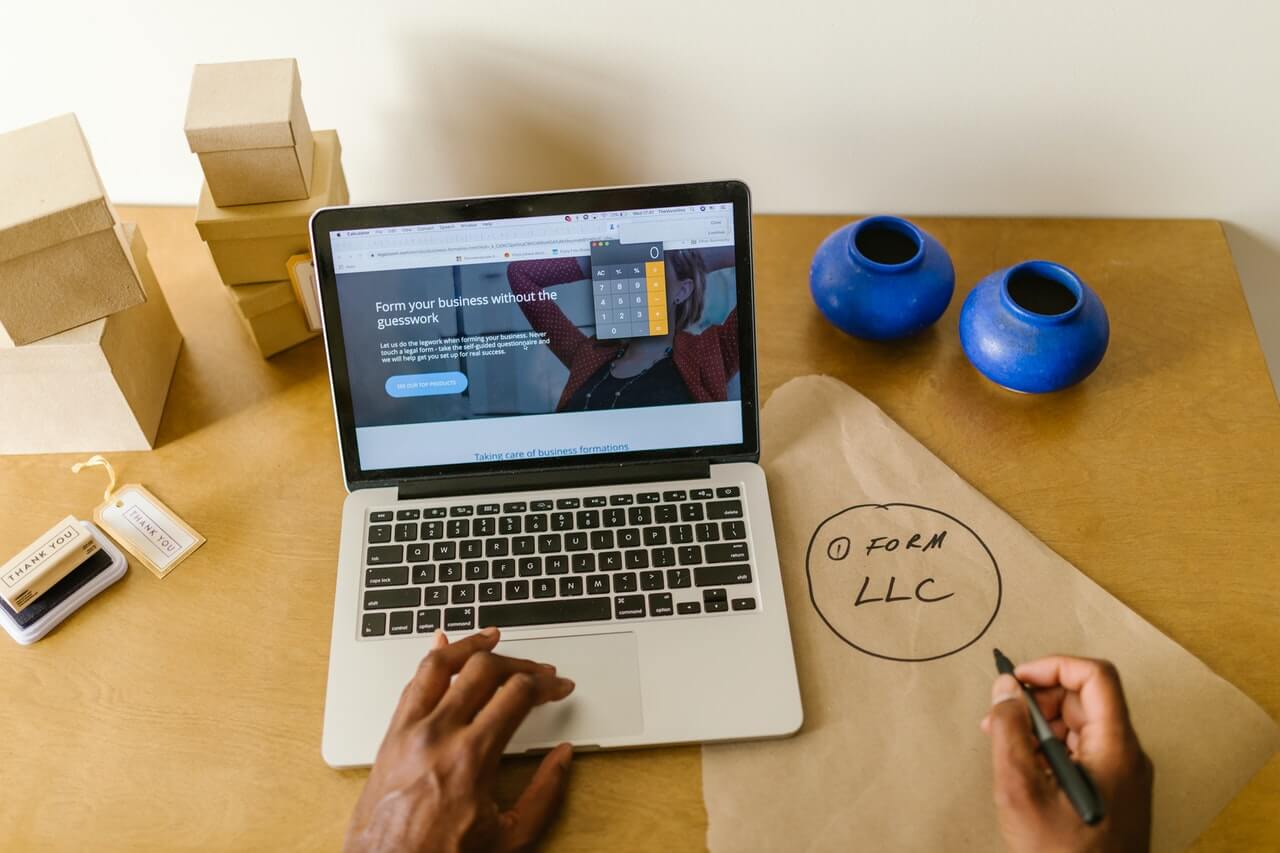

Customer lifetime value (CLV) is a metric you can track to discover who are your best and most valuable consumers. It measures how much a customer is likely to spend over a “lifespan.” Learn how to calculate your small business’s CLV, and ways you can improve unsatisfactory values.

What is Customer Lifetime Value?

Customer Lifetime Value reflects the amount of profit a company earns from a particular consumer over their lifespan. This metric studies the average amount a consumer buys, how often they make purchases, and the duration in years a customer shops at your company. The info helps quantify an individual’s happiness with your products and your business’s ability to bring people back for more.

Why Does CLV Matter?

CLV helps you to determine whether you need to invest more capital in retaining customers or bringing in new ones. Statistically, you have a much better chance of making a sale to an existing customer than a new one.

Generally speaking, it’s much harder to bring a new client on board than retain repeat customers. It often requires a big hook to lure a first-time shopper to your site. Customers have a lot of choice, so you need to spend time making your site or store unique. Then use marketing tools to make your products or services the most appealing.

The amount you spend to land a new customer is called customer acquisition cost (CAC). By comparing this value to a consumer’s CLV, you can see at a glance if you’re spending more to obtain new individuals than you are ultimately making off them in the long run.

Because of the costs required to bring in new consumers, most of your profits are going to come from repeat shoppers. Knowing each one’s CLV affords insight into strategies that can further drive growth.

Through CLV, you may notice customers favoring a particular type of product year after year. You can use these highly sought-after products to entice both new and existing shoppers. Similarly, you may notice clients sign up for your service for a year but are not making a point to renew.

Contributing Factors to CLV

Customer loyalty is a huge driving factor for bringing individuals back to your business, thus increasing CLV. If you don’t give shoppers a reason to come back to your site, what’s stopping them from purchasing somewhere else next time?

You can look at your company’s churn rate to determine whether or not you have a problem keeping people around. Every few months, it’s wise to look at how many customers you’re retaining and how that value compares to the number from last quarter.

It’s nearly impossible to keep 100% of your clients from year to year, but you should be seeing an overall increase in customers and not the opposite. Those who stop shopping at your business after a short time will have very low CLV scores.

From a product or service standpoint, it’s up to you to provide the best you can. Items that can’t stand the test of time or don’t perform as intended will not make customers want to buy from you again.

How CLV Works in the Real World

Tracking CLV across your client base at strategic intervals can help you better understand how your business is doing. For instance, crunching the numbers before and after a pivotal marketing campaign will reveal success if there’s an uptick in sales. No change or CLV loss quickly tells you that the campaign was a bust.

Looking at the overall CLV value, you can also see which types of customers are spending the most. You want to pay more attention to your most profitable clients to boost sales further. You can then hone your advertising campaigns to target the those who are spending the most on your site.

You can also use CLV to identify points of frustration that consumers may face while shopping. Having a difficult to navigate site or a weak return process can show up as reduced sales numbers or frequency.

How to Calculate Customer Lifetime Value

The calculation for customer lifetime value isn’t an overly difficult one, but you will have to brush off your math skills. The equation to calculate CLV is as follows:

CLV = Customer Lifespan * Customer Value

Customer lifespan is simple enough to discover. This number represents in years the entire length of time a customer has been shopping with your business.

Customer value is the product of two important aspects of an individual’s shopping behavior. To calculate this number, you must multiply the average purchase amount of a consumer by the number of times the customer shops in a given year.

Customer Value = Average Purchase Frequency * Average Purchase Value

An Example CLV Calculation

To demonstrate CLV in action, consider a local hair salon. A customer who makes a point of getting a cut and a color once a month for $80 is going to have a higher CLV than a mother who brings a child in once every two months to shorten things up a bit.

We can calculate the CLV for each of these customers over the course of five years. Our cut and color customer looks as follows:

Customer Value = 12 appointments per year * $80 = $960

CLV = $960 * 5 years = $4,800

Our child who gets a $10 haircut will have a significantly different value. Let’s check out the numbers:

Customer Value = 6 appointments per year * $10 = $60

CLV = $60 * 5 years = $300

While both clients are important, the regular cut and color has a much higher CLV. Incentivizing this client and other similar customers will earn you a lot more profit in the long run.

Ways to Improve CLV

To have a profitable business, you need your customer lifetime value to be higher than your customer acquisition cost. The higher the difference between the two, the more money your company will make. If these values aren’t where you want them to be, don’t fret – there are ways to improve CLV among your client base. Here are some of the best ways to give CLV a boost.

Invest in the Customer Experience

Whether you offer goods or services, your customers are the lifeblood of your business. Giving your customers the best experience you can will likely keep them coming back for more. Work out the kinks in your website, removing dead links and delays in the process that may turn a customer off. Make sure checkout is as simple as can be. Time is money, and customers will likely remember these details.

Ensure Your Onboarding Process Is Seamless

Whatever brings a customer to their first purchase on your site, it’s up to you to give them a reason to return. Sharing details about your brand on your web page or through a follow-up email adds a personal touch that other businesses may not do. If clients can relate to what your company stands for or a struggle you’ve overcome, they may feel more connected.

Start a Loyalty Program

What better way to keep customers coming back than through a loyalty system? By offering discounts for repeat purchases, you’re giving a tangible reason to return and shop more. Eateries may give away a 10th item for free. An e-commerce business might provide a discount through a coupon code for someone who shops regularly.

Make Returns Easy

It may seem counterintuitive, but allowing customers to return things with minimal hassle is as sure a way as any to bring them back. Shoppers will remember the painless process, making them more likely to come back down the road.

Upsell

Companies like McDonald’s and Amazon do a great job of this, presenting other products that would be perfect with the item you’re about to purchase. You can do the same, offering a slightly more expensive substitute or suggesting things that work well with what they’re buying.

Provide Omnichannel Support

No one likes endless hold times when trying to reach customer support, and having a poor response system can turn customers off in a hurry. Providing a direct line or short wait time should keep consumers coming back for more even if they experience an issue.

In this digital age, clients enjoy reaching out through other means besides the telephone. You can use a chatbot on your site to interact with people or encourage them to send a text message. If your business has social media accounts, you can even handle customer issues from there.

Remember the Power of Social Media

In addition to customer support, it’s possible to use social media to promote sales and stand out against the competition. With over half the world using various forms of social media, it seems foolish not to take advantage of this space.

Reach Out to Unhappy Customers

Unhappy customers are going to stop buying your brand and may report unfavorable experiences online for the world to see. Navigating these murky waters and attempting to rebuild a damaged relationship can go a long way. In a best-case scenario, you can win back a lost customer who will feel even more loyal because of the extra effort you made.

Tools to Help With CLV

You don’t have to look far to find tools that can help calculate CLV and improve a customer’s score. Hubspot has a free CLV calculator you can use to track this important value and several others.

Alongside tools for calculating CLV, many customer relationship management (CRM) services include features to improve the retention rate of your clients. With these tools, it’s possible to manage contacts, track interactions with customers, improve customer support, and much more. Some CRM platforms even offer free plans to get you started without spending a penny.

Frequently Asked Questions (FAQs) for Customer Lifetime Value

Understanding customer lifetime value can be challenging. This FAQ section answers some of the most common questions surrounding the topic.

Bottom Line on Customer Lifetime Value (CLV)

Having a firm grasp on customer lifetime value for your clients helps paint a very accurate picture of how your business is performing. This one number reveals your best customers and the products or services that keep them coming back for more. It also gives an idea of how much you can afford to spend when attempting to bring on new clients. Without CLV, you’re likely missing a lot of information about profitability and customer turnover that can lead to issues in the future.