What started as a joke, now has a $22 billion market value. Dogecoin collected a fanbase worldwide and despite its recent success it’s still possible to mine Dogecoin and make some profit. In this article, we’ll walk you through a step-by-step guide on how to mine Dogecoin.

Mine Dogecoin with Hashshiny Cloud Mining!

How Mining Dogecoin Works

Before talking about Dogecoin mining, it’s important to first understand how mining cryptocurrency works in general. Dogecoin and other cryptocurrencies operate in a blockchain network that works by adding new blocks to its decentralized ledger.

“Mining” is critical for cryptocurrencies’ maintenance, development, and circulation. In practical terms, sophisticated hardware needs to solve complex mathematical problems and the first computer able to find the solution, receives the next block, the process begins again and the miner receives a newly minted coin as a reward for completing the “block.”

There are two different ways to mine: Proof of Work and Proof of Stake. Proof of Work (PoW) is what all types of hardware are needed for mining, such as GPUs, ASICs, and FPGAs (more on this later). Proof of Stake is an alternative for PoW, PoS is a consensus mechanism where cryptocurrency validators share the task of validating transactions.

Mine Dogecoin with Hashshiny Cloud Mining!

For the most part of mining cryptocurrency, including Dogecoin, miners resort to PoW. Here is the difference between Dogecoin mining and Bitcoin mining (as of December 2022):

Dogecoin

Bitcoin

Algorithm

Scrypt

SHA-256

Difficulty

8.48 million

36.95 trillion

Total Supply

Infinite

21 million

Reward per block

10,000

6.25

Block time

1 min

10 min

Bitcoin is the oldest and largest cryptocurrency by market cap and it uses a hashing algorithm called SHA-256. A hashing algorithm is simply a function that generates a fixed-length code using a certain technique. Each hashing algorithm uniquely creates random codes.

On the other hand, Dogecoin uses a hashing algorithm called Scrypt – a bit less complex than Bitcoin’s SHA-256. This makes mining Dogecoin much faster and less energy-intensive than BTC.

Most cryptocurrencies have a limited supply cap. Bitcoin, for instance, has 21 million whereas Dogecoin doesn’t, which means that its mining and circulating capacity increases continuously. This gives a larger block time between the two. New Dogecoin blocks are discovered every minute, while Bitcoin blocks, every 10 minutes.

The Process of Mining Dogecoin

Since the unexpected rise of Dogecoin at the beginning of 2021 – among pop culture, memes, and Elon Musk tweets about it – the meme coin ignited the interest of many crypto enthusiasts in Dogecoin mining and sent mining profitability to a new six-year high.

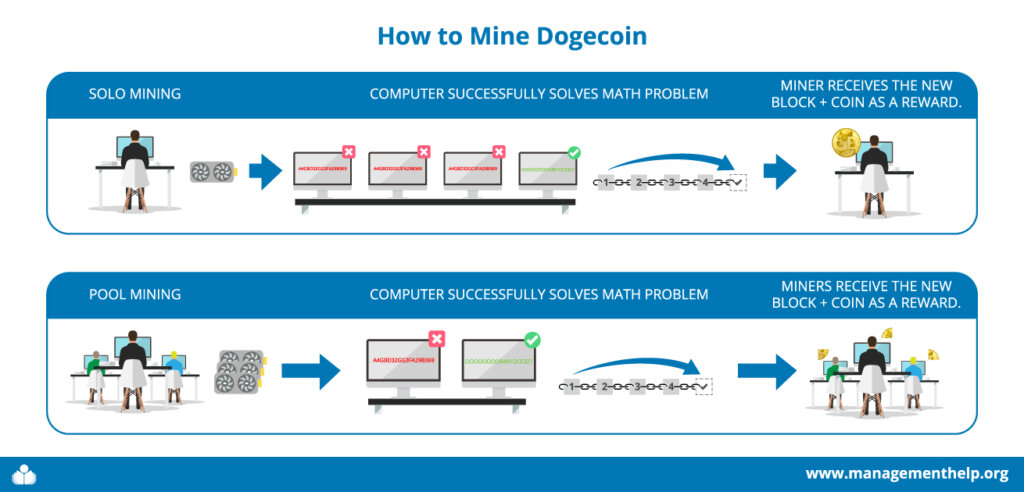

As its popularity increased, so did the mining process. This means, it is still possible to mine Dogecoin but it’s getting more and more difficult to do it. Because of that, miners got together and formed “mining pools.”

Mining pools are a group of miners who mine the cryptocurrency as a single entity – or node – by merging their computing power. The rewards get distributed among the participants proportionally by the amount of computer power committed by each miner. Today there are three ways to mine Dogecoin: individual mining, mining pools, and cloud mining.

Start Cloud Mining with Hashshiny!

Dogecoin Mining Risks

Mining Dogecoin individually is possible as long as you know the risks. So, before diving into Dogecoin mining, you should know what you’re getting yourself into. We’ve listed the main risks of mining Dogecoin solo:

- Electricity: Mining any PoW crypto consumes a lot of energy because computers must run 24/7. A GPU (graphics processing unit) from Nvidia and AMD requires high-wattage power supplies. A rig with three GPUs can consume 1,000 watts of power or more.

- Faster wear and tear of equipment: If a miner decides to use their laptop to mine Dogecoin, they must be aware that, just like GPUs are up and running 24 hours a day, a laptop must do the same. This may accelerate the depreciation and affect the lifespan of your equipment.

- GPU shortage could return: Nvidia has recently put an end to GPU shortage and boosted RTX 30-series graphics cards. Still, since dedicated GPUs are mainly manufactured by two companies, AMD and Nvidia, the market is vulnerable and maybe, still susceptible to another shortage again.

How to Mine Dogecoin in 3 Steps

Now that you know the process of mining Dogecoin, how it works, and the risks that come with it, and if you’re ready to venture into mining this successful meme coin, there are a few steps to follow.

Note that you can start mining Dogecoin instantly with a cloud-mining platform like Hashshiny. The steps below would work only if you’re willing to invest in mining hardware and take the longer route.

Step 1: Get Equipped

There are a few must-haves to start mining Dogecoin or any other cryptocurrency, and the two starters are hardware and software.

Hardware

There are three types of hardware equipment you can use:

- CPU: Your regular PC’s processing unit can do the work, but as mentioned above, you might end up damaging your equipment due to overheating.

- GPU: A graphic process unit is much more potent than a regular CPU; GPUs are also faster and more efficient and have become a must-have among miners.

- ASIC: Application-specific integrated circuit miners are the highest level of mining crypto. They’re more powerful than GPUs and were specifically designed for mining crypto. However, it’s also more expensive.

Software

After choosing your equipment, it’s time to pick the software. Each one of the hardware listed above has its software to accompany it. We’ve listed the main ones:

- CPU: CPU miner by Pooler, for Litecoin, Bitcoin, Dogecoin, and other cryptocurrencies

- GPU: EasyMiner is a good option for beginners, CudaMiner works best with Nvidia GPUs, while CGminer goes well with all types of GPUs

- ASIC: CGminer and EasyMiner can also be used with ASICs

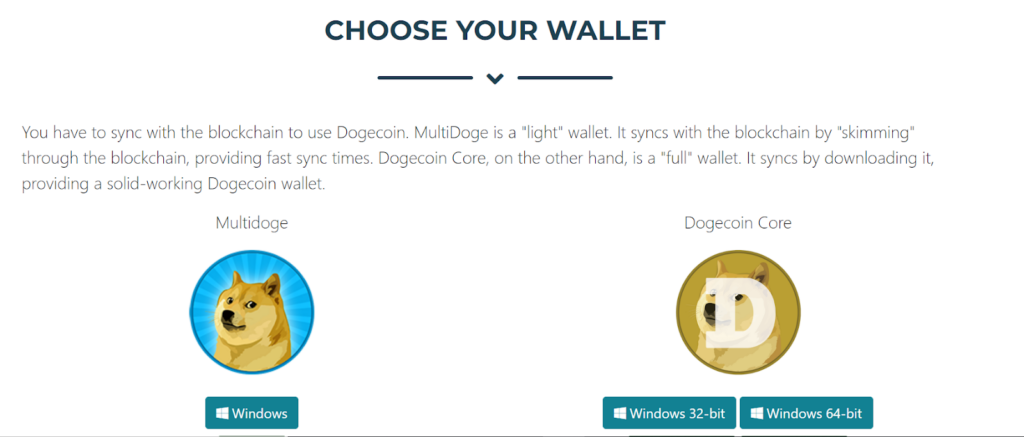

Step 2: Get a Wallet

The second step is to get yourself a wallet. Dogecoin offers its official wallets – called Dogecoin Core and Multidoge but you can find another one that also stores Dogecoin. If you don’t know which crypto wallet to choose, check the best crypto wallets in 2023. A wallet will let you collect any revenue as a reward from mining DOGE.

Step 3: Decide How You Will Mine

As already mentioned, there are three approaches to mining Dogecoin: solo, pools, or cloud mining. If you intend to mine DOGE just for fun, you can do it by yourself, using a GPU through software such as Easy Miner or Cuda Mine, for example.

The function of a GPU is basically to process and render all images on a computer’s screen, and many laptops and desktop computers use it to improve image processing.

However, solo mining alone can be a tricky process if the individual isn’t used to it, and oftentimes it’s not profitable unless you’re willing to shell out significant sums of money on high-quality and professional equipment and electrical bills.

For first-time miners, we recommend trying to join a DOGE mining pool or a cloud-mining platform. Mining in a group increases the chances of becoming a block validator due to the collective hashing power of the pool. Also, a pool boosts the chances of profiting from mining – which is higher than mining solo.

The Crypto Economics Behind Dogecoin Mining

Most people want to know if it’s still possible to make some profit mining Dogecoin, even after its last peak in April 2021. But before discussing its profitability, let’s quickly look at the economics behind the Shiba Inus coin.

As opposed to the most popular cryptocurrencies out there such as Bitcoin and Litecoin, Dogecoin doesn’t have a fixed upper coin limit, which makes it an inflationary currency.

Although when first created, it was designed to be a limited supply of 100 billion coins, and the block reward was set to halve every 100,000 blocks until block 600,000 was mined. However, one year and 160 days after its launch, developers decided to give Dogecoin an infinite supply, thus DOGE turn into an inflationary currency with a slowly declining inflation rate.

With no hard cap supply, the DOGE hash rate declined significantly after that. To protect the network from 51% percent attacks, developers decided to allow merge, letting Dogecoin miners receive hashing power from another proof-of-work network. As a result, miners today can mine both Dogecoin and Litecoin simultaneously.

Is Mining Dogecoin Profitable?

That’s a very common question among miners and crypto enthusiasts. Profiting from DOGE depends on four main factors: energy costs, equipment’s hashpower, the current Dogecoin price, and the block reward. Generally speaking, the most costly variable is energy costs, as depending on the region or even the country, costs can go through the roof, then mining isn’t that profitable, especially if done solo.

The hash power provided is also an important variable that defines whether mining Dogecoin will turn out to be a profitable activity or not. The most popular GPU can make $0.25 to $2 per day. If using a new ASIC model, miners can make a profit of approximately $10-$40 per day.

Of course, it’s worth remembering that we aren’t including amortization into consideration – some GPU or ASIC models can take years to pay off the equipment’s price.

Mine Dogecoin with Hashshiny Cloud Mining!

How to Trade Crypto

Besides mining, there are other ways to profit from the crypto craze, such as NFT, DeFi, and trading. One of the most common ways is through trading.

You can trade cryptocurrency by exchanging one crypto for another (such as Bitcoin to Ethereum) or buying or selling crypto using fiat currency (like US dollar to Bitcoin). The process, however, can get complex if you aren’t familiar with the crypto market – which is similar to stocks and other financial markets.

Before starting off, you should understand how blockchain technology and the market involved in trading crypto works. Signing up with a quality crypto exchange will make things much easier for you.

Pros & Cons of Cryptocurrency

Cryptocurrencies are highly volatile, so it’s very common to see Bitcoin prices fluctuate over 10% in a single day. This is a great opportunity for high-risk profiles to make a profit quicker with crypto trading.

But is crypto worth investing in? Or is it something for you? If you can handle volatility and are okay with the risk of loss (in case you can’t access your wallet or private key) and security, cryptocurrencies have a high return potential (oftentimes higher than the stock market).

It gives users anonymity, and it’s very accessible and versatile – it only takes a few minutes to trade and transfer Bitcoin or any other crypto. If you’re sold on the idea of profiting from cryptocurrencies, check the fastest growing cryptocurrencies in 2023 and get ready.

Pros:

- Potential for high rewards

- Anonymity

- Cryptocurrencies beat inflation

Cons:

- Understanding cryptocurrency takes time and effort

- Cryptocurrencies are highly volatile

- Crypto newbies are vulnerable to security risks

Evaluate the complete pros and cons of cryptocurrencies to make the right decision for yourself.

Frequently Asked Questions (FAQs) for How to Mine Dogecoin

We have answered the most frequently asked questions so you can learn more about how to mine Dogecoin.

Bottom Line on How to Mine Dogecoin

If you’re wondering if there’s still space for late adopters to make some profit with Dogecoin, the short answer is yes. However, there are some aspects and risks to consider when it comes to mining not only Dogecoin but any other cryptocurrency.