6: Use a Time Tracking System

You must have an accurate time tracking system in place to track your employees’ worked hours. The FLSA makes it a must for employers to accurately track hours for their hourly employees. A simple solution is to use spreadsheets, but if you want a more advanced solution, use time tracking software.

Employees can clock in and out their hours through the tracking system. By integrating the time tracking app with your payroll software, you can import the total hours worked instantly. Not just that, issues like determining overtime hours are also taken care of.

Step 7: Run Payroll

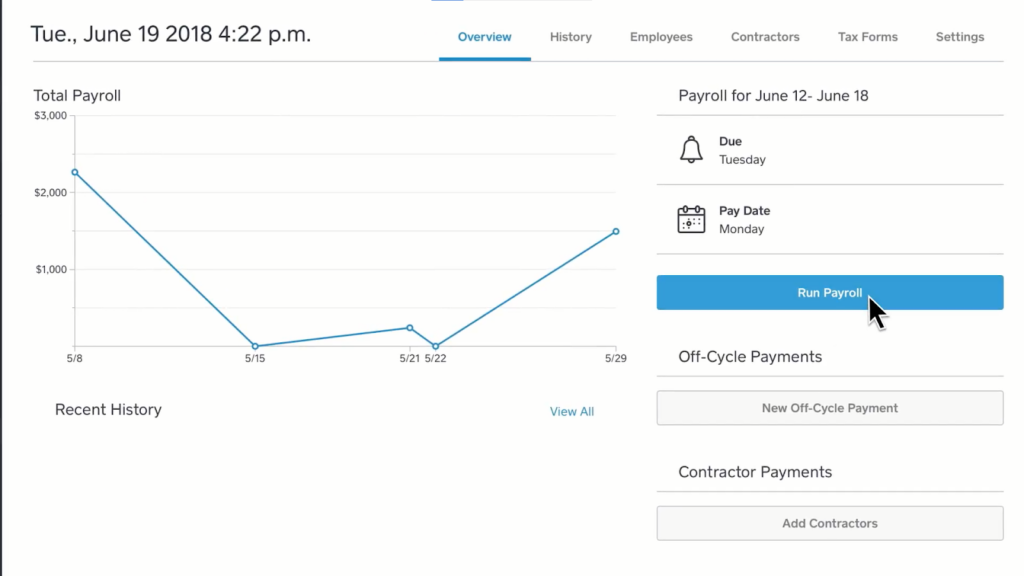

Once everything is set up and you’re ready to pay your employees, your payroll software gives you an option to run payroll for a given pay period. After you verify information, you can simply press a button to pay workers.

Step 8: Input Employees’ Hours or Import Timecards

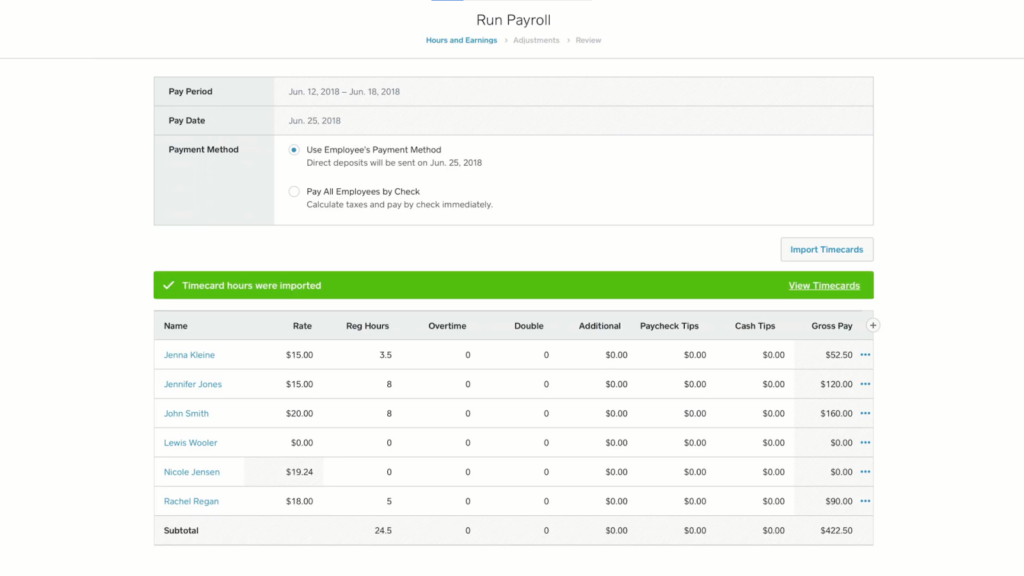

With payroll software, you can either input employees’ hours worked manually or import them through the time tracking system you use. Note that the latter is the faster and more efficient way to pay your employees accurately.

If you import timecards, the hours each employee has worked are automatically entered. If employees have worked overtime or double overtime, those hours are entered accurately too. Note that you can still edit these hours manually if needed.

Next up, you can add any additional payments, paycheck tips, or take cash tips into account. The payroll software uses this information to accurately calculate the gross pay for each employee.

Step 9: Deductions and Adjustments

The most complicated part of payroll processing may be calculating and paying payroll taxes. This complexity is due to several factors. As an employer, you must calculate both what you and your employees owe when determining your company’s total payroll tax liability. Employers should withhold income taxes and other payroll taxes from employees’ wages, to be paid on their behalf.

Federal taxes include federal income tax, as well as the federal unemployment tax. Deductions governed by the Federal Insurance Contributions Act (FICA), including medicare tax and social security tax, also need to be tracked and paid. Taxes are also owed at the state level, including but not limited to state income tax and state unemployment tax.

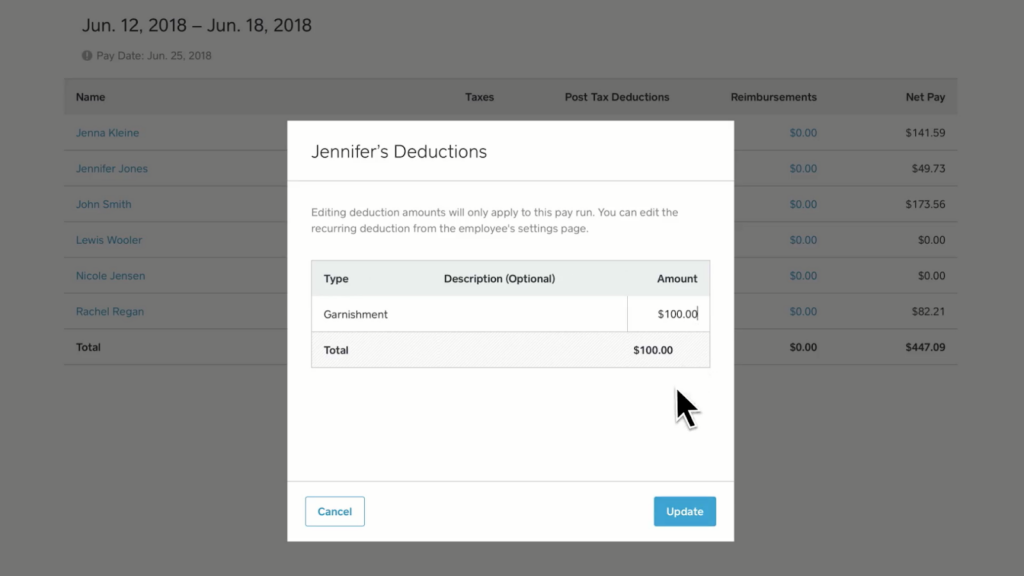

All of this is taken care of by the payroll software. It calculates all taxes accurately so you don’t have to worry about any of that. You just need to make sure if there are any extra adjustments you want to make in each employee’s paycheck. For example, if you’ve received a garnishment order or want to make a post-tax deduction, you can at this stage.

Step 10: Review Payroll Run Summary and Pay Your Employees

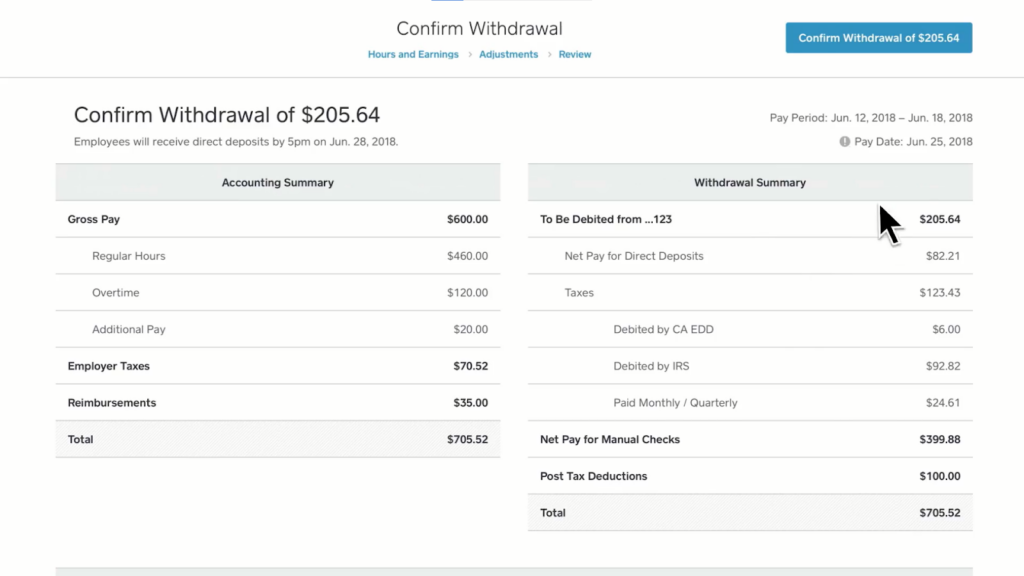

Finally, the payroll software takes you to a review page where you can see each employee’s net pay and all payroll taxes and other deductions in one place. Once you’ve reviewed it, you can finally pay your employees by confirming withdrawal.

Note that if you opt for direct deposit, the payments can take two to four days to reach your worker’s bank accounts. Other payment methods can take varying time periods to reach employees.

As a note, pay stubs from each pay period showing information like deductions are made available to employees. This can be an additional concern but is not a problem if you use payroll software.

Step 11: Keep Payroll Records

Paying employees generates a lot of paperwork, some of which needs to be saved. Not keeping this paperwork safe is one of the most common payroll mistakes new employers tend to make. Records of payroll tax forms and other information have to be saved for at least four years.

These records include:

- Your employer identification number

- Amounts and dates of all payments to employees

- Tips reported

- The fair market value of in-kind payments, ie. trading goods for labor or other goods, rather than paying money

- Important information regarding employees, including names, social security numbers, and occupations

- Dates of employment

- Sick or vacation pay

- Copies of each employee’s W-4

- Payroll records of tax deposits

- Copies of tax returns

- Records of fringe benefits

Keeping payroll records is essential to maintain transparency and helps you stay clear of legal trouble. It also makes it easy for you to conduct a payroll audit.

There may also be specific requirements for different business types. Additional records may be required for some payroll deductions or other tax documents. Employers have a few other recordkeeping and reporting responsibilities. One that’s important for new employers to be aware of is notifying the correct state agency when bringing a new employee on board.

Should You Do Payroll Yourself?

Small business owners have lots of claims on their time, so sitting down to run payroll yourself may be a sacrifice. At the same time, it’s one of a business’s biggest expenses, so it can be nerve-wracking to put it in the hands of a payroll service.

However, payroll can be complicated and time-consuming, with several aspects and a multitude of requirements as you might’ve found out in the steps above. Running payroll is not like most other administrative tasks you’re able to pull along with your main work. It’s technical and requires undivided attention to be done properly.

Thus, it’s only natural to think about whether you should hire an in-house accountant to run payroll. This might be out of the question for smaller teams but larger businesses may want to give it a thought. But if you think your business can’t afford an accountant’s services yet, investing in reliable payroll processing software is a smart step.

You Have to Familiarize Yourself with Federal & State Payroll Laws

If you’re running payroll on your own, you’re responsible for complying with all federal and state payroll laws. This includes important payroll laws like minimum wage rules in your city or state, worker’s compensation insurance requirements, final paycheck, and PTO payout regulations.

You’re an entrepreneur trying to grow your business. Why slow yourself down trying to learn laws and regulations? Go for automated payroll software as they take care of all the legal requirements for you. You don’t need to study any laws since these payroll services take into account all federal and state regulations automatically.

Should You Use Professional Payroll Services?

A payroll provider is usually the more expensive payroll solution. However, you’re paying for a wider range of services. They’ll manage payroll calculations and file payroll taxes for an employer, of course, but may offer a number of other benefits as well.

What to Expect

With a payroll service, payroll processing is taken largely out of the employer’s hands. They’ll handle distributing employees’ paychecks, whether by direct deposit or another method, after calculating net pay. They’ll also pay payroll taxes and manage record-keeping.

They may offer additional services that can help both you and your employees, such as advances on future earnings and making pay stubs available. You will have to pay more for the more elaborate features, however, which can quickly add up.

Benefits of Using Payroll Software

Payroll software lets you pay your employees with ease. It takes care of everything from employee paperwork to filing taxes and frees up a lot of your time. Employees can enter their information on the software and it automatically calculates all taxes and benefits for each worker. All you have to do is run the payroll on payday, everything else is handled by the software.

Payroll processing software comes in a wide variety of options. Some might be better thought of as a payroll system, doing a lot more than simply filling out tax forms. Examples include Quickbooks Payroll or Paychex. Other options are less complex and correspondingly less expensive. If you’ve got a small team with simple payroll needs, check out the best free payroll software.

You’re also likely to find industry-specific payroll software. For instance, we recommend restaurant owners use the best restaurant payroll software to manage payroll.

What to Expect

Even basic payroll software options help you process payroll and calculate deductions like state and federal taxes. A full payroll system automatically makes tax payments from your bank account and produces payroll reports at the end of each pay period. Software of that kind often comes with guarantees backing their tax calculations.

At this point, some software options are on par with a payroll service, both in terms of services and expense. Some software options may also offer full bookkeeping options, or integrate with bookkeeping software to make moving information easier. Higher-end options will even notify the correct state agency when you hire new employees.

Frequently Asked Questions (FAQs) for How to Do Payroll

Here are some of the most common questions new employers ask about running payroll manually.

Bottom Line on How to Do Payroll

Every business owner should know how to do payroll manually, but that doesn’t mean they should do it that way. It’s good that you’re aware of the underlying processes but given the tons of time consumed by payroll processing, smart entrepreneurs automate it with payroll software.

Sections of this topic

Sections of this topic