There are thousands of different NFT projects listed on NFT marketplaces such as OpenSea, Rarible, and SuperRare. With more than $37 billion sent by cryptocurrency wallets to NFT marketplaces from January 2022 to May 2022, the NFT market continues to grow. This guide sums up the best NFTs to buy in 2023.

Best NFTs to Buy

- Bored Ape Yacht Club – Overall Best NFT to Buy

- CryptoPunks – Best NFT for Longevity

- Azuki – Best Newly Released NFT

- Moonbirds – Best Viral NFT Collection

- VeeFriends – Best NFT for Notable Founder

- World of Women – Best NFT for a Diverse Community

- Fidenza Art Blocks – Best NFT for Generative Art

- Cool Cats – Best NFT for Active Community

- CyberKongz – Best NFT for Token Earnings

- HAPE PRIME – Best NFT for 3D Art

NFT Project

Release Date

Mint Price

Floor Price*

All-Time-High Floor Price

Collection Size (# of NFTs)

Twitter Followers*

*floor price and Twitter followers as of 25 May, 2022

Bored Ape Yacht Club (BAYC) was created by Yuga Labs LLC. It’s a collection of 9,999 randomly generated art pieces created from 170 unique traits. Each Bored Ape Yacht Club receives access to members-only benefits such as merchandise, real-life meetups, and various rewards.

This NFT collection is the most influential NFT project of all time. It’s owned by notable celebs, including Jimmy Fallon, Justin Bieber, Timbaland, Snoop Dogg, Steph Curry, and Paris Hilton. BAYC released the collection of 9,999 NFTs for only 0.08 ETH. As one of the first mainstream projects in the NFT space, the floor price stands at 91 ETH.

People who owned a Bored Ape Yacht Club NFT received early access to additional NFT drops such as the Mutant Ape Yacht Club and Bored Ape Kennel Club, two derivative projects. To date, the Bored Ape Yacht Club has generated over $1 billion in revenue.

Bored Ape Yacht Club Overview

Art

The Bored Ape Yacht Club artwork features randomly generated profile pictures of apes.

Community

The BAYC NFT collection has the strongest community in the NFT space because of its popularity and ownership by many A-list celebrities. Bored Ape Yacht Club has nearly one million followers on Twitter.

Utility

Owning a BAYC NFT grants you access to exclusive events, airdrops, and giveaways.

Team

BAYC was founded by four developer friends with an impressive background in marketing and branding.

Roadmap

BAYC continues to hold private events for their NFT holders that grant access to an exclusive network of high-net-worth individuals.

Why we chose it: Bored Ape Yacht Club is the overall best NFT to buy because it’s the number one blue-chip NFT. This means that even during volatile market conditions, you can expect BAYC to remain stable and return to previous highs.

- Most popular NFT ever

- Access to real-life meetups

- Exclusive community with many notable celebrities

- Extremely expensive

- Price fluctuations

- Overwhelming Discord server

Pricing: Over 2022, the floor price has ranged from 60 ETH to 150 ETH. It currently sits at 91 ETH as of May 25, 2022.

CryptoPunks had the highest floor price in the NFT marketplace until Bored Ape Yacht Club passed it in December of 2021. This is because CryptoPunks launched in 2017, four years before the massive NFT boom in 2021. As one of the first NFT projects released, CryptoPunks were able to build a strong community.

Many CryptoPunk NFTs have sold for millions of dollars. In fact, CryptoPunk #5822 sold for around $23.7 million in Ethereum. The creator of the BAYC, Yuga Labs, purchased CryptoPunks from Larva Labs in March of 2022. As such, Yuga Labs now owns the two most popular NFT projects in the world.

Because of this, you can expect Yuga Labs to continue creating value for the NFT holders through clever marketing, real-life events, and various giveaways.

CryptoPunks Overview

Art

The CryptoPunks artwork features simple 8-bit pixelated art images which were generated algorithmically. Most of the artwork features punky-looking girls and guys. However, there are a few rarer art pieces mixed in, including apes, zombies, and aliens.

Community

CryptoPunks NFT is similar to Bored Ape Yacht Club because many high-level celebrities and entrepreneurs own one.

Utility

The core utility of a CryptoPunks NFT is owning a rare piece of the first popular NFT collection ever created.

Team

Cryptopunks is currently owned by Larva Labs.

Roadmap

CryptoPunks didn’t even have a roadmap when it launched. The project was an experiment that grew to a worldwide sensation.

Why we chose it: CryptoPunks is the best NFT for longevity because it still holds its spot as the number two most popular NFT, even after five years. Although the floor price has fallen from its all-time high, it’s one of the most notable NFT projects of all time.

- First NFT project on Ethereum

- Second most popular NFT project

- Several CryptoPunks have sold for millions of dollars

- Extremely high floor price

- Can only be purchased with Ethereum

- Simple art may not be attractive to everyone

Pricing: Over 2022, the floor price has ranged from 47 ETH to 84 ETH. It currently sits at 47 ETH as of May 25, 2022.

Azuki stormed the NFT marketplace in early 2022 because of a viral and successful pre-launch Twitter campaign. This NFT collection features 10,000 anime-style profile pictures that live on the Ethereum blockchain. Each Azuki NFT holder gains access to Azuki’s metaverse, The Garden. The Garden gives holders access to exclusive NFT drops, live events, and merch.

The Azuki collection stands out because it had an initial mint price of $3,400 with 8,700 art pieces. The 8,700 art pieces didn’t take long to sell out. In just four minutes, the entire collection sold out. This netted one of the quickest $29 million transactions in NFT launch sales history.

Azuki accumulated $300 million in trading volume after 30 days and is on its way to becoming the next Bored Ape Yacht Club. Even five months after its release, Azuki continues to rank high on OpenSea in terms of sales volume and floor price. The hype is still growing, and the Azuki NFT collection is prepped to soar to new all-time highs once the crypto market recovers.

This NFT collection showcased the power of outstanding artwork and a strong social media campaign. Before Azuki, the majority of popular NFT collections featured simple and uninspired artwork. Furthermore, one of the founding members was the Character Art Director at Overwatch, a popular first-person shooter game. His reputation skyrocketed the NFT’s success.

Azuki Overview

Art

Azuki NFTs feature beautifully designed anime style profile pictures.

Community

The Azuki community is extremely active with over 100,000 Discord members.

Utility

Owning an Azuki NFT grants you access to real-life meetups, physical merch, and Azuki’s metaverse creation.

Team

Azuki was founded by Zagabond. Although he failed three NFT projects in the past, Azuki proved he understands the cryptocurrency space.

Roadmap

Azuki is planning to create exclusive streetwear collabs, NFT drops, and live events, which is only rivaled by BAYC.

Why we chose it: The Azuki collection is the best newly released NFT project because it’s been able to keep up the initial hype through continuous marketing and community building. While most projects with strong initial hype simmer down, Azuki has remained vigorous.

- Outstanding artwork

- Relatively low floor price compared to BAYC and CryptoPunks

- High potential to become blue-chip NFT collection

- High floor price

- The founder has abandoned three projects in the past

- Unclear roadmap

Pricing: Over 2022, the floor price has ranged from 8 ETH to 31 ETH. It currently sits at 11.5 ETH as of May 25, 2022.

Newly released in April 2022, Moonbirds have gone viral all over NFT Twitter. This NFT collection was created by Proof Collective, which includes Digg founder Kevin Rose.

Moonbirds is an excellent example of an NFT acting both as a community-driven movement and profile picture art. Similar to Azuki, Moonbirds has been able to surpass its initial hype by continuing to grow and expand.

Moonbirds Overview

Art

Moonbirds artwork features simple 2D images of birds.

Community

Moonbirds has a cult-like community of over 200,000 Twitter followers, and it’s fast approaching Azuki’s popularity.

Utility

If you own a Moonbirds NFT, you get access to the private PROOF Discord server. Here, you will receive access to private drops, real-life events, and the upcoming PROOF metaverse.

Team

Moonbirds was founded by prominent entrepreneur Kevin Rose. Kevin Rose was the founder of digg, a news aggregator website.

Roadmap

Moonbirds NFT holders get first-access to the metaverse world Moonbirds is building.

Why we chose it: The Moonbirds NFT collection is the best viral NFT collection because it aims to be the next blue-chip NFT while building one of the strongest communities in the space. This collection has a highly notable founding team, which offers excellent potential for the future.

- Reputable founding team

- Massive pre-launch social media campaign

- Private Discord server

- High floor price

- Mediocre artwork

- Unclear roadmap

Pricing: Over 2022, the floor price has ranged from 12.85 ETH to 38.65 ETH. It currently sits at 24 ETH as of May 25, 2022.

Gary Vaynerchuk is a highly influential entrepreneur that’s been invested in the NFT marketplace since the beginning. VeeFriends is Gary Vaynerchuk’s personal NFT collection and consists of 10,225 NFT art pieces. The artwork is all drawn by Gary Vee himself.

VeeFriends Overview

Art

The artwork featured in the VeeFriends NFT collection is hand drawn by Gary Vaynerchuk.

Community

VeeFriends has a dedicated community of Gary Vaynerchuk fans and cryptocurrency enthusiasts.

Utility

Each NFT holder receives three years’ access to VeeCon, Gary’s annual Web 3 conference in Minneapolis. Other benefits include exclusive networking opportunities and various giveaways, which could be seen as more valuable than even the top-ranked NFTs, BAYC and CryptoPunks.

Team

VeeFriends was founded and is still led by prominent entrepreneur, Gary Vaynerchuk.

Roadmap

VeeFriends recently dropped series 2 and will continue adding new art to the NFT collection.

Why we chose it: Many high-level influencers have tried creating their own NFT collections, but none of them have had as much success as Gary Vaynerchuk and VeeFriends. Therefore, VeeFriends is the best NFT collection with a notable founder.

- Created by Gary Vaynerchuk

- Strong floor price despite volatile market conditions

- Constant innovation and utility rewards

- Long-term utility is unclear

- High floor price

- Different series can be confusing to distinguish

Pricing: Over 2022, the floor price has ranged from 7.04 ETH to 18.21 ETH. It currently sits at 7.69 ETH as of May 25, 2022.

While cryptocurrency communities are notably male-centric, World of Women is a project created by women to encourage a more diverse NFT community.

A notable feat of the World of Women is its partnership with the play-to-earn blockchain game, The Sandbox. The partnership’s primary focus will be a $25 million grant used to bring cryptocurrency education to women.

World of Women Overview

Art

The artwork features 10,000 unique images of randomly generated women

Community

Notable owners of World of Women NFTs include Eva Longoria, Reece Witherspoon, and Dez Bryant.

Utility

As a holder of World of Women NFT, you get direct access to involvement in several philanthropic movements.

Team

Designer, Yam Karkai, created the NFT artwork.

Roadmap

World of Women aims to provide free cryptocurrency education to women around the world, which offers a different sort of value compared to BAYC, for example.

Why we chose it: The World of Women collection is the best NFT for diversity and inclusion because it’s created by women

- Most popular female-inclusion NFT collection

- Supported by multiple female celebrities

- Partnerships with other projects

- Inherently excludes male investors

- Highly fluctuating floor price

- Decreasing sales volume

Pricing: Over 2022, the floor price has ranged from 2.04 ETH to 13.33 ETH. It currently sits at 4.14 ETH as of May 25, 2022.

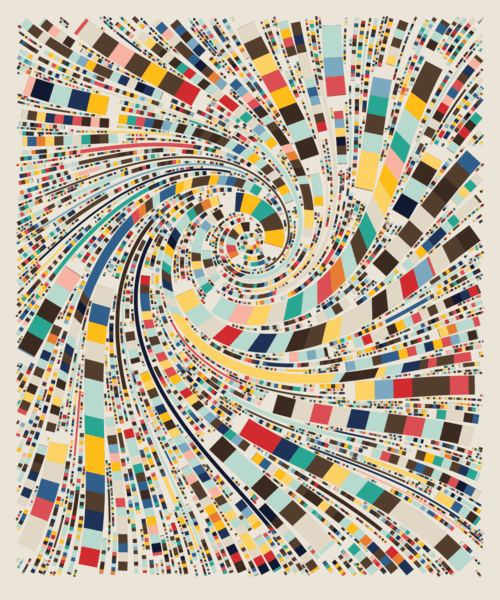

Art Blocks was the first-ever NFT project dedicated to generative art. This means that these NFTs are created using a programmable algorithm to generate unique art pieces.

Fidenza Art Blocks Overview

Art

The Fidenza Art Blocks were created using a versatile generative algorithm. As such, this is the most famous NFT collection that was designed entirely by computer code and not by an artist.

Community

The Fidenza Art Blocks has a strong community of passionate art enthusiasts and programmers.

Utility

The core utility of a Fidenza Art Blocks NFT is that it’s a piece of art that will likely continue rising in price.

Team

The project was created by Tyler Hobbs, a prominent NFT artist.

Roadmap

Tyler Hobbs will continue creating innovative art in the NFT space, giving Fidenza holders first access.

Why we chose it: Fidenza Art Blocks is the best NFT for generative art because it uses computer algorithms instead of real-life artists.

- Extremely unique artwork

- Computer-generated

- Massive total sales volume

- Exceedingly high floor price

- Limited collection

- Hard to continue innovating

Pricing: Over 2022, the floor price has ranged from 39 ETH to 89.36 ETH. It currently sits at 72 ETH as of May 25, 2022.

After its release in July of 2021, Cool Cats quickly gained the number three spot in relation to popularity and sales on OpenSea. If you want to learn how to buy NFTs, you can purchase them using Ethereum and other cryptocurrencies on OpenSea, Rarible, and SuperRare. Once you purchase an NFT, you can store it in the best NFT wallet, MetaMask.

Today, the Cool Cats community still has an active and vibrant community. Although the founders have a goal to innovate and push the NFT space forward, Cool Cat’s roadmap is a little unclear.

Nonetheless, the project founders are public and are known for being leaders in the cryptocurrency market. This project went viral a week after its release when Mike Tyson changed his Twitter profile picture to a Cool Cat NFT. Other owners include Steve Aoki, Reece Witherspoon, and Reddit co-founder Alexis Ohanian.

Cool Cats Overview

Art

The Cool Cats NFT collection features 2D cartoon cat drawings.

Community

Cool Cats has nearly 100,000 Discord members.

Utility

Cool Cats is working on brand collaborations and rewards its holders with exclusive NFT airdrops and giveaways.

Team

Cool Cats was founded by Clon, Xtremetom, Lynqoid, and Elu. These are all prominent developers in the blockchain space.

Roadmap

Cool Cats is building Cooltopia, a gamified ecosystem built on utility and interactivity. Holders can expect community rewards and continued growth in the metaverse.

Why we chose it: Cool Cats is the best NFT with an active community because every Cool Cats owner gets a warm welcome to the Cool Cats universe, Cooltopia. This is the Discord server, Cool Cats marketplace, and exclusive access to the founding team.

- Low floor price

- One of the first popular NFT collections

- Massive total sales volume

- Simple artwork

- Lost its initial popularity

- Outpaced by newer projects

Pricing: Over 2022, the floor price has ranged from 3.15 ETH to 16.07 ETH. It currently sits at 3.15 ETH as of May 25, 2022.

Released two months before the Bored Ape Yacht Club, CyberKongz is a pixelated batch of NFT gorillas. CyberKongz is often referred to as the first NFT collection with utility. At the start, the collection included 1,000 genesis Kongz. These 1,000 Kongz generated 10 $BANANA, a cryptocurrency token, per day.

CyberKongz owners who owned two Kongz and 600 $BANANA could breed their NFTs to create a BabyKong. Although BabyKongz don’t generate tokens, owners could sell them for thousands of dollars.

As such, CyberKongz gained popularity because of its ability to generate passive income. At its all-time high, $BANANA tokens were selling for $20 each. Since Genesis Kongz produces 10 tokens per day, holders earned $200 per day just by holding the NFT.

CyberKongz Overview

Art

The CyberKongz NFT collection features randomly generated 2D and 3D gorillas.

Community

CyberKongz has a strong community of over 300,000 Twitter followers, and it’s often compared to the top NFT BAYC.

Utility

Holding a CyberKongz NFT allows you to earn $BANANA, CyberKongz’s cryptocurrency token.

Team

The artist, Myoo, created CyberKongz in early 2021.

Roadmap

CyberKongz continues to reward its holders through exclusive airdrops and token earning.

Why we chose it: CyberKongz is the best NFT for token earning because you can generate $BANANA to redeem exclusive rewards or sell for USD.

- Utility

- Passive Income

- First-mover NFT project

- $BANANA has decreased

- High floor price

- Limited collection

Pricing: Over 2022, the floor price has ranged from 21.26 ETH to 116.60 ETH. It currently sits at 91 ETH as of May 25, 2022.

HAPE PRIME by HAPE BEAST generated tons of buzz on social media for its release in January of 2022. These NFTs feature 3D artwork and are targeted toward hypebeasts, which are streetwear fashion enthusiasts.

This NFT collection plays off of the success of the Bored Ape Yacht Club. Although there have been many ape-based projects, HAPE PRIME is one of the most successful derivative ape collections.

HAPE PRIME Overview

Art

HAPE PRIME features 3D apes wearing stylish and trendy clothing.

Community

This NFT collection has a community of over 300,000 Twitter followers.

Utility

Owning a HAPE PRIME NFT grants you access to exclusive off-chain gifts and wearable loyalty badges.

Team

Matt Sypien is the founder and creative designer of HAPE PRIME. He previously worked at Chelsea Football Club and Digimental Studio as a design director.

Roadmap

HAPE PRIME will be dropping its clothing line in late 2022.

Why we chose it: HAPE PRIME is the best NFT for 3D art because the artwork features ultra-stylish apes wearing various streetwear apparel.

- Low floor price

- Affordable

- High-potential roadmap

- Has lost its initial steam

- Dramatically lower floor price than all-time-highs

- Success based on community involvement

Pricing: Over 2022, the floor price has ranged from 0.66 ETH to 4.41 ETH. It currently sits at 0.74 ETH as of May 25, 2022.

Methodology for the Best NFTs to Buy

There’s an abundance of different NFT collections, and new collections releasing every day. Therefore, selecting the right NFT project to invest in is a difficult task. When searching for the Best NFTs to buy, here is the criteria we used to rank our list. This criterion explains what is an NFT and how to distinguish good NFT ideas from bad ones.

- Art: Most NFTs are digital art pieces made by various artists. For this reason, it’s important to find NFTs you find attractive. Although art is subjective, you should like the art of the NFT you want to purchase. Read our article on how you can create your own NFTs.

- Community: All successful NFT projects have strong communities and dedicated supporters. Without a loyal community, the NFT project will likely fail. An NFT’s community typically lives on the NFT’s Discord. In the Discord, they will talk about the project, cryptocurrency in general, and other non-related topics. You can gauge how strong the community is by seeing how active the chat is and how willing the members are to help each other.

- Utility: Utility is the extra benefits you receive from an NFT for being the owner. A few examples of utility include real-life events, crypto tokens, additional NFT airdrops, and early access to collaboration projects. Strong utility usually indicates a high-potential NFT project.

- Team: Since there are so many NFT projects, one way to differentiate them is by looking at the founding team. You should see if the founders are public or anonymous. Some founders are public and have previous work experience at big tech companies. If a team is fully anonymous, there’s always a risk that they rug pull the project. If the team members are public, you can look at their backgrounds to see if they have the skills to turn the project into a massive success.

- Roadmap: An NFT project’s roadmap is a timeline of future events, releases, and updates. You can judge an NFT project based on how realistic the roadmap is and what type of unlocks it offers.

Frequently Asked Questions (FAQs) for Best NFTs to Buy

Below are a few common questions surrounding the best NFTs to buy in 2023.

Bottom Line on the Best NFTs to Buy

The long-term success of an NFT project depends on the NFT’s community, team, utility, and roadmap. Bored Ape Yacht Club and CryptoPunks are the top two blue-chip NFT projects with the least built-in risk. However, all NFT projects have massive fluctuations in pricing because of the cryptocurrency market’s volatility.