Contractor payroll is an organized process that enables you to pay independent contractors and freelancers. It is an essential procedure for you if you hire people to perform services for your business. An independent contractor is a temporary employee, while a freelancer is a self-employed, nonpermanent worker.

Learn how to manually complete the freelancer payroll process in six steps. Find out how to pay contractors using Square Payroll in three steps. Discover which one is easier: processing payroll manually or using software like Square Payroll.

How To Complete Contractor Payroll in 6 Steps

The payroll process for independent contractors and freelancers is different from the payroll procedure for employees. You can conduct the freelancer payroll process using a manual method. Follow the steps below:

Contractor Payroll Process Summary

Step 1: Make a Payment Agreement

Establish payment rates, payment periods & tax requirements of contractors

Step 2: Request W-9 Forms

Require freelancers to submit Form W-9

Step 3: Record Contractor Data

Input the personal data, tax information & bank account details of contractors

Step 4: Compute Contractor Payments

Calculate payments at the end of each cycle

Step 5: Make Contractor Payments

Use your preferred method to pay contractors

Step 6: Submit 1099-NEC Forms

Fill out Form 1099-NEC for all contractors paid over $600 within the year

Step 1: Make a Payment Agreement

First of all, make a clear payment agreement with contractors and freelancers. Temporary workers are not paid a regular salary like permanent employees. Instead, they are compensated based on the projects they completed or the time they spent working. That’s why you should determine three factors at the beginning of the process:

Payment Rates

How much should you pay the contractor? On one hand, each freelancer has his or her own standard rate as a professional. On the other hand, you have your own budget as a business owner for hiring a freelancer for the job. Together, settle on an hourly, weekly, monthly, or per-project rate that meets your mutual requirements.

Payment Period

How often should you pay the contractor? Establish the frequency of payment, whether it be weekly, bimonthly, or monthly. Estimate the period of time that you expect the person to be working for your business. Predict the approximate working period based on the length and complexity of the projects or tasks you hired the worker to perform.

Tax Requirements

What are the tax requirements of the contractor? Most contractors pay taxes independently so you do not need to withhold taxes on their behalf. Keep this in mind as you negotiate payment rates with freelancers.

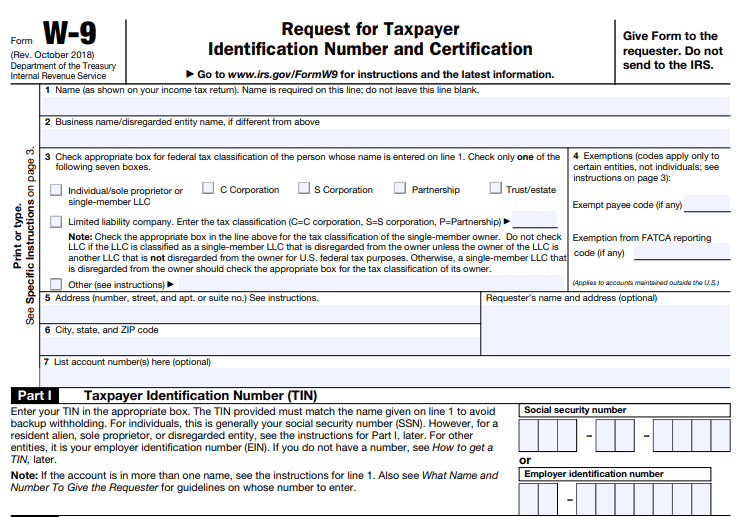

Step 2: Request for W-9 Forms

Ask the contractors and freelancers you hired to fill out a Form W-9 before they start working for your business. This Internal Revenue Service (IRS) tax form is also called Request for Taxpayer Identification Number and Certification. It requires workers to provide their name, address, federal tax classification, and Taxpayer Identification Number (TIN).

The W-9 form is a requirement for U.S. citizens and permanent residents whom you employed on a contractual or freelance basis. You need this form to report the annual earnings of temporary workers via the Form 1099-NEC at the end of every year.

Step 3: Record Contractor Data

Manually input the personal and tax information of your contractors in your payroll system after they submit the Form W-9. Save the banking details of the freelancers if they opt for direct deposit. Record the data in the payroll system of your business via paper records or computer spreadsheets to make accurate payments and deposits to your freelancers.

Step 4: Compute Contractor Payments

Calculate the payment of your contractors at the end of each weekly, bimonthly, or monthly payment cycle. Compute the amount based on the freelancer rates multiplied by the number of hours they worked or projects which they completed within the period. You may perform computations using a manual calculator or a digital spreadsheet.

Step 5: Make Contractor Payments

Select the payment option that works best for you and your contractors. Make a payment based on your preferred method:

- Direct deposit: You can deposit the payment straight to the bank account of the contractor. Take note that direct deposit processes usually take a few days to complete.

- Cash: You may pay contractors in cash in case they currently don’t have a bank account.

- Check: You can print checks which you can mail to your contractors or hold in the office for pickup.

- Prepaid debit cards: You can issue pay cards to your freelancers which you can reload during each payday.

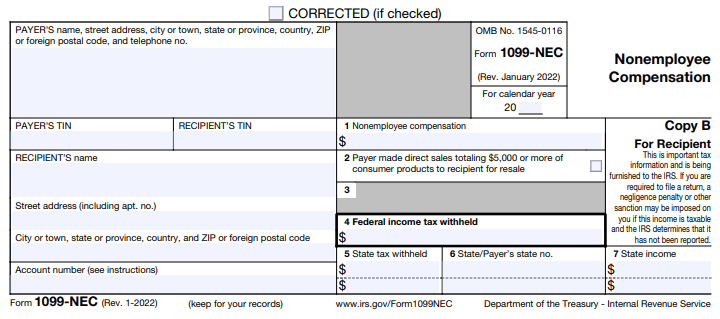

Step 6: Submit 1099-NEC Forms

Fill out and submit a Form 1099-NEC for every contractor who received over $600 from your business during that year. Indicate the total amount you paid annually to each person. Submit copies of the form to the IRS and state tax agency. Furnish the contractor with a copy so they can compute how much in taxes they owe. Keep a copy of each form for your business records as well.

How to Process Contractor Payroll Using Square Payroll in 3 Steps

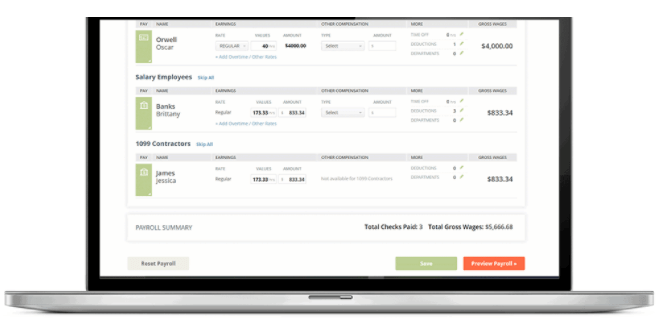

As an alternative, you can use Square Payroll if you want a more convenient method to complete the freelancer payroll process. We recommend this online payroll software because it lets you make contractor payments in a faster, easier way.

Square Payroll is best for small businesses that hire contractors because of its useful features and seamless integrations. Follow the steps below to begin using Square Payroll:

Square Payroll Process Summary

Step 1: Add Contractors to Square Payroll

Register contractors in the software system

Step 2: Prepare Contractor Payments

Select the pay period dates & payment method + Input contractor rates, hours & commissions

Step 3: Make Contractor Payments

Review data & submit payments

Step 1: Add Contractors to Square Payroll

Click on “Add Team Member” and “Create New” to register new independent contractors in the Square system. Enter their personal data, including the first name, last name, and email address. Select the contractor employment type, payment type, and payment method for each person. Input their bank account information if they prefer to be paid via direct deposit. Generate a Point of Sale Passcode in case you plan to use Timecards.

Click on “Save” to complete the registration. The data you saved will be recorded in the system so you don’t need to keep entering it repeatedly each payment cycle.

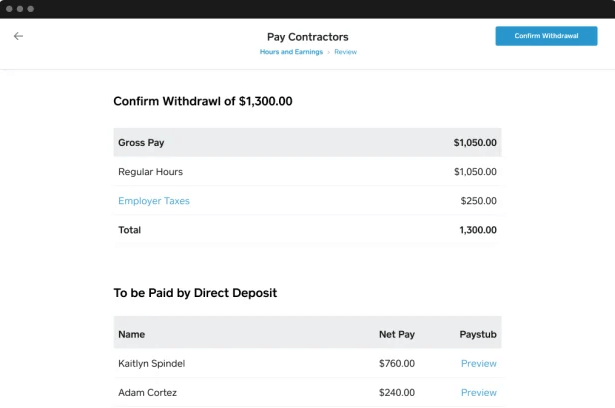

Step 2: Prepare Contractor Payments

Proceed to the “Payroll” menu of your Square dashboard. Click on “Pay Contractors.” Choose the pay period dates and payment method. Select the contractors you wish to pay. Input the rates, hours, and commissions of the freelancers. If you are using Timecards or Commission Tracking, click on “Import time and wages” to automatically sync the hours and commissions in the system.

Step 3: Make Contractor Payments

Once the information is complete, click on “Continue.” Check the contractor payment details carefully to confirm that all the data is correct. Finally, click on “Submit Payment” to start the payment process. The contractors who are paid via direct deposit will receive the amount approximately four days afterwards.

Run Contractor Payroll Using Other Payroll Software

While Square Payroll is our top choice, there are other contractor payroll software that you can try. We suggest these programs as alternatives because they are capable payroll tools in their own right.

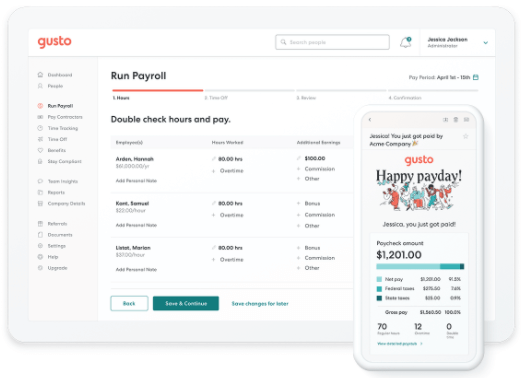

Gusto

Gusto is an all-purpose payroll platform that equips you to hire and pay employees and contractors. It allows you to focus on team management through its multifunctional features, such as full-service payroll, hiring, onboarding, time tracking, attendance monitoring, talent management, and insights reporting.

Contractors have the option to self-board online and to receive payday email messages. Gusto is commendable because it expedites payment processing for workers.

ADP Payroll

ADP Payroll is a payroll and HR tool that enables you to pay and manage your contractors and employees in a quick, simple way. It offers built-in features which cover taxes, compliance, hiring, and HR support. The personalized dashboard lets you access your payroll to-do list, payment history, and flexible payment methods. Its handy add-ons and integrations increase its functionality.

This software helps you with tax reporting by automatically generating Forms 1099-NEC for the contractors you hired. Consider using ADP Payroll because of its 24/7 customer service availability and customization options.

SurePayroll

SurePayroll is an online payroll service that is easy to use. It streamlines the payroll process for your contractors and employees through its automatic payroll, tax calculation and filing, and direct deposit setup features. It is possible for you to set up and run this tool in just a few minutes.

This platform enables you to complete your contractor payroll together with your employee payroll through a single process. Based on a SurePayroll review, it is ideal for small businesses because of its affordable pricing and simple UI.

What You Need To Learn About Contractor Payroll

Boost your expertise on the freelancer payroll process by increasing your knowledge about payroll matters. Learn the definition of payroll and contractor payroll. Discover who can be considered as independent contractors and freelancers. Find out what exactly Square Payroll is.

What Is Payroll?

Payroll is the systematic process of computing and distributing the salary of employees of a business. It also involves the calculation of taxes and the documentation of the procedure. It covers payment cycles which can be set for weekly, bimonthly, monthly, or custom periods.

A payroll system ensures that you compensate your workers with the right amount at the right time. You have the option of carrying out your payroll tasks through a manual method or digital method using cloud-based solutions or on-premises software. Selecting the suitable payroll tools for you is vital so you can minimize time and costs when preparing payments for your freelancers.

In small startups, the business owner or associate typically handles payroll processes in small startups. In large companies, HR or accounting team members are usually responsible for payroll procedures. Some business teams choose to outsource payroll tasks with agencies, although this leads to extra expenses.

What Is Contractor Payroll?

Contractor payroll is the organized process that is tailored to the payment of independent contractors and freelancers. It is commonly used to compute and disburse the compensation of temporary workers based on payment rates and pay periods. It is also used to collect and record the personal data and tax information of freelancers and contractors. You can process contract payroll either manually or by using software solutions.

Who Are Contractors and Freelancers?

Independent contractors are nonpermanent workers who typically perform long-term projects for businesses. Freelancers are self-employed temporary workers who are usually assigned short-term or long-term projects for clients. Both contractors and freelancers may offer services or products to various organizations since they are not tied to a single employer.

Freelancers and contractors do not receive a regular salary like permanent employees. Instead, both are paid based on the projects they completed or the time they spent working for the client. That’s why there is a special payroll process for contractors and freelancers.

What Is Square Payroll?

Square Payroll is a payroll tax software that is especially designed for small businesses. It enables you to pay your contractors and employees quickly through your Square Checking account and balance. Also, it automatically files your federal, state, and local payroll taxes. And you can use it to track your freelancers’ time by syncing with timecards.

Square Payroll smoothly integrates with other related tools. Its mobile app enables you to make payments even when you are on the go. It has straightforward pricing and affordable rates. It offers technical support through live payroll service specialists who can guide you in navigating the platform and troubleshooting issues. Read our Square Payroll review to find out more about its features and pricing.

Frequently Asked Questions (FAQs) for Contractor Payroll

Contractor payroll can be intimidating especially if you are not familiar with the process. Become more confident in tackling your freelancer payroll tasks by discovering the answers to the basic questions on contractor payroll matters.

Bottom Line on Contractor Payroll

It is possible for you to manually complete the contractor payroll process in six steps. However, you can save time and effort by using freelance payroll software which simplifies the procedure into three steps.

We recommend Square Payroll if you need an excellent contractor payroll platform for your small business. Start using it now to experience its powerful payroll features, cost-effective pricing, and accessible customer support.

Sections of this topic

Sections of this topic