Different industries have different needs and payroll obligations, so it’s essential to find the best payroll software for your industry. You may need specific payroll software that makes it easy for you to pay contractors or full-time employees, for example.

1. Nanny Payroll

Whenever you hire a nanny, it counts as adding a household employee and puts you on the hook with the Internal Revenue Service (IRS). You’ll need to file Schedule H (household employment taxes) payroll taxes. Failure to do so may result in large fines. There are many nanny payroll software solutions that can simplify and automate the majority of the nanny payroll process.

The best software for nanny payroll includes:

- SurePayroll

- Paychex

- HomePay

- NannyChex

Each of these software solutions offer nanny payroll services that help you file taxes correctly and avoid IRS penalties. By using one of the nanny payroll solutions, your only job will be to enter your nanny’s hours or salary, preview the taxes, and approve the payroll. The software will handle everything else.

2. Construction Payroll

Construction projects involve large teams and an extensive hierarchical structure. Dealing with all the different employee hours, salaries, and taxes for a big group isn’t easy or enjoyable. However, construction payroll software can automate most of the process and provide error-free payroll processing.

A construction payroll solution ensures your payroll runs smoothly. Construction projects have special union requirements that present unique payroll challenges. Furthermore, you need to keep track of all of your contractors and make sure their 1099s are filed correctly.

Construction payroll offers time-tracking features that allow you to create schedules by shift or job. Your workers can easily log their hours online for you to approve in just a couple clicks. Payroll software also automates your worker’s comp coverage payments with automatic, pay-as-you-go premiums.

General contractors (GC) are also responsible for paying wages all the way down the chain. Even if you fully pay your subcontractors, if the subcontractor doesn’t pay their subcontractors, you are still liable as the GC. A comprehensive construction payroll software confirms everyone down the chain is paid fairly based on the completed work.

In essence, construction payroll keeps your employees and managers happy so that the entire team can focus solely on the construction project at hand.

Here are the best payroll software for construction companies:

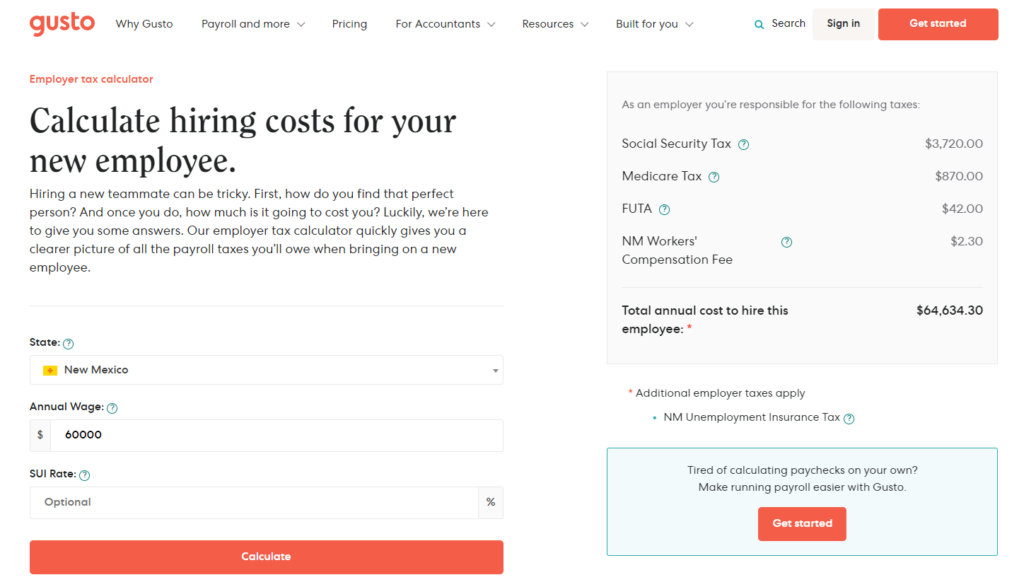

- Gusto

- QuickBooks Payroll

- Payroll4Construction

- Paylocity

3. Restaurant Payroll

Running a restaurant requires you to manage a lot of moving pieces. Payroll can be particularly complicated because workers tend to be paid differently than most full-time employees. You must track hundreds of shift hours, shift changes, tip splits, and overtime payments. On top of that, you have to file taxes for each employee that works in your restaurant.

Restaurants have an even more significant challenge compared to other industries because of the minimum wage requirement. Unlike standard employees, restaurant employees who collect tips as part of their income may also earn a unique minimum wage from other employees. This also depends on which state your restaurant resides in because different states have different minimum wage requirements.

Fortunately, there’s payroll software that specifically aims to help restaurant owners. The software included below ensures that your employees are always paid accurately and on time.

Here are the five best payroll software by industry for restaurants:

4. Payroll Software for Manufacturing Companies

Manufacturing companies face unique challenges and obstacles. This is because manufacturing companies have a variety of roles with different pay scales. Whether it’s machine operation, assembly work, packaging, shipping, or supervising, businesses in this industry need a payroll solution that can handle all of its complexities.

Every minute is crucial on the manufacturing line. Shutdowns or delays caused by employee absences, miscommunications, or safety violations results in loss of productivity and revenue. Modern payroll software solutions provide enhanced visibility and reporting capabilities that give payroll managers a clear picture of the process and labor costs.

Here’s the three best payroll software for manufacturing companies:

- Paycor

- Paychex

- Gusto

Read our Gusto review and Paychex payroll review to know more about their pricing and features.

5. Payroll Software for Retail Stores

Managing payroll obligations for a retail store is a challenge. From managing inventory, hiring new employees, and keeping current employees satisfied, running payroll duties adds even more stress and difficulties.

Luckily, there are payroll software solutions for retail store owners that facilitate and streamline all of your payroll responsibilities. The software options in our list ensure that your employees are paid punctually in the correct amount.

Payroll software helps you track the W-4, I-9, W-2, and other withholding forms for each of your employees. It will also track time and attendance records as well as automatically pay your employees upon approval. Whenever tax laws are updated, the software will ensure your retail store stays compliant to avoid tax penalties.

Here are our top five payroll solutions for retail stores:

Not sure which to go for? Check out the OnPay payroll review or Gusto vs Onpay review.

6. Payroll for IT companies

Your IT company needs payroll software that keeps managers and lower-level employees satisfied and happy. Without a payroll solution, your company is vulnerable to wage and tax filing errors.

IT companies are unique because you may have employees located in different states or even different countries. Due to the nature of IT companies, remote work is gaining momentum in the industry. This brings new payroll and tax challenges that can be difficult to navigate without a modern payroll system.

Choose software solutions that are reliable and easy to configure. They ensure your employees receive accurate, on-time payments via direct deposit or a paycheck. Payroll software also allows your staff to efficiently navigate complex payroll flows while complying with tax laws and financial regulations.

The best payroll software for IT companies include:

7. Payroll for the Education Industry

The education industry faces many complexities that have hindered a smooth rollout of regulations, employee obligations, and transactions. Daycares, early childhood centers, schools, universities, and online education programs all face the pressure of achieving compliance with government regulations, employee certifications, and accurate pay obligations.

There are several payroll software solutions that specifically cater to companies that operate in the education industry. The solutions on our list offer comprehensive HR solutions in addition to their payroll features. This allows you to effectively recruit new educators, train your employees, and simplify the scheduling process.

For instance, Rochester University and Baptist Bible College use Paycor as their payroll solution. Paycor offers extensive tools for education operators, such as employee self-service, tax compliance, payroll automation, and I-9 and W-4 form filing. Read the Paycor review if you’re interested in knowing more about this software.

The best payroll software for education companies include:

8. Payroll for Healthcare Industry

The healthcare industry is one of the fastest-growing industries worldwide. As such, it’s imperative that your employees can work seamlessly without worrying about being paid fairly and on time.

Every hospital is equipped with a union of workers that include nurses and healthcare professionals. Your payroll solution should be able to handle the salaries of permanent staff members and those with temporary shifts. Payroll software keeps you in line with union regulations so you can create a healthier relationship with the workers and the union.

It’s also vital to implement payroll software to ensure your workers stay with your healthcare company. Hiring competent employees is a challenge in itself, so it’s essential to keep them satisfied.

Here are the best payroll software for the healthcare industry:

9. Payroll for the Public Sector

Choosing the best payroll software for public sector organizations doesn’t need to be challenging. The right payroll solution allows you to maximize opportunities despite all the public sector’s complexities.

Furthermore, payroll software empowers your organization to deal with the constant pressures and government changes to create operational efficiencies within your payroll processing. These solutions enhance your regulatory compliance and optimize your organization’s public spending. This way, your organization can focus on innovation and improvement without needing to stress about payroll obligations.

The best payroll software for public sector organizations are:

- Paycor

- QuickBooks

- Gusto – Read the Gusto vs. QuickBooks Payroll article to see how Gusto compares to QuickBooks

- OnPay

10. Payroll for Farms and Ranches

If you run an agricultural business like a farm or ranch, you’re aware that you deal with unique tax rules. For example, as a farm or ranch owner, you must file an annual Form 943, which shows how much money you withheld from each employee’s pay for federal income tax. Non-agricultural businesses file a quarterly Form 941. Payroll software will ensure your employees are paid accurately and that your business follows every tax rule and payroll law.

The best payroll software by industry for farms and ranches include:

11. Payroll for Remote Workers

Due to the COVID-19 outbreak in 2020, many companies have shifted to remote work and allowed their employees to work from home. Furthermore, many new startups have operated entirely remotely. For this reason, you need a payroll software dedicated to handling payroll obligations for remote workers.

Additionally, if your small business relies on spreadsheets to track payroll, your business may be vulnerable to many payroll issues. Using payroll software can help you avoid miscalculations, delayed payments, and data mismanagement.

Here’s the best payroll for remote workers:

Bottom Line on Payroll Software by Industry

We understand how important it is to find the specific payroll software for your type of company. Different payroll software specializes in different industries, and choosing the right software can significantly enhance and optimize your company.

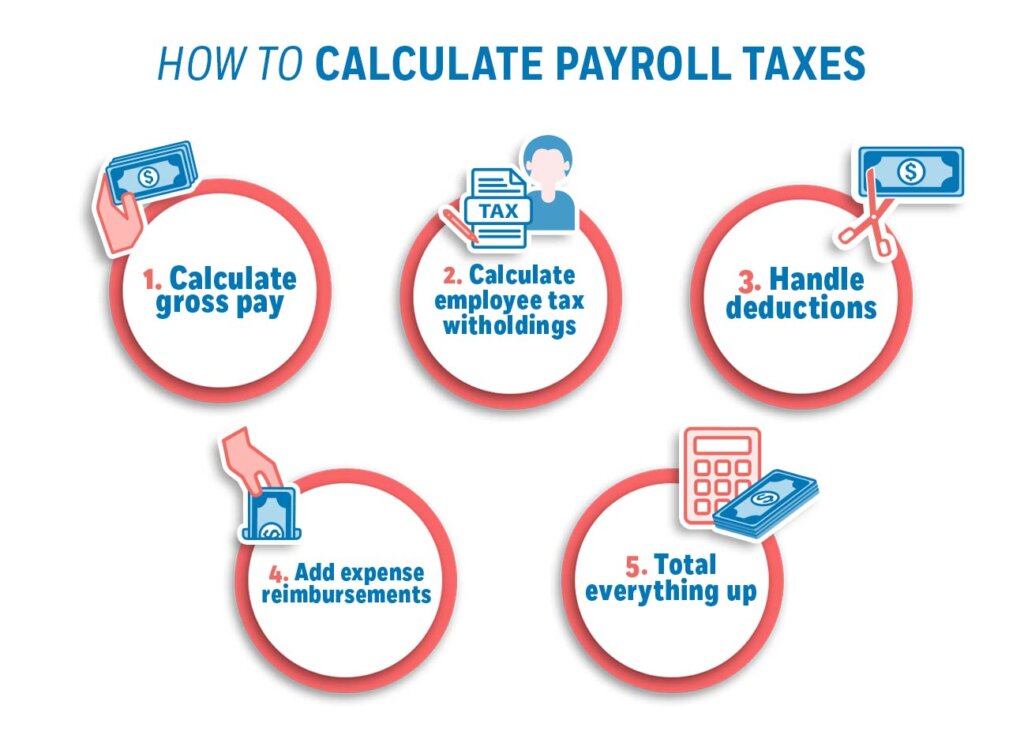

To better understand how payroll works, we recommend learning how to do payroll. This way, you’ll have an easier time navigating your payroll software and ensuring everything runs smoothly.